Office Depot 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 |Office Depot 2004 Annual Report

NOTE G—Debt

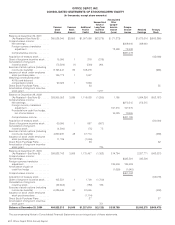

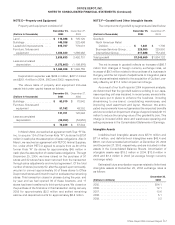

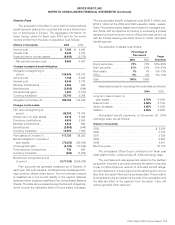

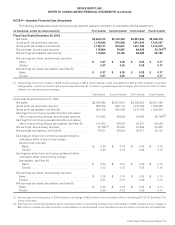

The debt components consisted of the following:

December 25, December 27,

(Dollars in thousands) 2004 2003

Current maturities of

long-term debt:

Capital lease obligations . . $ 13,673 $ 11,219

Other. . . . . . . . . . . . . . . . . . 1,470 1,697

$ 15,143 $ 12,916

Long-term debt, net of

current maturities:

Revolving credit facility. . . . $103,068 $100,102

$250 million senior

subordinated notes. . . . . —259,440

$400 million senior notes . . 403,771 398,923

Capital lease obligations . . 76,841 69,367

Other. . . . . . . . . . . . . . . . . . —1,470

$583,680 $829,302

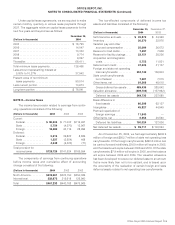

In April 2004, we replaced our existing credit facility with a

$750 million 5-year unsecured multi-currency revolving credit

facility, which includes up to $350 million available for standby

and trade letters of credit. Upon mutual agreement, the maxi-

mum borrowing may be increased to $900 million. The agree-

ment provides borrowings up to the total amount in U.S. dollars,

British pounds, euro, or yen. We may elect interest periods of

one, two, three, six, nine or twelve months. Interest is based on

the London Interbank Offering Rate (“LIBOR”), plus a spread

determined at the time of usage. Based on current credit rat-

ings, borrowings include a spread of 0.70%. The effective inter-

est rate on yen borrowings at the end of 2004 was 0.763%.

At December 25, 2004, we had approximately $565.7 million

of available credit under our revolving credit facility, which

covers $81.9 million outstanding letters of credit. We had an

additional $8.2 million of letters of credit outstanding under a

separate trade agreement.

The credit facility in effect at December 27, 2003 allowed

borrowings up to $600 million and was an unsecured revolv-

ing credit facility that was due to mature in April 2005. Similar

to the current facility, this previous facility allowed us to select

currencies, and interest periods. Interest was based on either

LIBOR, U.S. prime, or a Eurocurrency rate, plus a spread to be

determined at the time of borrowing. At December 27, 2003, we

had yen borrowings equivalent to $100.1 million outstanding

with an average effective interest rate of 0.988%, and out-

standing letters of credit totaled $72.8 million.

In July 2001, we issued $250 million of senior subordinated

notes due on July 15, 2008. The notes were issued with a

coupon interest rate of 10.00%, payable semi-annually on

January 15 and July 15. In August 2001, we entered into LIBOR-

based fixed-to-variable rate swap agreements as a fair value

hedge of these notes. In September 2002, these interest rate

swap agreements were terminated and we received proceeds

of $18.8 million. The benefit associated with these proceeds

was being amortized over the remaining term of the notes,

lowering the effective interest rate on this borrowing to 8.7%.

In December 2004, we redeemed the entire issue of the $250

million senior subordinated notes, pursuant to the optional

redemption provisions of the subordinated notes indenture. The

payment of approximately $302 million included the principal,

accrued interest to the termination date, and contractual

interest, discounted at the appropriate U.S. Treasury rate plus

50 basis points. The redemption resulted in a fourth quarter

2004 charge of $45.4 million which included the make whole

payment, removal of deferred issuance costs, and the previ-

ously deferred gain related to the interest rate swap. The charge

is reported as loss on extinguishment of debt in the other

income (expense), net section of the Consolidated Statements

of Earnings.

In August 2003, we issued $400 million senior notes due

August 2013. These notes are not callable and bear interest at

the rate of 6.250% per year, to be paid on February 15 and

August 15 of each year. The notes contain provisions that, in cer-

tain circumstances, place financial restrictions or limitations on

us. Simultaneous with completing the offering, we liquidated a

treasury rate lock. The proceeds of $16.6 million are being amor-

tized over the term of the issue, reducing the effective interest

rate to 5.87%. During 2004, we entered into a series of fixed-to-

variable interest rate swap agreements as fair value hedges on

the $400 million of notes. The swaps qualify for shortcut hedge

accounting and no ineffectiveness has been recognized.

We are in compliance with all restrictive covenants included

in the above debt agreements.

Our scheduled debt maturities over the next five years

include $103 million for our revolving credit facility due in 2009;

$400 million for our senior notes is due thereafter.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)