NVIDIA 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

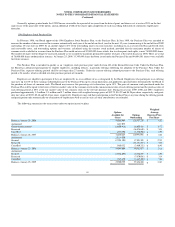

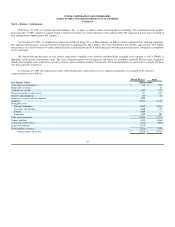

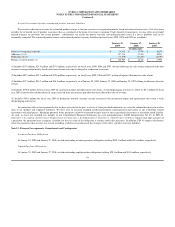

Note 3 – Restructuring Charges and Other

On September 18, 2008, we announced a workforce reduction to allow for continued investment in strategic growth areas, which was completed in the third

quarter of fiscal year 2009. As a result, we eliminated approximately 360 positions worldwide, or about 6.5% of our global workforce. During fiscal year 2009,

expenses associated with the workforce reduction, which were comprised primarily of severance and benefits payments to these employees, totaled $8.0

million. The remaining accrual of $0.2 million as of January 25, 2009 relates to severance and benefits payments, which are expected to be paid during the first

quarter of fiscal year 2010.

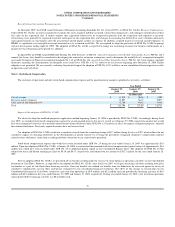

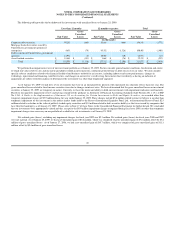

The following table provides a summary of the restructuring activities and related liabilities recorded in accrued liabilities in our Consolidated Balance Sheet

as of January 25, 2009:

Restructuring and other expenses for fiscal year 2009 also included a non

-

recurring charge of $18.9 million associated with the termination of a development

contract related to a new campus construction project that has been put on hold.

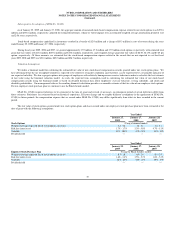

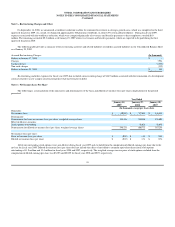

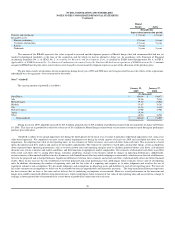

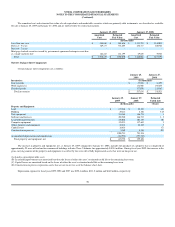

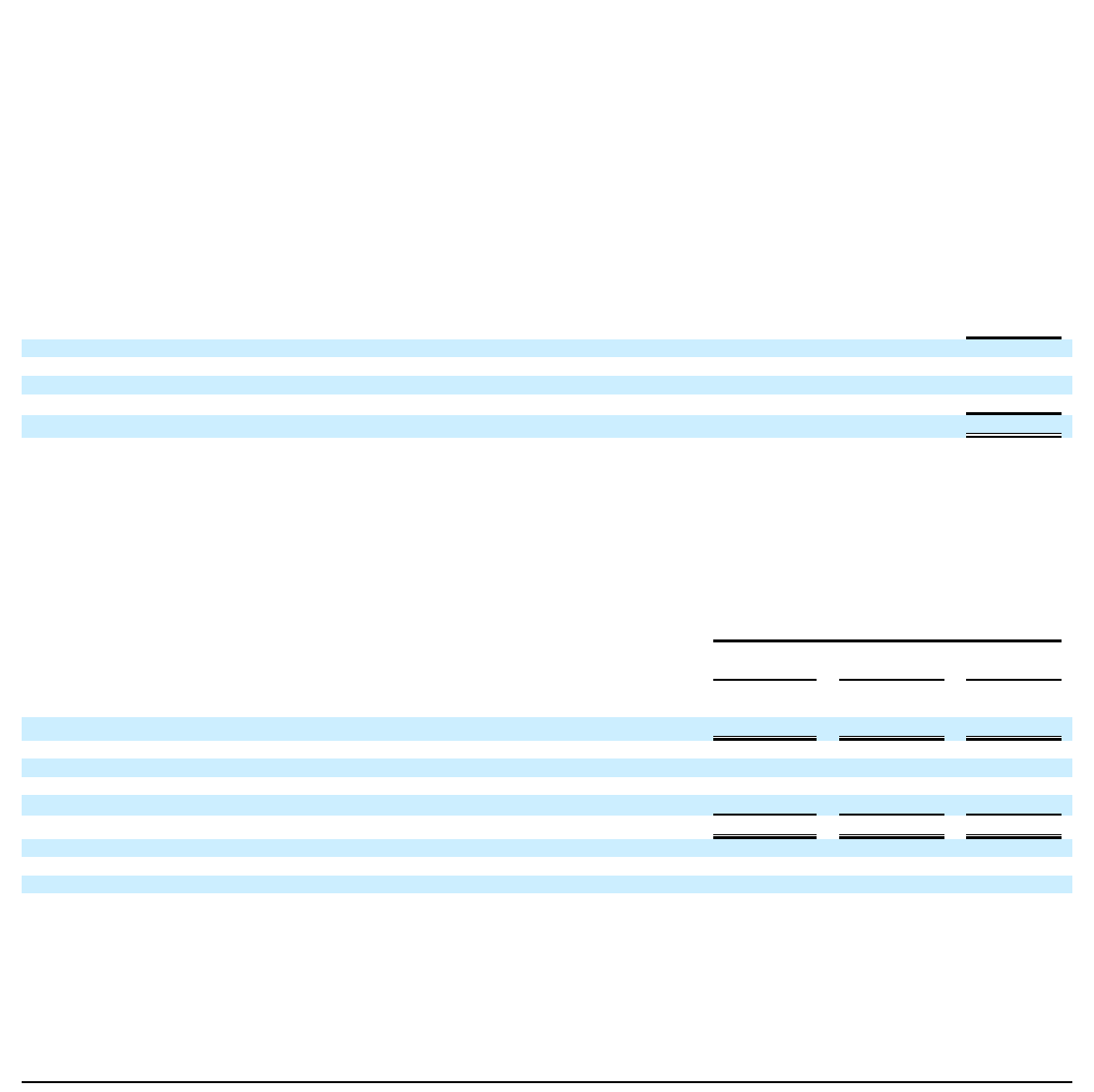

Note 4 – Net Income (Loss) Per Share

The following is a reconciliation of the numerators and denominators of the basic and diluted net income (loss) per share computations for the periods

presented:

All of our outstanding stock options were anti

-

dilutive during fiscal year 2009 and excluded from the computation of diluted earnings per share due to the

net loss for fiscal year 2009. Diluted net income (loss) per share does not include the effect of anti

-

dilutive common equivalent shares from stock options

outstanding of 11.9 million and 13.4 million for fiscal years 2008 and 2007, respectively. The weighted average exercise price of stock options excluded from the

computation of diluted earnings per share was $32.05 and $20.09 for fiscal years 2008 and 2007, respectively.

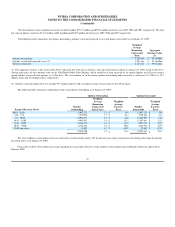

Accrued Restructuring Charges :

(In thousands)

Balance at January 27, 2008

$

-

Charges

7,956

Cash payments

(7,440

)

Non

-

cash charges

(330

)

Balance at January 25, 2009

$

186

Year Ended

January 25,

2009

January 27,

2008

January 28,

2007

(In thousands, except per share data)

Numerator:

Net income (loss)

$

(30,041

)

$

797,645

$

448,834

Denominator:

Denominator for basic net income (loss) per share, weighted average shares

548,126

550,108

528,606

Effect of dilutive securities:

Stock options outstanding

-

56,624

58,650

Denominator for diluted net income (loss) per share, weighted average shares

548,126

606,732

587,256

Net income (loss) per share:

Basic net income (loss) per share

$

(0.05

)

$

1.45

$

0.85

Diluted net income (loss) per share

$

(0.05

)

$

1.31

$

0.76

83