NVIDIA 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

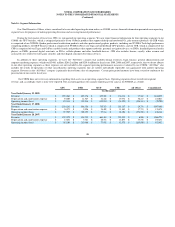

Note 17 –

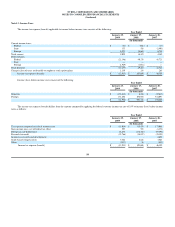

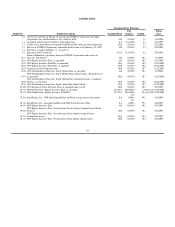

Fair Value of Cash Equivalents and Marketable Securities

We measure our cash equivalents and marketable securities at fair value. The fair values of our financial assets and liabilities are determined using quoted

market prices of identical assets or quoted market prices of similar assets from active markets. Level 1 valuations are obtained from real

-

time quotes for

transactions in active exchange markets involving identical assets. Level 2 valuations are obtained from quoted market prices in active markets involving similar

assets. Level 3 valuations are based on unobservable inputs to the valuation methodology and include our own data about assumptions market participants

would use in pricing the asset or liability based on the best information available under the circumstances.

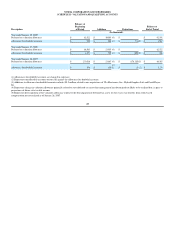

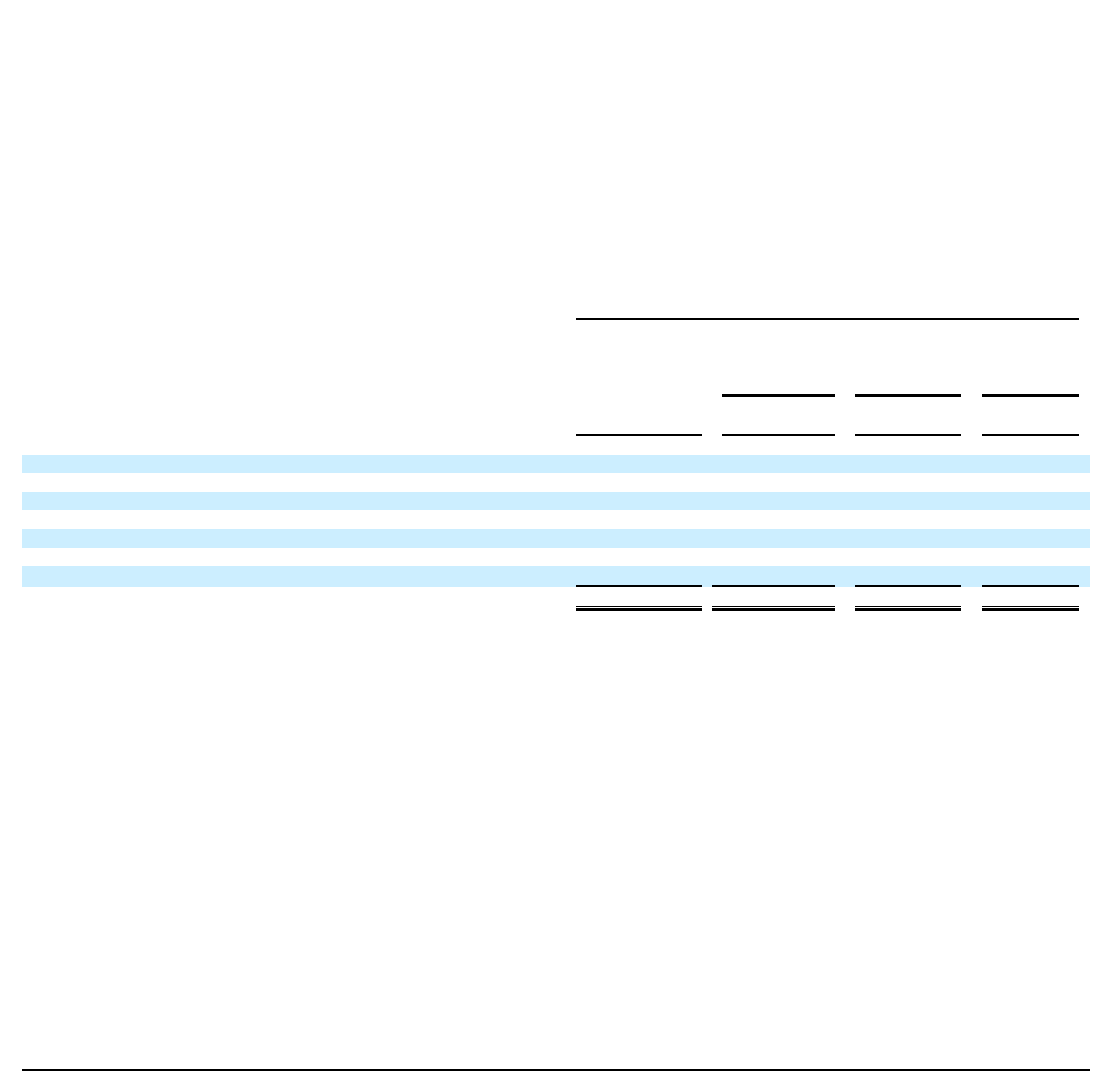

Financial assets and liabilities measured at fair value are summarized below:

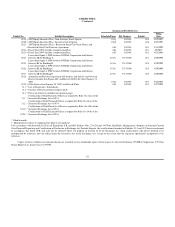

(1) Included in Marketable securities on the Consolidated Balance Sheet.

(2) Included in Cash and cash equivalents on the Consolidated Balance Sheet.

(3) Includes $38,091 in Cash and cash equivalents and $213,083 in Marketable securities on the Consolidated Balance Sheet.

(4) Includes $73,233 in Cash and cash equivalents and $244,888 in Marketable securities on the Consolidated Balance Sheet.

(5) Includes $14,646 in Cash and cash equivalents and $124,400 in Marketable securities on the Consolidated Balance Sheet.

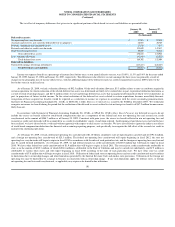

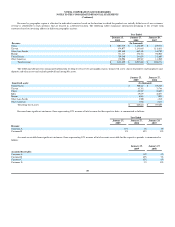

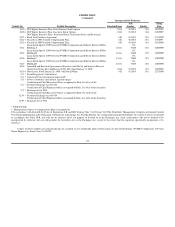

For our money market funds that were held by the International Reserve Fund at January 25, 2009, we assessed the fair value of the money market funds by

considering the underlying securities held by the International Reserve Fund. As the International Reserve Fund has halted redemption requests and is currently

believed to be holding all of their securities until maturity, we valued the underlying securities held by the International Reserve Fund at their maturity value using

an income approach. Certain of the debt securities held by the International Reserve Fund were issued by companies that have filed for bankruptcy as of January

25, 2009 and, as such, our valuation of those securities was zero. The net result was that, as of January 25, 2009, we estimated the fair value of the International

Reserve Fund

’

s investments to be 95.7% of their last

-

known value prior to January 25, 2009. Based on this assessment, we recorded an other than temporary

impairment charge of $5.6 million during fiscal year 2009. Due to the inherent subjectivity and the significant judgment involved in the valuation of our holdings of

International Reserve Fund, we have classified these securities under the Level 3 fair value hierarchy.

As of January 25, 2009, our money market investment in the International Reserve Fund, which was valued at $124.4 million, net of other than temporary

impairment charges, was classified as marketable securities in our Consolidated Balance Sheet due to the halting of redemption requests in September 2008 by the

International Reserve Fund.

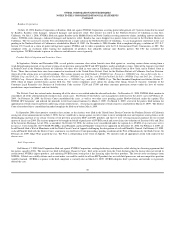

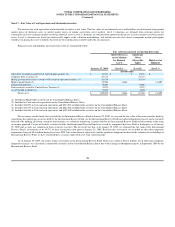

Fair value measurement at reporting date using

Quoted Prices in

Active Markets

for Identical

Assets

Significant

Other

Observable

Inputs

High Level of

Judgment

January 25, 2009

(Level 1)

(Level 2)

(Level 3)

(In thousands)

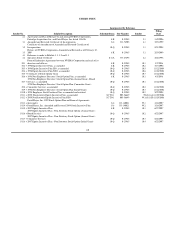

Other debt securities issued by U.S. Government agencies (4)

$

318,121

$

-

$

318,121

$

-

Corporate debt securities (3)

251,174

-

251,174

-

Mortgage

-

backed securities issued by Government

-

sponsored entities (1)

161,199

-

161,199

-

Money market funds (5)

139,046

14,646

-

124,400

Commercial paper (2)

56,997

-

56,997

-

Debt securities issued by United States Treasury (1)

55,275

-

55,275

-

Asset

-

backed securities (1)

38,858

-

38,858

-

Total assets

$

1,020,670

$

14,646

$

881,624

$

124,400

106