Medtronic 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

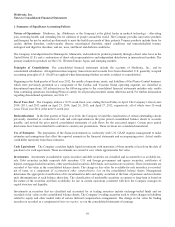

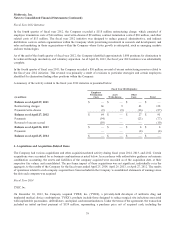

Other Intangible Assets Other intangible assets include patents, trademarks, purchased technology, and IPR&D (since

April 25, 2009). Intangible assets with a definite life are amortized on a straight-line or accelerated basis, as appropriate, with

estimated useful lives ranging from three to 20 years. Intangible assets with a definite life are tested for impairment whenever

events or changes in circumstances indicate that the carrying amount of an intangible asset (asset group) may not be

recoverable. Indefinite-lived intangible assets are tested for impairment annually in the third quarter and whenever events or

changes in circumstances indicate that the carrying amount may be impaired. Impairment is calculated as the excess of the

asset’s carrying value over its fair value. Fair value is generally determined using a discounted future cash flow analysis.

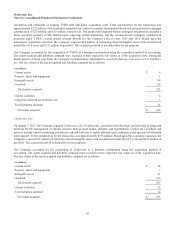

IPR&D During fiscal year 2010, the Company adopted authoritative guidance related to business combinations. Subsequent

to the adoption of this guidance, IPR&D acquired in a business combination is capitalized at its fair value as an indefinite-lived

intangible asset. Prior to the adoption of this guidance, IPR&D was immediately expensed. The adoption of the authoritative

guidance did not change the requirement to expense IPR&D immediately with respect to asset acquisitions. IPR&D charges are

included within acquisition-related items in the consolidated statements of earnings. IPR&D has an indefinite life and is not

amortized until completion and development of the project, at which time the IPR&D becomes an amortizable asset. If the

related project is not completed in a timely manner or the project is terminated or abandoned, the Company may have an

impairment related to the IPR&D, calculated as the excess of the asset’s carrying value over its fair value.

The Company’s policy defines IPR&D as the fair value of those projects for which the related products have not received

regulatory approval and have no alternative future use. Determining the fair value of IPR&D acquired as part of a business

combination requires the Company to make significant estimates. The fair value assigned to IPR&D is determined by estimating

the future cash flows of each project or technology and discounting the net cash flows back to their present values. The discount

rate used is determined at the time of measurement in accordance with accepted valuation methodologies. These methodologies

include consideration of the risk of the project not achieving commercial feasibility.

At the time of acquisition, the Company expects that all acquired IPR&D will reach technological feasibility, but there can be

no assurance that the commercial viability of these products will actually be achieved. The nature of the efforts to develop the

acquired technologies into commercially viable products consists principally of planning, designing, and conducting clinical

trials necessary to obtain regulatory approvals. The risks associated with achieving commercialization include, but are not

limited to, delay or failure to obtain regulatory approvals to conduct clinical trials, delay or failure to obtain required market

clearances, or delays or issues with patent issuance, or validity and litigation. If commercial viability were not achieved, the

Company would likely look to other alternatives to provide these therapies.

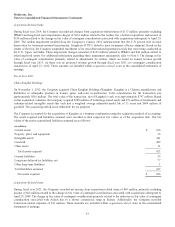

Contingent Consideration During fiscal year 2010, as mentioned above, the Company adopted authoritative guidance related

to business combinations. Under this guidance, the Company must recognize contingent consideration at fair value at the

acquisition date. Prior to the adoption of this guidance, contingent consideration was not included on the balance sheet and was

recorded as incurred. The acquisition date fair value is measured based on the consideration expected to be transferred

(probability-weighted), discounted back to present value. The discount rate used is determined at the time of measurement in

accordance with accepted valuation methodologies. The fair value of the contingent consideration is remeasured at the estimated

fair value at each reporting period with the change in fair value recognized as income or expense within acquisition-related

items in the consolidated statements of earnings. Therefore, any changes in the fair value will impact the Company’s earnings in

such reporting period thereby resulting in potential variability in the Company’s earnings until contingencies are resolved.

Warranty Obligation The Company offers a warranty on various products. The Company estimates the costs that may be

incurred under its warranties and records a liability in the amount of such costs at the time the product is sold. Factors that affect

the Company’s warranty liability include the number of units sold, historical and anticipated rates of warranty claims, and cost

per claim. The Company periodically assesses the adequacy of its recorded warranty liabilities and adjusts the amounts as

necessary. The amount of the reserve recorded is equal to the net costs to repair or otherwise satisfy the claim. The Company

includes the warranty obligation in other accrued expenses and other long-term liabilities on the Company’s consolidated

balance sheets. The Company includes the covered costs associated with field actions, if any, in cost of products sold in the

Company’s consolidated statements of earnings.

71