NVIDIA 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT

’

S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

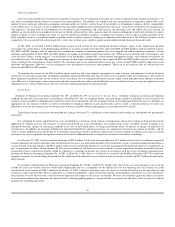

Our common stock is traded on the NASDAQ Global Select Market under the symbol NVDA. Public trading of our common stock began on January 22,

1999. Prior to that, there was no public market for our common stock. As of

March 10, 2009,

we had approximately

460

registered stockholders, not including those

shares held in street or nominee name. The following table sets forth for the periods indicated the high and low sales price for our common stock as quoted on the

NASDAQ Global Select Market:

(1) Reflects a three

-

for

-

two stock split effective on September 10, 2007.

Dividend Policy

We have never paid and do not expect to pay cash dividends for the foreseeable future.

Issuer Purchases of Equity Securities

During fiscal year 2005, we announced that our Board of Directors, or Board, had authorized a stock repurchase program to repurchase shares of our

common stock, subject to certain specifications, up to an aggregate maximum amount of $300 million. During fiscal year 2007, the Board further approved an

increase of $400 million to the original stock repurchase program. In fiscal year 2008, we announced a stock repurchase program under which we may purchase up

to an additional $1.0 billion of our common stock over a three year period through May 2010. On August 12, 2008, we announced that our Board further authorized

an additional increase of $1.0 billion to the stock repurchase program. As a result of these increases, we have an ongoing authorization from the Board, subject to

certain specifications, to repurchase shares of our common stock up to an aggregate maximum amount of $2.7 billion through May 2010.

The repurchases will be made from time to time in the open market, in privately negotiated transactions, or in structured stock repurchase programs, and

may be made in one or more larger repurchases, in compliance with the Securities Exchange Act of 1934, or the Exchange Act, Rule 10b

-

18, subject to market

conditions, applicable legal requirements, and other factors. The program does not obligate NVIDIA to acquire any particular amount of common stock and the

program may be suspended at any time at our discretion. As part of our share repurchase program, we have entered into, and we may continue to enter into,

structured share repurchase transactions with financial institutions. These agreements generally require that we make an up

-

front payment in exchange for the

right to receive a fixed number of shares of our common stock upon execution of the agreement, and a potential incremental number of shares of our common

stock, within a pre

-

determined range, at the end of the term of the agreement.

During the three months ended January 25, 2009, we did not enter into any structured share repurchase transactions or otherwise purchase any shares of

our common stock. During fiscal year 2009, we entered into structured share repurchase transactions to repurchase 29.3 million shares for $423.6 million, which we

recorded on the trade date of the transactions. Through fiscal year 2009, we have repurchased an aggregate of 90.9 million shares under our stock repurchase

program for a total cost of $1.46 billion. As of January 25, 2009, we are authorized, subject to certain specifications, to repurchase shares of our common stock up

to an additional amount of $1.24 billion through May 2010.

Additionally, during fiscal year 2009, we granted approximately 17.9 million stock options under the 2007 Equity Incentive Plan. Please refer to Note 2 of the

Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Form 10

-

K for further information regarding stock

-

based compensation and stock options

granted under our equity incentive program.

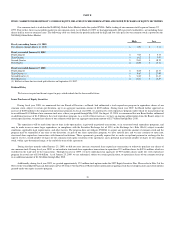

High

Low

Fiscal year ending January 31, 2010

First Quarter (through March 10, 2009)

$

9.97

$

7.21

Fiscal year ended January 25, 2009

Fourth Quarter

$

9.45

$

5.75

Third Quarter

$

14.12

$

5.97

Second Quarter

$

25.35

$

10.70

First Quarter

$

27.59

$

17.31

Fiscal year ended January 27, 2008

Fourth Quarter

$

38.20

$

22.33

Third Quarter

(1)

$

39.67

$

27.00

Second Quarter

(1)

$

31.89

$

21.47

First Quarter

(1)

$

23.27

$

18.69

36