Office Depot 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Office Depot 2004 Annual Report |51

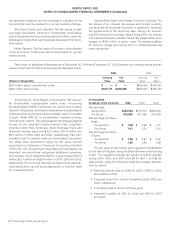

been considered permanently reinvested, they have not been

subject to an incremental U.S. tax provision. Cumulative undis-

tributed earnings of our foreign subsidiaries for which no

income taxes have been provided was $1,203.5 million and

$1,046.2 million as of December 25, 2004 and December 27,

2003, respectively.

The American Jobs Creation Act of 2004 included a one-

time reduction in U.S. Federal taxes on the repatriation of for-

eign earnings of an affiliate. We are still evaluating the potential

impact of this legislation and awaiting further clarification and

interpretation of the Act. However, we have determined that we

will repatriate at least $200 million during 2005 and have

included a current expense of $11.5 million in the 2004 Con-

solidated Statement of Earnings for this U.S. tax consequence.

During 2005, we may decide to repatriate an additional amount

of these foreign earnings, and would recognize the tax expense

at that time. The maximum repatriation allowable to us is $778.7

million, which would add approximately $32.9 million of tax

expense. Repatriation of lesser amounts will result in propor-

tionally lower tax expense.

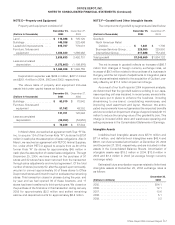

Property and Equipment: Property and equipment addi-

tions are recorded at cost. Depreciation and amortization is

recognized over their estimated useful lives using the straight-

line method. The useful lives of depreciable assets are esti-

mated to be 15-30 years for buildings and 3-10 years for

furniture, fixtures and equipment. Computer software is amor-

tized over three years for common office applications, five years

for larger business applications and seven years for certain

enterprise-wide systems. Leasehold improvements are amor-

tized over the shorter of the terms of the underlying leases or

the estimated economic lives of the improvements.

Other Investments: In prior years, we made various invest-

ments in Internet-based companies and funds. These invest-

ments are carried at cost and their value is reduced if a decline

is considered other than temporary. During 2003, we liquidated

various investments and recognized an $8.4 million charge in

miscellaneous income (expense), net. Impairment charges of

$3.0 million were recorded in 2002. At December 25, 2004 and

December 27, 2003, the portfolio totaled $4.9 million and $5.0

million, respectively.

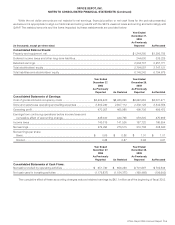

Goodwill and Other Intangible Assets: Goodwill represents

the excess of the purchase price and related costs over the

value assigned to net tangible and identifiable intangible assets

of businesses acquired and accounted for under the purchase

method. Accounting rules require that we test at least annually

for possible goodwill impairment. We perform our test in the

fourth quarter of each year using a discounted cash flow analy-

sis that requires that certain assumptions and estimates be

made regarding industry economic factors and future profitabil-

ity. As a result of the 2004 impairment analysis, we determined

that the goodwill balance existing in our Japanese reporting unit

was impaired. Accordingly, we recorded an impairment charge

of approximately $11.5 million which is included in store and

warehouse operating and selling expenses in the Consolidated

Statements of Earnings. No other indication of goodwill impair-

ment was identified. See Note F for goodwill balances and

related information.

We amortize the cost of other intangible assets over their

estimated useful lives unless such lives are deemed indefinite.

Amortizable intangible assets are tested as appropriate for

impairment based on undiscounted cash flows and, if impaired,

written down to fair value based on either discounted cash

flows or appraised values. Intangible assets with indefinite

lives are tested annually for impairment and written down to

fair value as required. We test for impairment of intangible

assets each year during the fourth quarter; no impairment has

been identified.

Impairment of Long-Lived Assets: Long-lived assets are

reviewed for possible impairment annually or whenever events

or changes in circumstances indicate that the carrying amount

of such assets may not be recoverable. Impairment is assessed

at the location level, considering the estimated undiscounted

cash flows over the asset’s remaining life. If estimated cash

flows are insufficient to recover the investment, an impairment

loss is recognized based on the fair value of the asset less any

costs of disposition.

Impairment losses of $3.9 million, $2.7 million and $5.4

million were recognized in 2004, 2003 and 2002, respectively,

relating to certain under-performing retail stores.

Facility Closure Costs: We regularly review store perform-

ance against expectations and close stores not meeting our

investment requirements. Costs associated with store closures,

principally lease cancellation costs, are recognized when the

facility is no longer used in an operating capacity or when a lia-

bility has been incurred. Store assets are also reviewed for pos-

sible impairment, or reduction of useful lives.

Accruals for lease termination costs are based on the future

commitments under contract, adjusted for anticipated sublease

and termination benefits. We conducted a comprehensive

review of closed store commitments during the fourth quarter

of 2003 and recorded a $23.9 million charge to terminate some

existing commitments and to adjust the remaining commitments

to current market values. We recorded similar charges in 2002

of $6.7 million. The accrued balance relating to our future com-

mitments under operating leases of our closed stores was $58.8

million and $57.6 million at December 25, 2004 and Decem-

ber 27, 2003, respectively.

Fair Value of Financial Instruments: The estimated fair val-

ues of financial instruments recognized in the Consolidated

Balance Sheets or disclosed within these Notes to Consoli-

dated Financial Statements have been determined using avail-

able market information, information from unrelated third party

financial institutions and appropriate valuation methodologies,

primarily discounted projected cash flows. However, consider-

able judgment is required when interpreting market information

and other data to develop estimates of fair value. Accordingly,

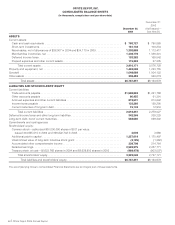

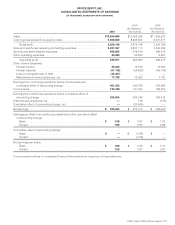

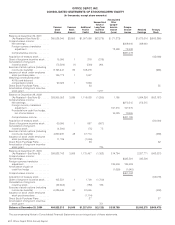

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)