NVIDIA 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Income Taxes

Statement of Financial Accounting Standards No. 109, or SFAS No. 109, Accounting for Income Taxes, establishes financial accounting and reporting

standards for the effect of income taxes. In accordance with SFAS No. 109, we recognize federal, state and foreign current tax liabilities or assets based on our

estimate of taxes payable or refundable in the current fiscal year by tax jurisdiction. We also recognize federal, state and foreign deferred tax assets or liabilities, as

appropriate, for our estimate of future tax effects attributable to temporary differences and carryforwards; and we record a valuation allowance to reduce any

deferred tax assets by the amount of any tax benefits that, based on available evidence and judgment, are not expected to be realized.

United States income tax has not been provided on earnings of our non

-

United States subsidiaries to the extent that such earnings are considered to be

permanently reinvested.

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves dealing with uncertainties in the

application of complex tax laws. Our estimates of current and deferred tax assets and liabilities may change based, in part, on added certainty or finality to an

anticipated outcome, changes in accounting standards or tax laws in the United States or foreign jurisdictions where we operate, or changes in other facts or

circumstances. In addition, we recognize liabilities for potential United States and foreign income tax contingencies based on our estimate of whether, and the

extent to which, additional taxes may be due. If we determine that payment of these amounts is unnecessary or if the recorded tax liability is less than our current

assessment, we may be required to recognize an income tax benefit or additional income tax expense in our financial statements, accordingly.

On January 29, 2007, we adopted FASB Interpretation No. 48, or FIN 48, Accounting for Uncertainty in Income Taxes, issued in July 2006. FIN 48 applies to

all tax positions related to income taxes subject to SFAS No. 109. Under FIN 48 we recognize the benefit from a tax position only if it is more

-

likely

-

than

-

not that the

position would be sustained upon audit based solely on the technical merits of the tax position. The cumulative effect of adoption of FIN 48 did not result in a

material adjustment to our tax liability for unrecognized income tax benefits. Our policy to include interest and penalties related to unrecognized tax benefits as a

component of income tax expense did not change as a result of implementing the FIN 48. Please refer to Note 13 of these Notes to the Consolidated Financial

Statements for additional information.

Comprehensive Income (Loss)

Comprehensive income (loss) consists of net income (loss) and other comprehensive income or loss. Other comprehensive income or loss components

include unrealized gains or losses on available

-

for

-

sale securities, net of tax.

Net Income (Loss) Per Share

Basic net income (loss) per share is computed using the weighted average number of common shares outstanding during the period. Diluted net income

(loss) per share is computed using the weighted average number of common and dilutive common equivalent shares outstanding during the period, using the

treasury stock method. Under the treasury stock method, the effect of stock options outstanding is not included in the computation of diluted net income (loss)

per share for periods when their effect is anti

-

dilutive.

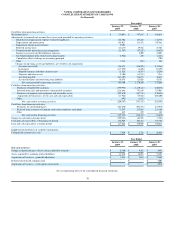

Cash and Cash Equivalents

We consider all highly liquid investments that are readily convertible into cash and have an original maturity of three months or less at the time of purchase

to be cash equivalents. As of January 25, 2009 and January 27, 2008, our cash and cash equivalents were $417.7 million and $727.0 million, which includes $14.6

million and $218.1 million invested in money market funds for fiscal year 2009 and fiscal year 2008, respectively.

74