Office Depot 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 |Office Depot 2004 Annual Report

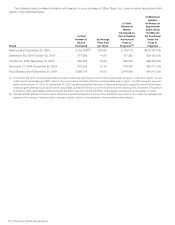

International Group company-owned store and CSC oper-

ations for the last three years are detailed below.

Office Supply Stores

Open at

Beginning Opened/ Open at End

of Period Acquired Closed of Period

2002 . . . 39 13 2 50

2003 . . . 50 16 2 64

2004 ... 64 15(1) 178

Customer Service Centers

Open at

Beginning Opened/ Open at End

of Period Acquired Closed of Period

2002(2) .14 3 2 15

2003 . . . 15 10(3) —25

2004 ... 25 2(4) 2(5) 25

(1) Includes three retail stores obtained in the acquisition of the busi-

ness in Hungary.

(2) Fiscal year 2002 information adjusted to reflect Australia as a dis-

continued operation.

(3) Acquired and operating (post-integration) warehouses obtained

as a result of June 2003 acquisition of Guilbert.

(4) Includes one customer service center obtained in the acquisition

of the business in Hungary.

(5) Represents updates to the Guilbert post-integration estimates.

Merchandising and Product Life Cycle

Our merchandising strategy is to meet our existing and

target customers’ needs by offering a broad selection of

branded office products, as well as an increasing array of pri-

vate label products. Our selection of private label products has

increased in breadth and level of sophistication in recent years.

We currently offer general office supplies, computer supplies,

business machines and related supplies, and office furniture

under various labels, including Office Depot®, Viking®Office

Products, Guilbert®, and NiceDay™. In North America, we cur-

rently have over 3,000 private label stock keeping units, or

SKUs, and we anticipate increasing our offerings within and

across product categories. Our domestic office supply super-

stores and customer service centers stock approximately 8,500

and 14,500 SKUs, respectively, including multiple brands and

variations in color and size.

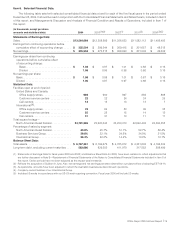

Total sales by product group were as follows:

2004 2003* 2002*

Supplies . ........ 55.0% 55.6% 52.2%

Technology ....... 25.1% 24.6% 27.1%

Furniture, low tech

and other ....... 19.9% 19.8% 20.7%

100.0% 100.0% 100.0%

*Conformed to current year product classification.

We classify our products into three categories: (1) sup-

plies, (2) technology, and (3) “furniture, low tech and other.” The

supplies category includes paper, filing, binders, writing instru-

ments, adhesives, school supplies, and ink and toner. The

technology category includes desktop and laptop computers,

monitors, printers, copiers, cables, software, digital cameras,

telephones, and wireless communications products. The “fur-

niture, low tech and other” category includes desks, chairs,

luggage, calculators, products and services sold at our copy

centers, and other miscellaneous items. The table above is

based on total company sales. Management also views the

business on a comparable (or “comp”) sales basis. This meas-

ures the sales for stores that have been open for one year or

more and all BSG and Internet sales. Store relocations are

included in the comp calculation after one year of operation in

the new location. Comp sales are used in MD&A to address

important factors affecting our business.

We buy substantially all of our merchandise directly from

manufacturers and other primary suppliers. We also enter into

arrangements with vendors that can lower our unit product

costs if certain volume thresholds or other criteria are met.

For additional discussion of these arrangements, see the Crit-

ical Accounting Policies section of MD&A. In most cases, our

suppliers deliver merchandise directly to our CSCs or our

crossdocks. The latter are centralized distribution centers for

re-supplying our retail stores at low handling and freight costs.

Merchandising functions are located in both the U.S. and

Europe. Each group is responsible for selecting, purchasing

and pricing merchandise as well as managing the product life

cycle of our key inventory. The merchandising and marketing

departments are integrated in the U.S. under a single executive.

This alignment helps ensure the right products are available to

satisfy customer demand. Two years ago, we launched a three-

year program to improve our North American merchandising

and supply chain processes, enabled by installation of a com-

prehensive retail merchandising software suite. While this instal-

lation is not yet complete, it is delivering the benefits planned

at this point in the program.

Sales and Marketing

We are able to maintain our competitive pricing policy pri-

marily as a result of the significant cost efficiencies we achieve

through our purchasing power and operating format. Our mar-

keting programs are designed to attract new customers and to

drive frequency of customer visits to our stores and increase the

“share of wallet” of our existing customers by capturing more

of what they spend in total on the products we sell. We regu-

larly advertise in major newspapers in most of our local markets

using both color inserts and run of press (ROP) advertisements.

These advertisements are supplemented with local and national

radio, network and cable television advertising campaigns,

direct marketing efforts, signage in various sports venues and

a naming rights agreement for a sports and entertainment arena

in south Florida, the “Office Depot Center.”™

To enhance our brand awareness, we announced two new

strategic marketing initiatives at the beginning of 2005. First, we

have re-committed ourselves to the Taking Care of Business

tagline, and incorporated that line into our logo and our adver-

tising. We also reached an alliance with NASCAR®as part of

a multi-year sponsorship that includes both sponsorship of a

NASCAR®racing car and overall supporting sponsorship of