Medtronic 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

stop development of a product or cease progress of a clinical trial, which would allow us to avoid making the contingent

payments. Although we are unlikely to cease development if a device successfully achieves clinical testing objectives, these

payments are not included in the table of contractual obligations because of the contingent nature of these payments and our

ability to avoid them if we decided to pursue a different path of development or testing. See Note 4 to the consolidated financial

statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K for additional

information regarding contingent consideration.

In the normal course of business, we periodically enter into agreements that require us to indemnify customers or suppliers for

specific risks, such as claims for injury or property damage arising out of our products or the negligence of our personnel or

claims alleging that our products infringe third-party patents or other intellectual property. Our maximum exposure under these

indemnification provisions cannot be estimated, and we have not accrued any liabilities within our consolidated financial

statements or included any indemnification provisions in our commitments table. Historically, we have not experienced

significant losses on these types of indemnification obligations.

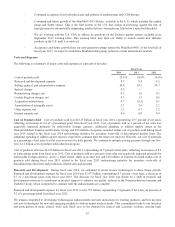

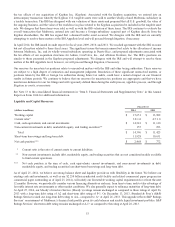

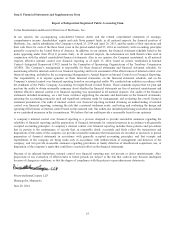

We believe our off-balance sheet arrangements do not have a material current or anticipated future effect on our consolidated

earnings, financial position, or cash flows. Presented below is a summary of contractual obligations and other minimum

commercial commitments as of April 25, 2014. See Notes 8 and 15 to the consolidated financial statements in “Item 8. Financial

Statements and Supplementary Data” in this Annual Report on Form 10-K for additional information regarding long-term debt

and lease obligations, respectively. Additionally, see Note 13 to the consolidated financial statements in “Item 8. Financial

Statements and Supplementary Data” in this Annual Report on Form 10-K for additional information regarding accrued income

tax obligations, which are not reflected in the table below.

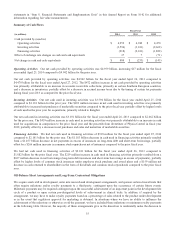

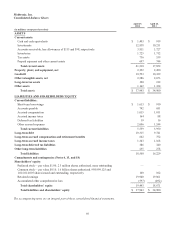

Maturity by Fiscal Year

(in millions) Total 2015 2016 2017 2018 2019 Thereafter

Contractual obligations related to

off-balance sheet arrangements:

Operating leases(1) $ 291 $ 112 $ 77 $ 45 $ 21 $ 13 $ 23

Inventory purchases(2) 181 127 39 9 — — 6

Commitments to fund minority

investments/contingent acquisition

consideration(3) 637 86 56 158 50 51 236

Interest payments(4) 5,019 404 350 320 324 311 3,310

Other(5) 212 82 37 19 9 3 62

Total $ 6,340 $ 811 $ 559 $ 551 $ 404 $ 378 $ 3,637

Contractual obligations reflected in

the balance sheet:

Long-term debt, including current

portion(6) $ 11,375 $ 1,250 $ 1,100 $ 500 $ 1,000 $ 400 $ 7,125

Capital leases 153 14 12 31 18 19 59

Total $ 11,528 $ 1,264 $ 1,112 $ 531 $ 1,018 $ 419 $ 7,184

(1) Certain leases require us to pay real estate taxes, insurance, maintenance, and other operating expenses associated with

the leased premises. These future costs are not included in the schedule above.

(2) We have included inventory purchase commitments which are legally binding and specify minimum purchase quantities.

These purchase commitments do not exceed our projected requirements and are in the normal course of business. These

commitments do not include open purchase orders.

(3) Certain commitments related to the funding of cost or equity method investments and/or previous acquisitions are

contingent upon the achievement of certain product-related milestones and various other favorable operational

conditions, and estimated royalty obligations. While it is not certain if and/or when these payments will be made, the

maturity dates included in this table reflect our best estimates.

(4) Interest payments in the table above reflect the contractual interest payments on our outstanding debt, and exclude the

impact of the debt discount amortization and impact of interest rate swap agreements. See Note 8 to the consolidated

financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K for

additional information regarding our debt agreements.

56