Medtronic 2014 Annual Report Download - page 68

Download and view the complete annual report

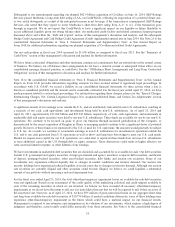

Please find page 68 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Neuromodulation, and Endovascular, partially offset by unfavorable foreign currency translation and a decline in Pacing

Systems and Coronary.

For fiscal year 2013, net sales outside the U.S. increased 2 percent over the prior fiscal year. Foreign currency had an

unfavorable impact of $328 million on net sales for fiscal year 2013. Outside the U.S., net sales growth was led by strong

growth in Endovascular, Diabetes, and Surgical Technologies, and solid growth in our Neuromodulation and Structural Heart

businesses. Growth was partially offset by unfavorable foreign currency translation and slight declines in CRDM defibrillation

and pacing systems and Core Spine.

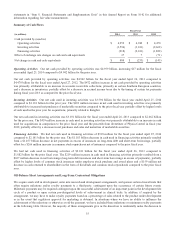

Net sales outside the U.S. are accompanied by certain financial risks, such as changes in foreign currency exchange rates and

collection of receivables, which typically have longer payment terms. We monitor the creditworthiness of our customers to

which we grant credit terms in the normal course of business. However, a significant amount of our outstanding accounts

receivable are with national health care systems in many countries. We continue to monitor the economic conditions in many

countries outside the U.S. (particularly Italy, Spain, Portugal, and Greece) and the average length of time it takes to collect on

our outstanding accounts receivable in these countries. As of April 25, 2014 and April 26, 2013, the aggregate accounts

receivable balance for Italy, Spain, Portugal, and Greece, net of allowance for doubtful accounts, was $628 million and

$770 million, respectively. We also continue to monitor the creditworthiness of customers located in these and other geographic

areas. In the past, accounts receivable balances with certain customers in these countries accumulated over time and were

subsequently settled as large lump sum payments. Although we do not currently foresee a significant credit risk associated with

a material portion of these receivables, repayment is dependent upon the financial stability of the economies of those countries.

For certain Greece customers, collectability is not reasonably assured for revenue transactions and we defer revenue recognition

until all revenue recognition criteria are met. As of April 25, 2014 and April 26, 2013, our remaining deferred revenue balance

for certain Greece distributors was $15 million and $21 million, respectively. Outstanding gross receivables from customers

outside the U.S. totaled $2.421 billion at April 25, 2014, or 61 percent of total outstanding accounts receivable, and

$2.349 billion as of April 26, 2013, or 61 percent of total outstanding accounts receivable.

Cautionary Factors That May Affect Future Results

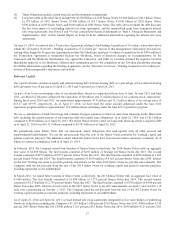

This Annual Report, and other written reports and oral statements made by or with the approval of one of the Company’s

executive officers from time to time, may include “forward-looking” statements. Forward-looking statements broadly include

our current expectations or forecasts of future results. Our forward-looking statements generally relate to our growth and growth

strategies, financial results, product development, research and development strategy, regulatory approvals, competitive

strengths, restructuring initiatives, intellectual property rights, litigation and tax matters, government investigations, mergers

and acquisitions (including our pending acquisition of Covidien), divestitures, market acceptance of our products, accounting

estimates, financing activities, ongoing contractual obligations, working capital adequacy, our effective tax rate, and sales

efforts. Such statements can be identified by the use of terminology such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “forecast,” “intend,” “looking ahead,” “may,” “plan,” “possible,” “potential,” “project,” “should,” “will,” and similar

words or expressions. Forward-looking statements in this Annual Report include, but are not limited to, statements regarding

our ability to drive long-term shareholder value, development and future launches of products and continued or future

acceptance of products in our operating segments; expected timing for completion of research studies relating to our products;

market positioning and performance of our products, including stabilization of certain product markets; unanticipated issues that

may affect U.S. FDA and non-U.S. regulatory approval of new products; increased presence in new markets, including markets

outside the U.S.; changes in the market and our market share; acquisitions and investment initiatives, as well as integration of

acquired companies into our operations; the resolution of tax matters; the effectiveness of our development activities in reducing

patient care costs and hospital stay lengths; our approach towards cost containment; our expectations regarding health care

costs; the elimination of certain positions or costs related to restructuring initiatives; outcomes in our litigation matters and

government investigations; general economic conditions; the adequacy of available working capital and our working capital

needs; the continued strength of our balance sheet and liquidity; our accounts receivable exposure; and the potential impact of

our compliance with governmental regulations and accounting guidance. One must carefully consider forward-looking

statements and understand that such statements may be affected by inaccurate assumptions and may involve a variety of risks

and uncertainties, known and unknown, including, among others, those discussed in the sections entitled “Government

Regulation and Other Considerations” within “Item 1. Business” and “Item 1A. Risk Factors” in this Annual Report on Form

10-K, as well as those related to competition in the medical device industry, reduction or interruption in our supply, quality

problems, liquidity, decreasing prices, changes in applicable tax rates, adverse regulatory action, litigation results, self-

insurance, commercial insurance, health care policy changes, international operations, inability to obtain approvals required to

complete the pending acquisition of Covidien, and failure to complete the pending acquisition of Covidien or, if completed,

failure to achieve the intended benefits of the acquisition or disruption of our current plans and operations.

60