Office Depot 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 |Office Depot 2004 Annual Report

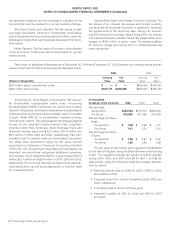

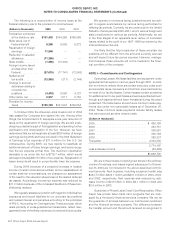

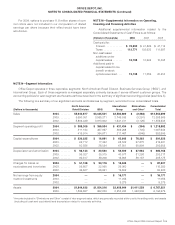

The following is a reconciliation of income taxes at the

Federal statutory rate to the provision for income taxes:

(Dollars in thousands) 2004 2003 2002

Federal tax computed

at the statutory rate. . . $161,432 $154,269 $166,589

State taxes, net of

Federal benefit . . . . . . 6,289 6,506 8,373

Repatriation of foreign

earnings . . . . . . . . . . . 11,540 ——

Reduction in valuation

allowance . . . . . . . . . . (11,295) ——

State credits . . . . . . . . . . (1,386) (10,400) —

Foreign income taxed

at rates other than

Federal . . . . . . . . . . . . (27,015) (17,741) (12,543)

Settlement of

tax audits . . . . . . . . . . (12,355) (217) (2,144)

Change in accrual

estimates relating to

uncertain tax

positions . . . . . . . . . . . (4,418) 8,090 4,127

Other items, net . . . . . . . 2,937 1,017 2,152

Provision for income

taxes. . . . . . . . . . . . . . $125,729 $141,524 $166,554

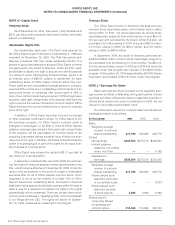

In October 2004, the American Jobs Creation Act of 2004

was passed by Congress and signed into law. Among other

things, the Act provided U.S. taxpayers a one-year reduction of

taxes on the repatriation of foreign earnings. We are still evalu-

ating the potential impact of this legislation and awaiting further

clarification and interpretation of the Act. However, we have

determined that we will repatriate at least $200 million of foreign

earnings during 2005 and have included in the 2004 Statement

of Earnings a tax expense of $11.5 million for this U.S. tax

consequence. During 2005, we may decide to repatriate an

additional amount of these foreign earnings, and would recog-

nize the tax expense at that time. The maximum repatriation

allowable to us under the Act is $778.7 million, which would

add approximately $32.9 million of tax expense. Repatriation of

lesser amounts will result in proportionally lower tax expense.

During 2004, because of a projected increase in taxable

income of certain international entities, and a reassessment of

certain state tax circumstances, we changed our assessment

of the need for the valuation allowances on the related deferred

tax assets. Accordingly, income tax expense was reduced by

$11.3 million because of the increased likelihood of these ben-

efits being realized.

We regularly assess our position with regard to individual tax

exposures and record liabilities for our uncertain tax positions

and related interest and penalties according to the principles

of FAS 5, Accounting for Contingencies. These accruals, which

relate primarily to cross-jurisdictional transactions, reflect man-

agement’s view of the likely outcomes of current and future audits.

We operate in numerous taxing jurisdictions and are sub-

ject to regular examinations by various taxing authorities for

differing tax periods. Currently, we are under audit in the United

States for the tax periods 2000–2001, and in various foreign and

state jurisdictions for various tax periods. Additionally, we are

in the final stages of an appellate level review of contested

issues related to the audit of our 1997–1999 tax returns by the

Internal Revenue Service.

It is likely that the future resolution of these uncertain tax

positions will be different from the amounts currently accrued

and will impact future tax period expense. However, manage-

ment believes those amounts will not be material to the finan-

cial condition of the company.

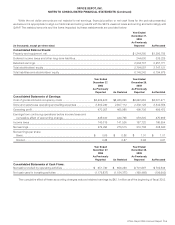

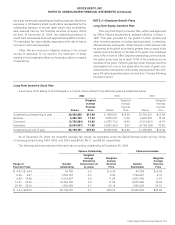

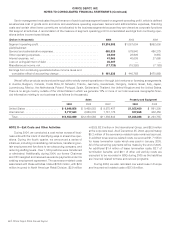

NOTE I—Commitments and Contingencies

Operating Leases: We lease facilities and equipment under

agreements that expire in various years through 2027. In addi-

tion to minimum rentals, there are certain executory costs such

as real estate taxes, insurance and common area maintenance

on most of our facility leases. Certain leases contain provisions

for additional rent to be paid if sales exceed a specified amount,

though such payments have been immaterial during the years

presented. The table below shows future minimum lease pay-

ments due under non-cancelable leases as of December 25,

2004. These minimum lease payments include facility leases

that were accrued as store closure costs.

(Dollars in thousands)

2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 426,180

2006 ................................... 383,751

2007 ................................... 336,561

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 306,163

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 288,337

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,033,205

3,774,197

Less sublease income . . . . . . . . . . . . . . . . . . . . . (84,469)

$3,689,728

We are in the process of opening new stores in the ordinary

course of business, and leases signed subsequent to Decem-

ber 25, 2004 are not included in the above described commit-

ment amounts. Rent expense, including equipment rental, was

$443.7 million, $424.1 million and $401.4 million in 2004, 2003,

and 2002, respectively. Rent expense was reduced by sub-

lease income of $2.9 million in 2004, $3.1 million in 2003 and

$2.9 million in 2002.

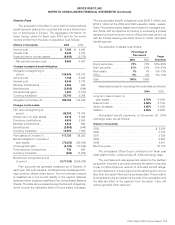

Guarantee of Private Label Credit Card Receivables: Office

Depot has private label credit card programs that are man-

aged by a third-party financial services company. We act as

the guarantor of all loans between our commercial customers

and the financial services company. The difference between

the transfer amount and the amount received is recognized in

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)