Office Depot 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Office Depot 2004 Annual Report |59

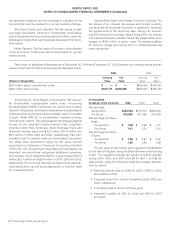

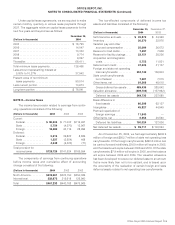

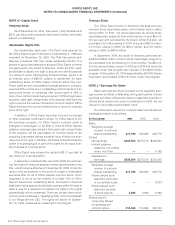

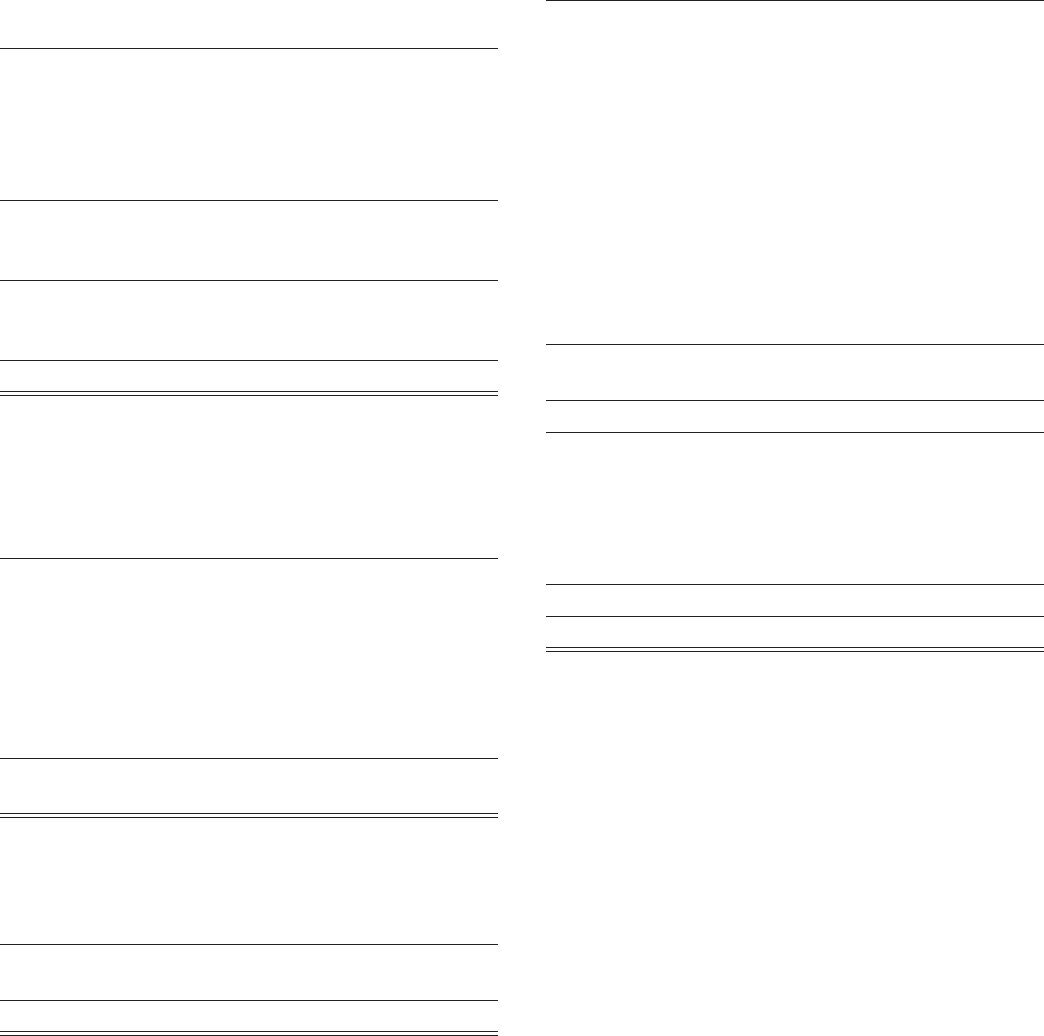

Under capital lease agreements, we are required to make

certain monthly, quarterly or annual lease payments through

2027. The aggregate minimum capital lease payments for the

next five years and beyond are as follows:

December 25,

(Dollars in thousands) 2004

2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 18,795

2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,047

2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,332

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,774

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,097

Thereafter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66,411

Total minimum lease payments . . . . . . . . . . . . . 128,456

Less amount representing interest at

5.00% to 10.27% . . . . . . . . . . . . . . . . . . . . . . 37,942

Present value of net minimum

lease payments . . . . . . . . . . . . . . . . . . . . . . . 90,514

Less current portion . . . . . . . . . . . . . . . . . . . . . . 13,673

Long-term portion ....................... $ 76,841

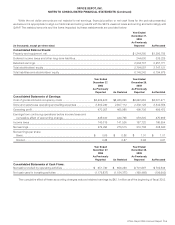

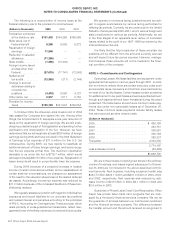

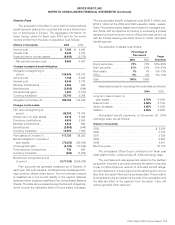

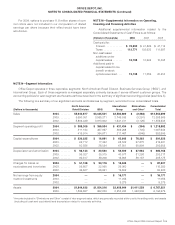

NOTE H—Income Taxes

The income tax provision related to earnings from contin-

uing operations consisted of the following:

(Dollars in thousands) 2004 2003 2002

Current:

Federal . . . . . . . . . . . . $ 90,606 $ 71,032 $114,497

State.............. 5,754 (4,370) 13,967

Foreign . . . . . . . . . . . . 18,480 43,116 28,994

Deferred:

Federal . . . . . . . . . . . . 5,013 39,822 8,699

State . . . . . . . . . . . . . . 1,327 (3,554) 468

Foreign............ 4,549 (4,522) (71)

Total provision for

income taxes ....... $125,729 $141,524 $166,554

The components of earnings from continuing operations

before income taxes and cumulative effect of accounting

change consisted of the following:

(Dollars in thousands) 2004 2003 2002

North America ........ $232,561 $225,150 $350,069

International . . . . . . . . . . 228,672 215,618 125,900

Total . . . . . . . . . . . . . . . . $461,233 $440,768 $475,969

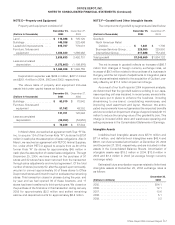

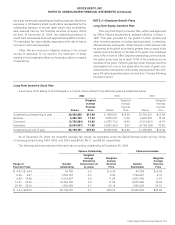

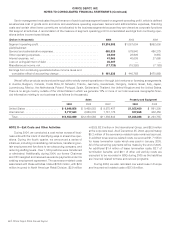

The tax-effected components of deferred income tax

assets and liabilities consisted of the following:

December 25, December 27,

(Dollars in thousands) 2004 2003

Self-insurance accruals . . . . . . . $ 25,870 $ 24,348

Inventory . . . . . . . . . . . . . . . . . . 30,370 22,976

Vacation pay and other

accrued compensation . . . . . 35,084 26,672

Reserve for bad debts . . . . . . . . 7,497 7,926

Reserve for facility closings . . . . 22,151 28,226

Acquisition and integration

costs . . . . . . . . . . . . . . . . . . . . 5,752 11,821

Deferred rent credit . . . . . . . . . . 47,626 51,137

Foreign and state net operating

loss carryforwards . . . . . . . . . 253,140 156,903

State credit carryforwards,

net of federal . . . . . . . . . . . . . 7,581 7,015

Other items, net . . . . . . . . . . . . . 54,368 48,618

Gross deferred tax assets . . . 489,439 385,642

Valuation allowance . . . . . . . . . . (239,704) (157,962)

Deferred tax assets . . . . . . . . 249,735 227,680

Basis difference in

fixed assets . . . . . . . . . . . . . . 86,399 62,127

Intangibles . . . . . . . . . . . . . . . . . 45,827 44,949

Planned repatriation of

foreign earnings . . . . . . . . . . . 11,540 —

Other items, net............. 6,258 20,560

Deferred tax liabilities....... 150,024 127,636

Net deferred tax assets . . . . . . . $ 99,711 $ 100,044

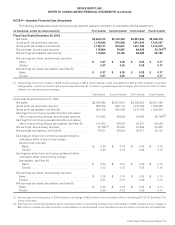

As of December 25, 2004, we had approximately $636.9

million of foreign and $802.7 million of state net operating loss

carryforwards. Of the foreign carryforwards, $490.8 million can

be carried forward indefinitely, $16.9 million will expire in 2005,

and the balance will expire between 2006 and 2019. Of the state

carryforwards, $7.9 million will expire in 2005, and the balance

will expire between 2006 and 2024. The valuation allowance

has been developed to reduce our deferred asset to an amount

that is more likely than not to be realized, and is based upon

the uncertainty of the realization of certain foreign and state

deferred assets related to net operating loss carryforwards.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)