Medtronic 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(5) These obligations include certain research and development arrangements.

(6) Long-term debt in the table above includes the $2.000 billion of 2014 Senior Notes, $3.000 billion of 2013 Senior Notes,

$1.075 billion of 2012 Senior Notes, $1.000 billion of 2011 Senior Notes, $3.000 billion of 2010 Senior Notes,

$700 million of 2009 Senior Notes, and $600 million of 2005 Senior Notes. The table above excludes the debt discount,

the fair value impact of outstanding interest rate swap agreements, and the unamortized gains from terminated interest

rate swap agreements. See Notes 8 and 9 to the consolidated financial statements in “Item 8. Financial Statements and

Supplementary Data” in this Annual Report on Form 10-K for additional information regarding the interest rate swap

agreements.

On June 15, 2014, we entered into a Transaction Agreement relating to the Pending Acquisition of Covidien, as described above

within the “Executive Overview - Pending Acquisition of Covidien plc” section of this management’s discussion and analysis.

Among other things the Transaction Agreement provides that Medtronic must pay Covidien a termination fee of $850 million if

the Transaction Agreement is terminated because the Medtronic board of directors changes its recommendation for the

transaction and the Medtronic shareholders vote against the transaction, and either (i) Covidien obtained the requisite Covidien

shareholder approval or (ii) Medtronic effected such termination prior to the completion of the Covidien shareholder meeting.

For further information regarding the Pending Acquisition, see the “Executive Overview - Pending Acquisition of Covidien plc”

section of this management’s discussion and analysis.

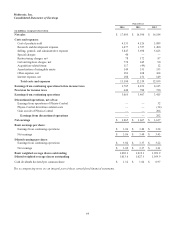

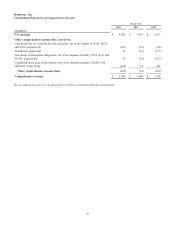

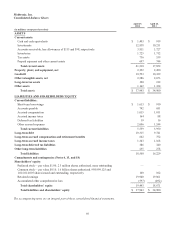

Debt and Capital

Our capital structure consists of equity and interest-bearing debt. Interest-bearing debt as a percentage of total interest-bearing

debt and equity was 38 percent as of April 25, 2014 and 36 percent as of April 26, 2013.

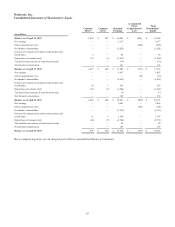

As part of our focus on returning value to our shareholders, shares are repurchased from time to time. In June 2013 and June

2011, our Board of Directors authorized the repurchase of 80 million and 75 million shares of our common stock, respectively.

During fiscal years 2014 and 2013, we repurchased approximately 47.8 million and 31.2 million shares at an average price of

$53.37 and $39.97, respectively. As of April 25, 2014, we have used the entire amount authorized under the June 2011

repurchase program and have approximately 59.4 million shares remaining under the June 2013 repurchase program.

We use a combination of bank borrowings and commercial paper issuances to fund our short-term financing needs. Short-term

debt, including the current portion of our long-term debt and capital lease obligations, as of April 25, 2014, was $1.613 billion

compared to $910 million as of April 26, 2013. We utilize Senior Notes to meet our long-term financing needs. Long-term debt

as of April 25, 2014 was $10.315 billion compared to $9.741 billion as of April 26, 2013.

We periodically issue Senior Notes that are unsecured, senior obligations that rank equally with all other secured and

unsubordinated indebtedness. We use the net proceeds from the sale of the Senior Notes primarily for working capital and

general corporate purposes. The indentures under which the Senior Notes have been issued contain customary covenants, all of

which we remain in compliance with as of April 25, 2014.

In February 2014, the Company issued four tranches of Senior Notes (collectively, the 2014 Senior Notes) with an aggregate

face value of $2.000 billion. The first tranche consisted of $250 million of floating rate Senior Notes due 2017. The second

tranche consisted of $250 million of 0.875 percent Senior Notes due 2017. The third tranche consisted of $850 million of 3.625

percent Senior Notes due 2024. The fourth tranche consisted of $650 million of 4.625 percent Senior Notes due 2044. Interest

on the 2017 floating rate notes is payable quarterly and interest on the other 2014 Senior Notes are payable semi-annually. The

Company used the net proceeds from the sale of the 2014 Senior Notes for working capital and general corporate purposes,

including repayment of our indebtedness.

In March 2013, we issued three tranches of Senior Notes (collectively, the 2013 Senior Notes) with an aggregate face value of

$3.000 billion. The first tranche consisted of $1.000 billion of 1.375 percent Senior Notes due 2018. The second tranche

consisted of $1.250 billion of 2.750 percent Senior Notes due 2023. The third tranche consisted of $750 million of 4.000 percent

Senior Notes due 2043. Interest on each series of the 2013 Senior Notes is payable semi-annually on April 1 and October 1 of

each year, commencing on October 1, 2013. The Company used the net proceeds from the sale of the 2013 Senior Notes for

working capital and general corporate purposes, including repayment of our indebtedness.

As of April 25, 2014 and April 26, 2013, we had interest rate swap agreements designated as fair value hedges of underlying

fixed-rate obligations including the Company’s $1.250 billion 3.000 percent 2010 Senior Notes due 2015, $600 million 4.750

percent 2005 Senior Notes due 2015, $500 million 2.625 percent 2011 Senior Notes due 2016, $500 million 4.125 percent 2011

57