Office Depot 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38 |Office Depot 2004 Annual Report

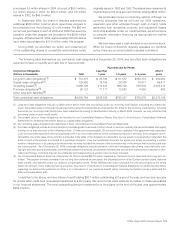

goodwill relating to our investment in Japan was written down

in 2004. The impact of any required write-off of goodwill

associated with any units of our company could have a

material adverse impact on our reported financial results in

future periods.

Office Depot is confident that our past practices and

reports filed with the SEC, the New York Stock Exchange and

other reports are in material compliance with all laws and

regulations, but the continued obligation to further enhance

disclosures and make filings that increase the transparency of

our reported results will undoubtedly add to the overall cost

of doing business. And some of the many proposed changes

in accounting policies and principles could dramatically alter

the reported results of our company, as contemplated by at

least certain currently pending proposals among various regu-

latory bodies.

Executive Management: Our former Chairman and Chief

Executive Officer resigned his positions in October 2004. That

role is being filled currently by a member of the company’s

board of directors, Neil R. Austrian, while a search for a per-

manent replacement is conducted. It is possible that the search

process for a new CEO may take longer than currently antici-

pated. It is also possible that an extended delay in identifying

and recruiting a new CEO may have an adverse impact on the

performance of our company. Further, it is possible that during

a period of uncertainty while the recruiting process is underway,

certain other senior executives may elect to depart the com-

pany, resulting in the necessity of filling other senior level man-

agerial positions. Even if they do not elect to leave the company,

their performance may suffer during the interim period, due to

lack of focus on operating matters. Such departures or lack of

management focus, if any, could also have an adverse impact

on the performance of our company.

Possible Changes to our Global Tax Rate: Our Company is

a multi-national, multi-channel reseller of office products. As a

result of our operations in many foreign countries, in addition to

the United States, our global tax rate is derived from a combi-

nation of applicable tax rates in the various jurisdictions in which

we operate. Depending upon the sources of our income, any

agreements we may have with taxing authorities in various juris-

dictions, and the tax filing positions we take, our overall tax

rate may be lower or higher than that of other companies. Our

overall tax rate is dependent upon numerous factors, any one

or more of which may change from time to time, resulting in a

change in our overall tax rate that could be material. Because

income from domestic and international sources may be taxed

at different rates, the shift in mix during a year or over years can

cause the effective tax rate to change. We base our estimate of

an annual effective tax rate at any given point in time upon a cal-

culated mix of the tax rates applicable to our Company and to

estimates of the amount of business likely to be done in any

given geography. We update those estimates quarterly. We also

regularly evaluate the status and likely outcome of uncertain tax

positions. The loss of one or more agreements with taxing juris-

dictions, a change in the mix of our business from year to year

and from country to country, or changes in tax laws in any of

the multiple jurisdictions in which we operate could result in a

favorable or unfavorable change in our overall tax rate, which

change could be material to our reported financial results.

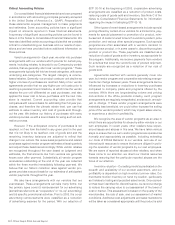

Disclaimer of Obligation to Update

We assume no obligation (and specifically disclaim any

such obligation) to update these Cautionary Statements or any

other forward-looking statements contained in this Annual

Report to reflect actual results, changes in assumptions or other

factors affecting such forward-looking statements.

Item 7A. Quantitative and Qualitative Disclosures About

Market Risk.

See the information in the “Market Sensitive Risks and

Positions” subsection of Management’s Discussion and Analy-

sis of Financial Condition and Results of Operation set forth in

Item 7 hereof.

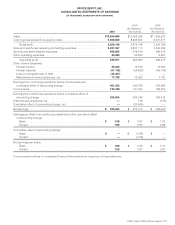

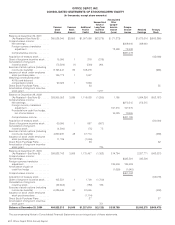

Item 8. Financial Statements and Supplementary Data.

See Item 15(a) in Part IV.

Item 9. Changes in and Disagreements with Accountants

on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Disclosure Controls and Procedures

The company’s management, with the participation of the

company’s Chief Financial Officer, Charles E. Brown, and the

company’s interim Chief Executive Officer, Neil R. Austrian, has

evaluated the effectiveness of the company’s disclosure con-

trols and procedures (as such term is defined in Rules 13a-15(e)

and 15d-15(e) under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”)) as of the end of the period

covered by this report. Based on that evaluation, these officers

have concluded that the corporation’s disclosure controls and

procedures are effective for the purpose of ensuring that mate-

rial information required to be in this report is made known to

them by others on a timely basis and that information required

to be disclosed by the company in the reports that it files or sub-

mits under the Exchange Act is accumulated and communi-

cated to the company’s management, including its principal

executive and principal financial officers, as appropriate to

allow timely decisions regarding required disclosure.