Medtronic 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

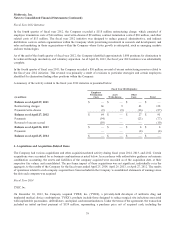

assumption and settlement of existing TYRX debt and direct acquisition costs. Total consideration for the transaction was

approximately $222 million, which included estimated fair values for product development-based and revenue-based contingent

consideration of $25 million and $35 million, respectively. The product development-based contingent consideration includes a

future potential payment of $40 million upon achieving certain milestones, and the revenue-based contingent consideration

payments equal TYRX’s actual annual revenue growth for the Company’s fiscal years 2015 and 2016. Based upon the

preliminary acquisition valuation, the Company acquired $94 million of technology-based intangible assets with an estimated

useful life of 14 years and $132 million of goodwill. The acquired goodwill is not deductible for tax purposes.

The Company accounted for the acquisition of TYRX as a business combination using the acquisition method of accounting.

The assets acquired and liabilities assumed were recorded at their respective fair values as of the acquisition date. During the

fourth quarter of fiscal year 2014, the Company recorded minor adjustments to goodwill and long-term deferred tax liabilities,

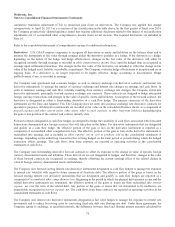

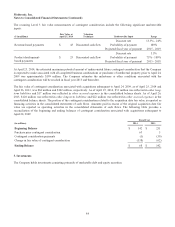

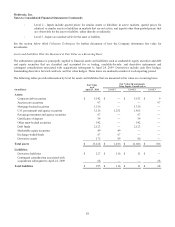

net. The fair values of the assets acquired and liabilities assumed are as follows:

(in millions)

Current assets $6

Property, plant, and equipment 1

Intangible assets 94

Goodwill 132

Total assets acquired 233

Current liabilities 4

Long-term deferred tax liabilities, net 7

Total liabilities assumed 11

Net assets acquired $ 222

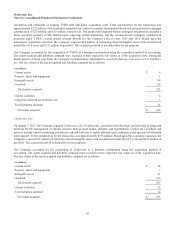

Cardiocom, LLC

On August 7, 2013, the Company acquired Cardiocom, LLC (Cardiocom), a privately-held developer and provider of integrated

solutions for the management of chronic diseases such as heart failure, diabetes, and hypertension. Cardiocom’s products and

services include remote monitoring and patient-centered software to enable efficient care coordination and specialized telehealth

nurse support. Total consideration for the transaction was approximately $193 million. Based upon the acquisition valuation, the

Company acquired $61 million of customer-related intangible assets with an estimated useful life of 7 years and $123 million of

goodwill. The acquired goodwill is deductible for tax purposes.

The Company accounted for the acquisition of Cardiocom as a business combination using the acquisition method of

accounting. The assets acquired and liabilities assumed were recorded at their respective fair values as of the acquisition date.

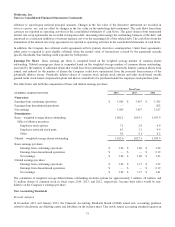

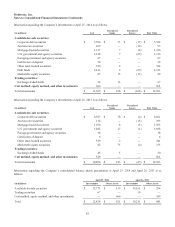

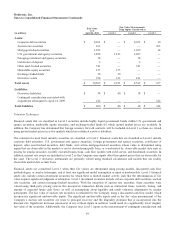

The fair values of the assets acquired and liabilities assumed are as follows:

(in millions)

Current assets $14

Property, plant, and equipment 7

Intangible assets 61

Goodwill 123

Total assets acquired 205

Current liabilities 12

Total liabilities assumed 12

Net assets acquired $ 193

80