NVIDIA 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

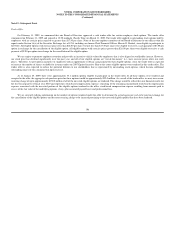

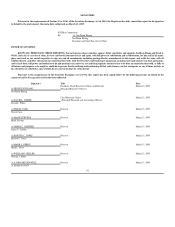

Note 19

-

Subsequent Event

Tender Offer

On February 11, 2009, we announced that our Board of Directors approved a cash tender offer for certain employee stock options. The tender offer

commenced on February 11, 2009 and expired at 12:00 midnight (Pacific Time) on March 11, 2009. The tender offer applied to outstanding stock options held by

employees with an exercise price equal to or greater than $17.50 per share. None of the non

-

employee members of our Board of Directors or our officers who file

reports under Section 16(a) of the Securities Exchange Act of 1934, including our former Chief Financial Officer, Marvin D. Burkett, were eligible to participate in

the Offer. All eligible options with exercise prices less than $28.00 per share, but not less than $17.50 per share were eligible to receive a cash payment of $3.00 per

option in exchange for the cancellation of the eligible option. All eligible options with exercise prices greater than $28.00 per share were eligible to receive a cash

payment of $2.00 per option in exchange for the cancellation of the eligible option.

We use equity to promote employee retention and provide an incentive vehicle valued by employees that is also aligned to stockholder interest. However,

our stock price has declined significantly over the past year, and all of our eligible options are “out

-

of

-

the

-

money”

(

i.e., have exercise prices above our stock

price). Therefore, we provided an incentive to employees with an opportunity to obtain cash payment for their eligible options. Also, the tender offer is expected

to increase the number of shares available for issuance under our 2007 Equity Incentive Plan to the extent eligible options were tendered in this tender offer. The

tender offer is also expected to reduce the potential dilution to our stockholders that is represented by outstanding stock options, which become additional

outstanding shares of our common stock upon exercise.

As of January 25, 2009, there were approximately 33.1 million options eligible to participate in the tender offer. If all these options were tendered and

accepted in the offer, the aggregate cash purchase price for these options would be approximately $92.0 million. As a result of the tender offer, we may incur a non

-

recurring charge of up to approximately $150.0 million if all of the unvested eligible options are tendered. This charge would be reflected in our financial results for

the first fiscal quarter of fiscal year 2010 and represents stock

-

based compensation expense, consisting of the remaining unamortized stock

-

based compensation

expense associated with the unvested portion of the eligible options tendered in the offer, stock

-

based compensation expense resulting from amounts paid in

excess of the fair value of the underlying options, if any, plus associated payroll taxes and professional fees.

We are currently tallying information on the number of options tendered under the offer to determine the actual aggregate cash to be paid in exchange for

the cancellation of the eligible options and the non

-

recurring charge to be incurred pertaining to the unvested eligible options that have been tendered.

108