NVIDIA 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

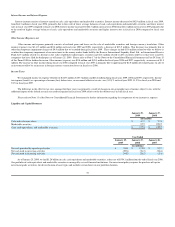

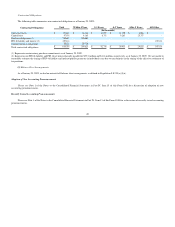

Operating Capital and Capital Expenditure Requirements.

We believe that our existing cash balances and anticipated cash flows from operations will be sufficient to meet our operating, acquisition and capital

requirements for at least the next twelve months. However, there is no assurance that we will not need to raise additional equity or debt financing within this time

frame. Additional financing may not be available on favorable terms or at all and may be dilutive to our then

-

current stockholders. We also may require additional

capital for other purposes not presently contemplated. If we are unable to obtain sufficient capital, we could be required to curtail capital equipment purchases or

research and development expenditures, which could harm our business. Factors that could affect our cash used or generated from operations and, as a result, our

need to seek additional borrowings or capital include:

We expect to spend approximately $200 million to $250 million for capital expenditures during fiscal year 2010, primarily for property development, leasehold

improvements, software licenses, emulation equipment, computers and engineering workstations. In addition, we may continue to use cash in connection with the

acquisition of new businesses or assets.

For additional factors see “Item 1A. Risk Factors

-

Risks Related to Our Business and Industry

-

Our revenue may fluctuate while our operating expenses

are relatively fixed, which makes our results difficult to predict and could cause our results to fall short of expectations.”

3dfx Asset Purchase

On December 15, 2000, NVIDIA Corporation and one of our indirect subsidiaries entered into an Asset Purchase Agreement, or APA, which closed on April

18, 2001, to purchase certain graphics chip assets from 3dfx. Under the terms of the APA, the cash consideration due at the closing was $70.0 million, less $15.0

million that was loaned to 3dfx pursuant to a Credit Agreement dated December 15, 2000. The Asset Purchase Agreement also provided, subject to the other

provisions thereof, that if 3dfx properly certified that all its debts and other liabilities had been provided for, then we would have been obligated to pay 3dfx one

million shares, which due to subsequent stock splits now totals six million shares, of NVIDIA common stock. If 3dfx could not make such a certification, but

instead properly certified that its debts and liabilities could be satisfied for less than $25.0 million, then 3dfx could have elected to receive a cash payment equal to

the amount of such debts and liabilities and a reduced number of shares of our common stock, with such reduction calculated by dividing the cash payment by

$25.00 per share. If 3dfx could not certify that all of its debts and liabilities had been provided for, or could not be satisfied, for less than $25.0 million, we would not

be obligated under the agreement to pay any additional consideration for the assets.

In October 2002, 3dfx filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the Northern District of California. In March 2003,

we were served with a complaint filed by the Trustee appointed by the Bankruptcy Court which sought, among other things, payments from us as additional

purchase price related to our purchase of certain assets of 3dfx. In early November 2005, after several months of mediation, NVIDIA and the Official Committee of

Unsecured Creditors, or the Creditors

’

Committee, agreed to a Plan of Liquidation of 3dfx, which included a conditional settlement of the Trustee

’

s claims against

us. This conditional settlement was subject to a confirmation process through a vote of creditors and the review and approval of the Bankruptcy Court. The

conditional settlement called for a payment by NVIDIA of approximately $30.6 million to the 3dfx estate. Under the settlement, $5.6 million related to various

administrative expenses and Trustee fees, and $25.0 million related to the satisfaction of debts and liabilities owed to the general unsecured creditors of 3dfx.

Accordingly, during the three month period ended October 30, 2005, we recorded $5.6 million as a charge to settlement costs and $25.0 million as additional

purchase price for 3dfx. The Trustee advised that he intended to object to the settlement. The conditional settlement never progressed substantially through the

confirmation process.

On December 21, 2006, the Bankruptcy Court scheduled a trial for one portion of the Trustee

’

s case against NVIDIA. On January 2, 2007, NVIDIA

terminated the settlement agreement on grounds that the Bankruptcy Court had failed to proceed toward confirmation of the Creditors

’

Committee

’

s plan. A non

-

jury trial began on March 21, 2007 on valuation issues in the Trustee's constructive fraudulent transfer claims against NVIDIA. Specifically, the Bankruptcy Court

tried four questions: (1) what did 3dfx transfer to NVIDIA in the APA?; (2) of what was transferred, what qualifies as "property" subject to the Bankruptcy Court's

avoidance powers under the Uniform Fraudulent Transfer Act and relevant bankruptcy code provisions?; (3) what is the fair market value of the "property"

identified in answer to question (2)?; and (4) was the $70 million that NVIDIA paid "reasonably equivalent" to the fair market value of that property? The parties

completed post

-

trial briefing on May 25, 2007.

·

decreased demand and market acceptance for our products and/or our customers

’

products;

·

inability to successfully develop and produce in volume production our next

-

generation products;

·

competitive pressures resulting in lower than expected average selling prices; and

·

new product announcements or product introductions by our competitors.

58