Medtronic 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

achieve this objective, we organize our marketing and sales teams around physician specialties. This focus enables us to develop

highly knowledgeable and dedicated sales representatives who are able to foster strong relationships with physicians and other

customers and enhance our ability to cross-sell complementary products. We believe that we maintain excellent working

relationships with physicians and others in the medical industry that enable us to gain a detailed understanding of therapeutic

and diagnostic developments, trends, and emerging opportunities and respond quickly to the changing needs of physicians and

patients. We attempt to enhance our presence in the medical community through active participation in medical meetings and by

conducting comprehensive training and educational activities. We believe that these activities contribute to physician expertise.

In keeping with the increased emphasis on cost-effectiveness in health care delivery, the current trend among hospitals and other

customers of medical device manufacturers is to consolidate into larger purchasing groups to enhance purchasing power. As a

result, transactions with customers have become increasingly significant and more complex. This enhanced purchasing power

may also lead to pressure on pricing and increased use of preferred vendors. Our customer base continues to evolve to reflect

such economic changes across the geographic markets we serve. We are not dependent on any single customer for more than

10 percent of our total net sales.

Competition and Industry

We compete in both the therapeutic and diagnostic medical markets in more than 140 countries throughout the world. These

markets are characterized by rapid change resulting from technological advances and scientific discoveries. The product lines in

which we compete face a mixture of competitors ranging from large manufacturers with multiple business lines to small

manufacturers offering a limited selection of products. In addition, we face competition from providers of alternative medical

therapies such as pharmaceutical companies.

Major shifts in industry market share have occurred in connection with product problems, physician advisories, safety alerts,

and publications about our products, reflecting the importance of product quality, product efficacy, and quality systems in the

medical device industry. In addition, in the current environment of managed care, economically motivated customers,

consolidation among health care providers, increased competition, and declining reimbursement rates, we have been

increasingly required to compete on the basis of price. In order to continue to compete effectively, we must continue to create or

acquire advanced technology, incorporate this technology into proprietary products, obtain regulatory approvals in a timely

manner, maintain high-quality manufacturing processes, and successfully market these products.

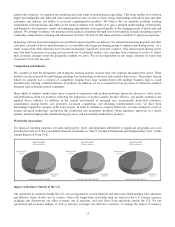

Worldwide Operations

For financial reporting purposes, net sales and property, plant, and equipment attributable to significant geographic areas are

presented in Note 20 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this

Annual Report on Form 10-K.

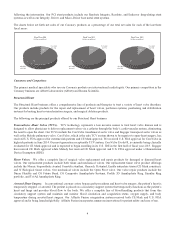

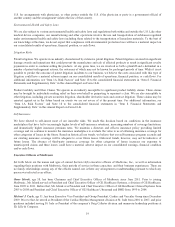

Fiscal Year 2012

(dollars in millions)

United States

$8,828

Outside the U.S.

$7,356

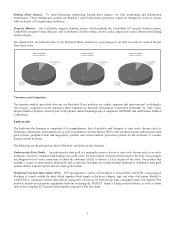

Fiscal Year 2013

(dollars in millions)

Outside the U.S.

$7,531

United States

$9,059

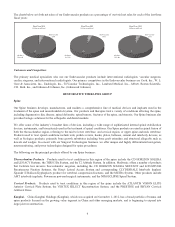

Fiscal Year 2014

(dollars in millions)

Outside the U.S.

$7,796

United States

$9,209

Consolidated Net Sales $16,184Consolidated Net Sales $16,590Consolidated Net Sales $17,005

54%

46%

55%

45%

55%

45%

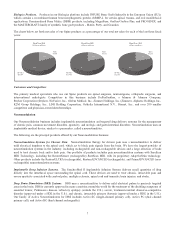

Impact of Business Outside of the U.S.

Our operations in countries outside the U.S. are accompanied by certain financial and other risks. Relationships with customers

and effective terms of sale vary by country, often with longer-term receivables than are typical in the U.S. Foreign currency

exchange rate fluctuations can affect revenues, net of expenses, and cash flows from operations outside the U.S. We use

operational and economic hedges, as well as currency exchange rate derivative contracts, to manage the impact of currency

13