Office Depot 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Office Depot 2004 Annual Report |53

Beginning with the third quarter of 2005, we will include the

expense associated with share-based payments issued to

employees in our Consolidated Statement of Earnings. See

New Accounting Standards below for discussion of the transi-

tion to this new accounting standard.

Revenue Recognition: Revenue is recognized at the point

of sale for retail transactions and at the time of successful deliv-

ery for contract, catalog and Internet sales. An accrual for sales

returns has been recorded based on historical experience.

Revenue from sales of extended warranty service plans is either

recognized at the point of sale or over the warranty period,

depending on the determination of legal obligor status. All per-

formance obligations and risk of loss associated with such

contracts are transferred to an unrelated third-party admin-

istrator at the time the contracts are sold. Costs associated

with these contracts are recognized in the same period as

the related revenue.

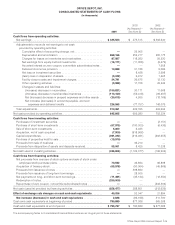

Shipping and Handling Fees and Costs: Income generated

from shipping and handling fees is classified as revenues for

all periods presented. Freight costs incurred to bring mer-

chandise to stores and warehouses are included as a compo-

nent of inventory and costs of goods sold. Freight costs incurred

to ship merchandise to customers are recorded as a component

of store and warehouse operating and selling expenses.

Shipping costs, combined with warehouse handling costs,

totaled $940.0 million in 2004, $827.7 million in 2003 and $717.8

million in 2002.

Advertising: Advertising costs are either charged to expense

when incurred or, in the case of direct marketing advertising,

capitalized and amortized in proportion to the related revenues.

We participate in cooperative advertising programs with

our vendors in which they reimburse us for a portion of our

advertising costs. Prior to 2003, these vendor arrangements

reduced advertising expense for the period. Following a change

in accounting rules that became effective at the beginning of fis-

cal year 2003, we now classify such reimbursements as a

reduction of the costs of our inventory and cost of goods sold

(see Note C). Advertising expense recognized was $571.5 mil-

lion in 2004 and $546.9 million in 2003. Advertising expense in

2002 was $317.6 million, which was net of $242.7 million of

cooperative advertising allowances.

Pre-opening Expenses: Pre-opening expenses related to

opening new stores and warehouses or relocating existing

stores and warehouses are expensed as incurred and included

in other operating expenses.

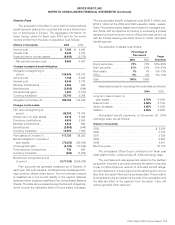

Self-Insurance: Office Depot is primarily self-insured for

workers’ compensation, auto and general liability and employee

medical insurance programs. Self-insurance liabilities are

based on claims filed and estimates of claims incurred but not

reported. These liabilities are not discounted.

Comprehensive Income: Comprehensive income repre-

sents the change in stockholders’ equity from transactions and

other events and circumstances arising from non-stockholder

sources. Comprehensive income consists of net earnings, for-

eign currency translation adjustments, realized or unrealized

gains (losses) on investment securities that are available-for-

sale and elements of qualifying cash flow hedges, net of appli-

cable income taxes.

Derivative Financial Instruments: Certain derivative financial

instruments may be used to hedge the exposure to foreign cur-

rency exchange rate and interest rate risks, subject to an estab-

lished risk management policy. Financial instruments authorized

under this policy include swaps, options, caps, forwards and

futures. Use of derivative financial instruments for trading or

speculative purposes is prohibited by company policies.

Vendor Arrangements: We enter into arrangements with

many of our vendors that entitle us to a partial refund of the cost

of merchandise purchased during the year, or payments for

reimbursement of certain costs we incur to advertise or other-

wise promote their product. The volume based rebates, sup-

ported by a vendor agreement, are estimated throughout

the year and reduce the cost of inventory and cost of goods

sold during the year. This estimate is regularly monitored and

adjusted for current or anticipated changes in purchase levels

and for sales activity. Other promotional rebates are generally

event-based and are recognized as a reduction of cost of goods

sold or inventory, as appropriate based on the type of promo-

tion and the agreement with the vendor, generally when the

promotion or event has occurred. See Note C for additional

discussion of cooperative advertising arrangements.

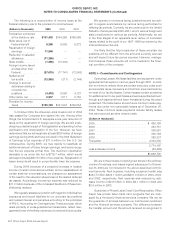

New Accounting Standards: In March 2004, Emerging

Issues Task Force Issue No. 03-1, The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Invest-

ments (“EITF 03-1”), was released. This guidance relates to

impairment measurements of debt and equity securities, and

essentially requires companies to recognize an impairment

unless they believe declines in value will be recovered over

the company’s intended investment horizon. The staff of the

Financial Accounting Standards Board (“FASB”) issued FASB

Staff Position (“FSP”) EITF 03-1-1, Effective Date of Paragraphs

10-20 of EITF Issue No. 03-1, The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Invest-

ments, which delayed the effective date for the measurement

and recognition criteria contained in EITF 03-1 until final appli-

cation guidance is issued. Our current investment portfolio con-

tains only a limited amount of the type of securities covered by

this guidance; however, a change in the method of accounting

for other-than-temporary declines could impact our results of

operations, when that guidance is finalized.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)