Office Depot 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Financial Accounting Standards Board (“FASB”) has

issued a new accounting pronouncement that will require com-

panies to expense the fair value of stock options granted to

employees. This rule will be applicable for all public companies

beginning with the third quarter of 2005. Because we currently

provide stock options to a large number of our employees, this

change could have a significant impact on our results in 2005

and beyond. Our assessment of this rule change is not yet

complete, but our financial statement footnote disclosures have

indicated that under one acceptable methodology for valuing

stock option grants, the full year impact of expensing stock

options in recent years would have reduced EPS in the range

of $0.06 to $0.09 per share. We anticipate refining our analysis

during the first half of 2005.

Corporate and other items not classified within our three

main segments are addressed below following the discussions

of segment results.

The Overall results table provides a subtotal for segment

operating profit. We use this measure of performance to assess

the operations of each business unit, and we believe it is use-

ful to investors because it reflects the sales and operating

expenses directly related to the segment’s activities. Our gen-

eral and administrative expenses primarily consist of personnel

and related costs associated with support functions. Because

these functions typically support all segments of our business,

we have historically not considered these costs in determining

our segment profitability, but rather have applied this expense

when looking at total company profitability. Other companies

may charge more or less general and administrative costs

to their segments, and our presentation therefore may not

be comparable to similarly titled measurements used by

some other entities. Our measure of segment operating profit

should not be considered as an alternative to operating income

or net earnings determined in accordance with GAAP. The table

above reconciles segment operating profit to operating profit

determined in accordance with GAAP.

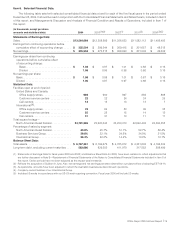

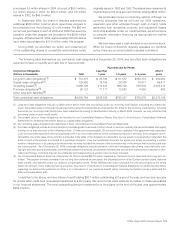

North American Retail Division

(Dollars in millions) 2004 2003 2002

Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,940.7 100.0% $5,650.1 100.0% $5,804.4 100.0%

Cost of goods sold and occupancy costs . . . . 4,367.9 73.5% 4,161.0 73.6% 4,349.9 74.9%

Gross profit . . . . . . . . . . . . . . . . . . . . . . . 1,572.8 26.5% 1,489.1 26.4% 1,454.5 25.1%

Store and warehouse operating and

selling expenses. . . . . . . . . . . . . . . . . . . . . . 1,184.5 19.9% 1,177.9 20.9% 1,037.6 17.9%

Segment operating profit ................. $ 388.3 6.6% $ 311.2 5.5% $ 416.9 7.2%

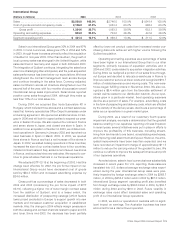

Sales in our North American Retail Division increased 5%

in 2004 over the prior year, compared to a decrease of 3% in

2003. Comparable sales in 2004 from the 892 stores that were

open for more than one year increased 3%. In 2003, comp

sales in the 870 stores that were open for at least one year were

down 4%. Comp sales were positive in each quarter of 2004,

reversing a trend of 15 consecutive quarters of decline. We

completed a chain-wide technology remerchandising effort

during the year, which improved both the breadth of product

selection and presentation. This, plus increased promotional

activity, drove significant technology sales increases. Overall,

while not achieving our desired attachment rate goals, we did

see improvement over last year in many categories. The comp

sales increase in 2004 reflects a higher average transaction size

but fewer transactions and the decrease in 2003 reflects both

lower average transaction size and fewer transactions. We

believe our sales in 2002 and part of 2003 were negatively

impacted by the overall soft U.S. economy at that time.

The overall technology products category increased 13%

in 2004, following an 11% decline in 2003. Sales of desktops,

laptops, and networking equipment were all positive in 2004

while such trends had been negative in 2003. The increase in

2004 in part reflects the remerchandising efforts in technology

and increased promotional activity. Generally, technology prod-

ucts produce lower margin rates as a percent of sales, and

those margins are reduced further by promotions; however,

promotions are frequently supported by our vendors, which

protects our margins. Sales of supplies remained flat in 2004,

with higher ink and toner sales offset by lower paper sales. The

furniture and low tech category comp sales declined, but mar-

gin contribution was positive, reflecting increased margin rates

for each sub-group in this category. During 2004, we launched

our Advantage customer loyalty program and enrolled almost

two million customers by year end. Merchandise costs associ-

ated with this program are included in cost of goods sold.

Overall segment gross margin increased for the year, primarily

from additional volume rebates and promotional support

received from our vendors, particularly in the fourth quarter of

the year. Also during 2004, we expanded our selection of pri-

vate label brands. We currently offer in our stores and catalogs

over 3,000 private label stock keeping units, or SKUs, and

expect to expand this offering in the future.

During 2004, we opened 36 stores that we acquired from

Toys “R” Us. The acquisition has provided us access to markets

in the Northeast region of the U.S. where we were under-

represented in retail. An additional 15 stores from the acquisi-

tion will be opened during 2005. We expect to open a total of

100 new stores during 2005 and remodel about 50 existing

locations. All of these stores will be opened or remodeled using

the M2 design, which we believe shoppers find more appeal-

ing than previous formats.

We adopted EITF 02-16 at the beginning of 2003. This

accounting change reclassified cooperative advertising pay-

ments received from our vendors from a reduction of advertising

expense to a reduction of product cost, primarily cost of goods

Office Depot 2004 Annual Report |23