Office Depot 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

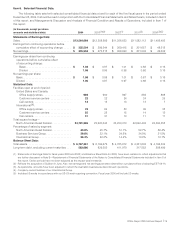

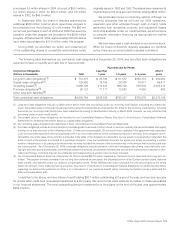

Item 6. Selected Financial Data.

The following table sets forth selected consolidated financial data at and for each of the five fiscal years in the period ended

December 25, 2004. It should be read in conjunction with the Consolidated Financial Statements and Notes thereto, included in Item 8

of this report, and Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 of

this report.

(In thousands, except per share

amounts and statistical data) 2004 2003(1)(2) 2002(1) 2001(3) 2000(3)(5)

Statements of Earnings Data:

Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13,564,699 $12,358,566 $11,356,633 $11,082,112 $11,495,493

Earnings from continuing operations before

cumulative effect of accounting change . . . . . $ 335,504 $ 299,244 $ 309,415 $ 201,657 $ 48,315

Net earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 335,504 $ 273,515 $ 308,640 $ 201,043 $ 49,332

Earnings per share from continuing

operations before cumulative effect

of accounting change:

Basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1.08$ 0.97 $ 1.01 $ 0.68 $ 0.16

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.06 0.95 0.98 0.66 0.16

Net earnings per share:

Basic. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1.08$ 0.88 $ 1.01 $ 0.67 $ 0.16

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.06 0.87 0.97 0.66 0.16

Statistical Data:

Facilities open at end of period:

United States and Canada:

Office supply stores................... 969 900 867 859 888

Customer service centers . . . . . . . . . . . . . . 22 22 24 24 25

Call centers ......................... 13 13 13 13 7

International(4):

Office supply stores . . . . . . . . . . . . . . . . . . . 78 64 50 39 35

Customer service centers .............. 25 25 15 14 12

Call centers ......................... 31 31 13 11 11

Total square footage—

North American Retail Division............. 24,791,255 23,620,343 23,203,013 22,842,403 24,384,355

Percentage of sales by segment:

North American Retail Division. . . . . . . . . . . . . 43.8% 45.7% 51.1% 52.7% 56.4%

Business Services Group................. 29.8% 32.1% 34.5% 34.0% 31.5%

International Group. . . . . . . . . . . . . . . . . . . . . . 26.4% 22.2% 14.4% 13.3% 12.1%

Balance Sheet Data:

Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,767,351 $ 6,194,679 $ 4,765,812 $ 4,331,643 $ 4,196,334

Long-term debt, excluding current maturities . . . 583,680 829,302 411,970 317,552 598,499

(1) Statements of Earnings Data for fiscal years 2003 and 2002, and Balance Sheet Data for 2003, have been restated to reflect adjustments that

are further discussed in Note B—Restatement of Financial Statements of the Notes to Consolidated Financial Statements included in Item 8 of

this report. Earlier periods have not been adjusted as the impact was immaterial.

(2) Reflects the acquisition of Guilbert in June. Also, net earnings and net earnings per share data reflect cumulative effect of adopting EITF 02-16.

(3) As applicable, amounts have been adjusted to reflect the Australian business as discontinued operations.

(4) Company-owned facilities of our International Group.

(5) Includes 53 weeks in accordance with our 52–53 week reporting convention. Fiscal year 2005 will include 53 weeks.

Office Depot 2004 Annual Report |19