NVIDIA 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

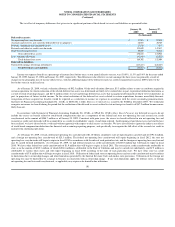

As of January 25, 2009, United States federal and state income taxes have not been provided on approximately $823.6 million of undistributed earnings of

non

-

United States subsidiaries as such earnings are considered to be permanently reinvested.

The Company has a tax holiday in effect for its business operations in India which will terminate in March 2010. This tax holiday provides for a lower rate

of taxation on certain classes of income based on various thresholds of investment and employment in such jurisdiction. For fiscal year 2009, the tax savings of

this holiday was approximately $0.9 million with no material per

-

share impact.

On January 29, 2007, we adopted FASB Interpretation No. 48, or FIN 48, Accounting for Uncertainty in Income Taxes. The cumulative effect of adoption

of FIN 48 did not result in a material adjustment to our tax liability for unrecognized income tax benefits. As of January 25, 2009, we had $95.3 million of

unrecognized tax benefits, all of which would affect our effective tax rate if recognized. However, included in the unrecognized tax benefits that would affect our

effective tax rate if recognized of $95.3 million is $19.7 million related to state income tax that, if recognized, would be in the form of a carryforward deferred tax asset

that would likely attract a full valuation allowance. The $95.3 million of unrecognized tax benefits as of January 25, 2009 consists of $37.4 million recorded in non

-

current income taxes payable and $57.9 million reflected as a reduction to the related deferred tax assets.

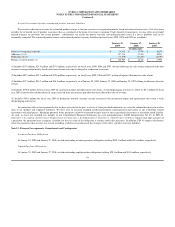

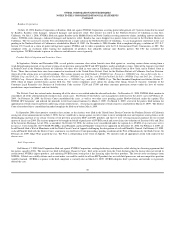

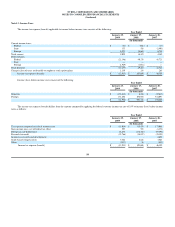

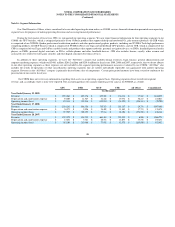

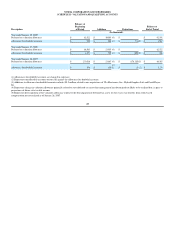

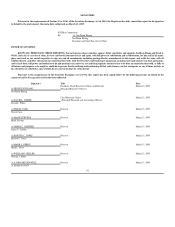

A reconciliation of unrecognized tax benefits is as follows:

We have historically classified certain unrecognized tax benefits as income taxes payable, which was included within the current liabilities section of our

Consolidated Balance Sheet. As a result of our adoption of FIN 48, we now classify an unrecognized tax benefit as a current liability, or as a reduction of the

amount of a net operating loss carryforward or amount refundable, to the extent that we anticipate payment or receipt of cash for income taxes within one

year. Likewise, the amount is classified as a long

-

term liability if we anticipate payment or receipt of cash for income taxes during a period beyond a year.

Our policy to include interest and penalties related to unrecognized tax benefits as a component of income tax expense did not change as a result of

implementing FIN 48. As of January 25, 2009 and January 27, 2008, we had accrued $11.8 million and $11.2 million, respectively, for the payment of interest and

penalties related to unrecognized tax benefits, which is not included as a component of our unrecognized tax benefits. As of January 25, 2009, non

-

current income

taxes payable of $49.2 million consists of unrecognized tax benefits of $37.4 million and the related interest and penalties of $11.8 million.

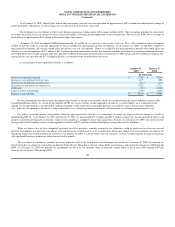

While we believe that we have adequately provided for all tax positions, amounts asserted by tax authorities could be greater or less than our accrued

position. Accordingly, our provisions on federal, state and foreign tax

-

related matters to be recorded in the future may change as revised estimates are made or the

underlying matters are settled or otherwise resolved. As of January 25, 2009, we do not believe that our estimates, as otherwise provided for, on such tax positions

will significantly increase or decrease within the next twelve months.

We are subject to taxation by a number of taxing authorities both in the United States and throughout the world. As of January 25, 2009, the material tax

jurisdictions that are subject to examination include the United States, Hong Kong, Taiwan, China, India, and Germany and include our fiscal years 2003 through

2009. As of January 25, 2009, the material tax jurisdictions for which we are currently under examination include India for fiscal years 2003 through 2007 and

Germany for fiscal years 2004 through 2006.

January 25,

2009

January 27,

2008

(In thousands)

Balance at beginning of period

$

77,791

$

57,544

Increases in tax positions for prior years

6,297

3,900

Decreases in tax positions for prior years

(272

)

(433

)

Increases in tax positions for current year

13,622

21,716

Settlements

(181

)

(2,445

)

Lapse in statute of limitations

(1,938

)

(2,491

)

Balance at end of period

$

95,319

$

77,791

102