Medtronic 2014 Annual Report Download - page 54

Download and view the complete annual report

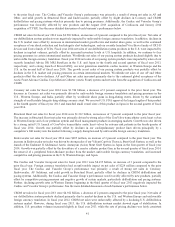

Please find page 54 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Acceptance of Kanghui’s broad portfolio of trauma, spine, and large-joint reconstruction products focused on

the growing global value segment.

•Adoption rates of stimulators and leads approved for full-body MRI scans to treat chronic pain in major

markets around the world. Our European launch occurred in fiscal year 2013. U.S. FDA approval was

received for the SureScan MRI system in the first quarter of fiscal year 2014 and the full launch began in the

second quarter of fiscal year 2014. We also launched the SureScan MRI system in Japan in January 2014 and

in Australia in the fourth quarter of fiscal year 2014.

•Continued acceptance of the non-MRI pain stimulators to treat chronic pain, including RestoreSensor, which

is currently available in the U.S. and certain international markets. RestoreSensor is a neurostimulator for

chronic pain that automatically adjusts to the patients’ position changes.

•Resolution of issues with the U.S. FDA relating to our Neuromodulation business. In July 2012, we received a

U.S. FDA warning letter regarding findings related primarily to our Neuromodulation corrective and

preventative action (CAPA) and complaint handling processes. We are currently working with the U.S. FDA

to resolve the issues. This warning letter may limit our ability to launch certain new Neuromodulation

products in the U.S. until it is resolved.

•Continued and future acceptance of our current indications for Medtronic DBS Therapy for the treatment of

movement disorders, epilepsy (approved in Europe), and OCD. The DBS Therapy portfolio includes Activa

PC, our small and advanced primary cell battery, and Activa RC, a rechargeable DBS device.

•Continued acceptance of InterStim Therapy for the treatment of the symptoms of overactive bladder, urinary

retention, and bowel incontinence. We launched InterStim Therapy for the treatment of the symptoms of

bowel incontinence in Japan during the fourth quarter of fiscal year 2014.

•Continued growth from Advanced Energy products and strategies to focus on its four core markets of

orthopedic, spine, breast surgery, and CRDM replacements.

•Continued acceptance of the Surgical Technologies StealthStation S7 and O-Arm Imaging Systems.

•Continued acceptance and growth of intraoperative nerve monitoring during surgical procedures utilizing the

NIM-Response 3.0 during head and neck surgical procedures. Additionally, continued growth in nerve

monitoring utilizing the NIM Eclipse system during spinal surgical procedures.

Diabetes Group

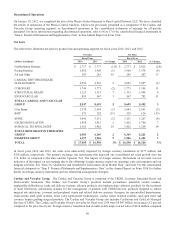

The Diabetes Group products include insulin pumps, CGM systems, insulin pump consumables, and therapy management

software. The Diabetes Group’s net sales for fiscal year 2014 were $1.657 billion, an increase of 9 percent over the prior fiscal

year. The Diabetes Group’s performance was primarily the result of 8 percent growth in the U.S. compared to the prior fiscal

year. Growth in the U.S. was driven by the launch of the MiniMed 530G System with Enlite Sensor. Approval was obtained late

in the second quarter of fiscal year 2014. In fiscal year 2014, we recognized $23 million of revenue that was deferred in fiscal

year 2013 as some customers upgraded to the MiniMed 530G System after it was released in the U.S. Net sales in the

international markets increased 9 percent compared to the prior fiscal year. The Diabetes Group’s performance in international

markets was favorably affected by the continued adoption and use of the Veo insulin pump with low-glucose suspend and Enlite

CGM sensor.

The Diabetes Group’s net sales for fiscal year 2013 were $1.526 billion, an increase of 3 percent over the prior fiscal year. The

increase in net sales was driven by international sales of our Paradigm Veo insulin pump along with the Enlite CGM sensor,

partially offset by a decline in insulin pump sales in the U.S. as we awaited U.S. FDA approval of MiniMed 530G and

unfavorable foreign currency translation.

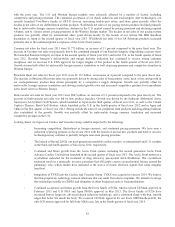

Looking ahead, we expect our Diabetes Group could be impacted by the following:

•Potential risk of pricing pressures, reduction in reimbursement rates, and fluctuations in foreign currency.

•Changes in medical reimbursement policies and programs. Continued acceptance and improved

reimbursement of CGM technologies.

46