NVIDIA 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

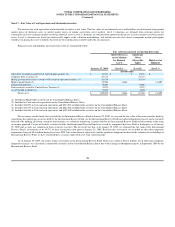

Subsequent to year

-

end, on January 30, 2009, we received $84.4 million from the International Reserve Fund. This was our portion of a payout of

approximately 65% of the total assets of the Fund. Each shareholder

’

s percentage of this distribution was determined by dividing the shareholder

’

s total unfunded

redeemed shares by the aggregate unfunded redeemed shares of the Fund, which was then used to calculate the shareholder

’

s pro rata portion of this distribution.

We expect to receive the proceeds of our remaining investment in the International Reserve Fund, excluding the $5.6 million that we have recorded as an other

than temporary impairment, by no later than October 2009, when all of the underlying securities held by the International Reserve Fund are scheduled to have

matured. However, redemptions from the International Reserve Fund are currently subject to pending litigation, which could cause further delay in receipt of our

funds.

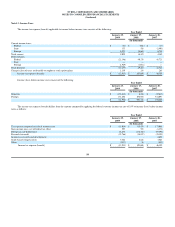

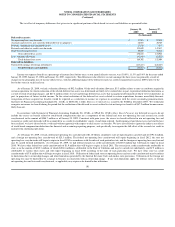

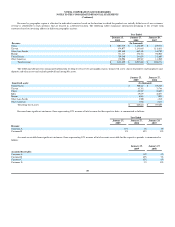

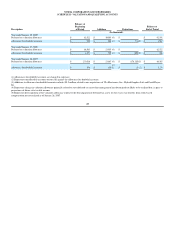

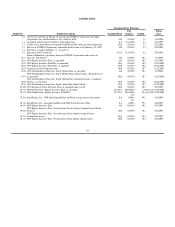

Reconciliation of financial assets measured at fair value on a recurring basis using significant unobservable inputs, or Level 3 inputs:

Total financial assets at fair value classified within Level 3 were 3.7% of total assets on our Consolidated Balance Sheet as of January 25, 2009.

Note 18

-

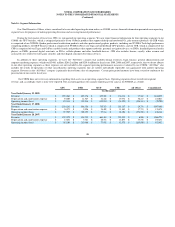

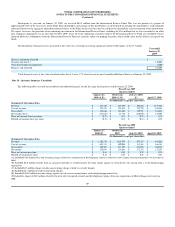

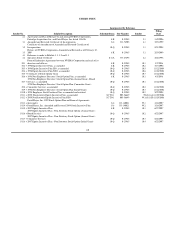

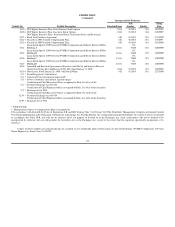

Quarterly Summary (Unaudited)

The following table sets forth our unaudited consolidated financial, for the last eight fiscal quarters ended January 25, 2009.

(A) Included $18.9 million for a non

-

recurring charge related to a termination of development contract related to a new campus construction project we have put on

hold.

(B) Included $8.0 million benefit from an insurance provider as reimbursement for some claims against us towards the cost arising from a weak die/packaging

material set.

(C) Included $4.5 million charge towards non

-

recurring charge related to a royalty dispute.

(D) Included $8.3 million towards restructuring charges.

(E) Included $196.0 million warranty charge against cost of revenue arising from a weak die/packaging material set.

(F) Included a charge of $4.0 million related to the write

-

off of acquired research and development expense from our acquisitions of Mental Images in fiscal year

2008.

Year ended

January 25,

2009

Balance, beginning of period

$

-

Transfer into Level 3

130,000

Other than temporary impairment

(5,600

)

Balance, end of period

$

124,400

Fiscal Year 2009

Quarters Ended

January 25,

2009 (A,B)

October 26,

2008 (C, D)

July 27, 2008

(E)

April 27, 2008

(In thousands, except per share data)

Statement of Operations Data:

Revenue

$

481,140

$

897,655

$

892,676

$

1,153,388

Cost of revenue

$

339,474

$

529,812

$

742,759

$

638,545

Gross profit

$

141,666

$

367,843

$

149,917

$

514,843

Net income (loss)

$

(147,665

)

$

61,748

$

(120,929

)

$

176,805

Basic net income (loss) per share

$

(0.27

)

$

0.11

$

(0.22

)

$

0.32

Diluted net income (loss) per share

$

(0.27

)

$

0.11

$

(0.22

)

$

0.30

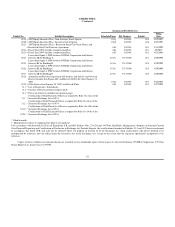

Fiscal Year 2008

Quarters Ended

January 27,

2008 (F)

October 28,

2007

July 29, 2007

April 29, 2007

(In thousands, except per share data)

Statement of Operations Data:

Revenue

$

1,202,730

$

1,115,597

$

935,253

$

844,280

Cost of revenue

$

653,133

$

600,044

$

511,261

$

464,142

Gross profit

$

549,597

$

515,553

$

423,992

$

380,138

Net income

$

256,993

$

235,661

$

172,732

$

132,259

Basic net income per share

$

0.46

$

0.42

$

0.32

$

0.24

Diluted net income per share

$

0.42

$

0.38

$

0.29

$

0.22

107