Medtronic 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

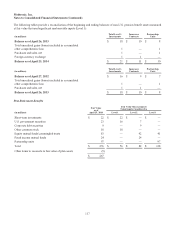

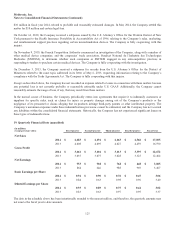

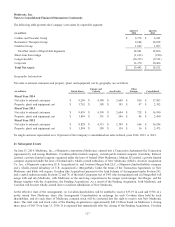

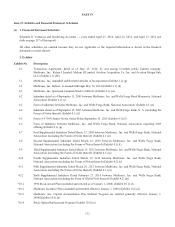

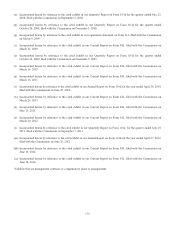

The following table presents the Company’s net assets by reportable segment:

(in millions)

April 25,

2014

April 26,

2013

Cardiac and Vascular Group $ 6,578 $ 6,941

Restorative Therapies Group 9,604 10,058

Diabetes Group 1,819 1,857

Total Net Assets of Reportable Segments 18,001 18,856

Short-term borrowings (1,613) (910)

Long-term debt (10,315) (9,741)

Corporate 13,370 10,466

Total Net Assets $ 19,443 $ 18,671

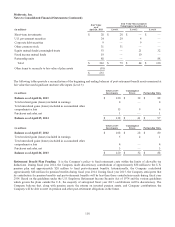

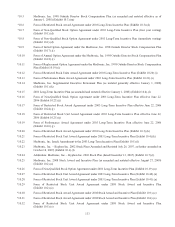

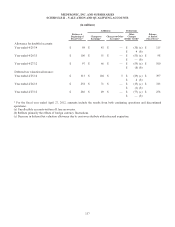

Geographic Information

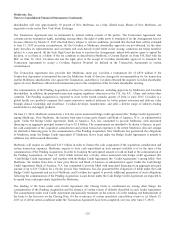

Net sales to external customers and property, plant, and equipment, net by geography are as follows:

(in millions) United States

Europe and

Canada Asia Pacific

Other

Foreign Consolidated

Fiscal Year 2014

Net sales to external customers $ 9,209 $ 4,380 $ 2,600 $ 816 $ 17,005

Property, plant, and equipment, net $ 1,762 $ 388 $ 195 $ 47 $ 2,392

Fiscal Year 2013

Net sales to external customers $ 9,059 $ 4,199 $ 2,604 $ 728 $ 16,590

Property, plant, and equipment, net $ 1,849 $ 391 $ 206 $ 44 $ 2,490

Fiscal Year 2012

Net sales to external customers $ 8,828 $ 4,313 $ 2,399 $ 644 $ 16,184

Property, plant, and equipment, net $ 1,894 $ 389 $ 154 $ 36 $ 2,473

No single customer represented over 10 percent of the Company’s consolidated net sales in fiscal years 2014, 2013, or 2012.

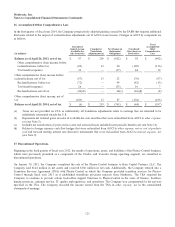

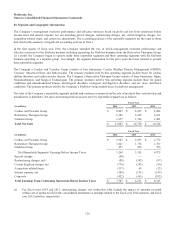

21. Subsequent Events

On June 15, 2014, Medtronic, Inc., a Minnesota corporation (Medtronic), entered into a Transaction Agreement (the Transaction

Agreement) by and among Medtronic, Covidien public limited company, an Irish public limited company (Covidien), Kalani I

Limited, a private limited company organized under the laws of Ireland (New Medtronic), Makani II Limited, a private limited

company organized under the laws of Ireland and a wholly-owned subsidiary of New Medtronic (IrSub), Aviation Acquisition

Co., Inc., a Minnesota corporation (U.S. AcquisitionCo), and Aviation Merger Sub, LLC, a Minnesota limited liability company

and a wholly-owned subsidiary of U.S. AcquisitionCo (MergerSub). Under the terms of the Transaction Agreement, (i) New

Medtronic and IrSub will acquire Covidien (the Acquisition) pursuant to the Irish Scheme of Arrangement under Section 201,

and a capital reduction under Sections 72 and 74, of the Irish Companies Act of 1963 (the Arrangement) and (ii) MergerSub will

merge with and into Medtronic, with Medtronic as the surviving corporation in the merger (such merger, the Merger, and the

Merger together with the Acquisition, the Pending Acquisition). As a result of the Pending Acquisition, both Medtronic and

Covidien will become wholly-owned direct or indirect subsidiaries of New Medtronic.

At the effective time of the Arrangement, (a) Covidien shareholders will be entitled to receive $35.19 in cash and 0.956 of a

newly issued New Medtronic share (the Arrangement Consideration) in exchange for each Covidien share held by such

shareholders, and (b) each share of Medtronic common stock will be converted into the right to receive one New Medtronic

share. The total cash and stock value of the Pending Acquisition is approximately $42.9 billion based on Medtronic’s closing

share price of $60.70 on June 13, 2014. It is expected that immediately after the closing of the Pending Acquisition, Covidien

127