Medtronic 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to the prior fiscal year. The Cardiac and Vascular Group’s performance was primarily a result of strong net sales in AF and

Other, and solid growth in Structural Heart and Endovascular, partially offset by slight declines in Coronary and CRDM

defibrillation and pacing systems which is primarily due to pricing pressures. Additionally, the Cardiac and Vascular Group’s

performance was favorably affected by new products and the August 2013 acquisition of Cardiocom and January 2014

acquisition of TYRX. See the more detailed discussion of each business’s performance below.

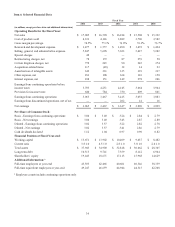

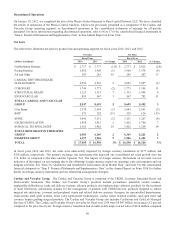

CRDM net sales for fiscal year 2014 were $4.996 billion, an increase of 2 percent compared to the prior fiscal year. Net sales of

our defibrillation system products were negatively impacted by unfavorable foreign currency translation. In addition, declines in

the U.S. market were offset by increases in international market growth rates and market share gains, as well as the continued

acceptance of our shock reduction and lead integrity alert technologies, and our recently launched Viva/Brava family of CRT-D

devices and Evera family of ICDs. Fiscal year 2014 net sales of our defibrillation system products in the U.S. were impacted by

declines in implant volumes, partially offset by increased inventory levels at U.S. hospitals. In addition, we continue to face

pricing pressures in certain international markets. Worldwide net sales of our pacing system products declined slightly due to

unfavorable foreign currency translation. Fiscal year 2014 net sales of our pacing system products were impacted by sales of our

recently launched Advisa DR MRI SureScan in the U.S. and Japan in the fourth and second quarters of fiscal year 2013,

respectively, and a strong launch of Reveal LINQ, our next generation insertable cardiac monitor, in Western Europe and the

U.S. in the second half of fiscal year 2014. The growth in net sales of our pacing system products was partially offset by

declines in the U.S. market and pricing pressures in certain international markets. Worldwide net sales of our AF and Other

products offset the above declines. AF and Other net sales increased primarily due to the continued global acceptance of the

Arctic Front Advance Cardiac CryoAblation Catheter (Arctic Front) system and net sales from the acquisition of Cardiocom and

CLMS.

Coronary net sales for fiscal year 2014 were $1.744 billion, a decrease of 2 percent compared to the prior fiscal year. The

decrease in Coronary net sales was primarily driven by unfavorable foreign currency translation and pricing pressures in the

U.S., Western Europe, and India, partially offset by worldwide share gains in drug-eluting stents, driven by the continued

strength of our Resolute Integrity drug-eluting coronary stent. We received U.S. FDA approval for longer lengths of this product

in the fourth quarter of fiscal year 2013 and launched small vessel sizes of this product in Japan in the second quarter of fiscal

year 2014.

Structural Heart net sales for fiscal year 2014 were $1.212 billion, an increase of 7 percent compared to the prior fiscal year.

The increase in Structural Heart net sales was primarily driven by strong sales of the CoreValve transcatheter aortic heart valves

in Western Europe and of our perfusion system and blood management products in emerging markets. Growth was also driven

by a strong initial U.S. launch of CoreValve transcatheter aortic heart valves for extreme risk patients in the fourth quarter of

fiscal year 2014. Growth was partially offset by declines in our cardiopulmonary product lines driven principally by a

competitor’s full reentry into the market following a supply disruption and by unfavorable foreign currency translation.

Endovascular net sales for fiscal year 2014 were $895 million, an increase of 3 percent compared to the prior fiscal year. The

increase in Endovascular net sales was driven by strong sales of our Valiant Captivia Thoracic Stent Graft System, as well as the

launch of the Endurant II Abdominal Aortic Aneurysm (AAA) Stent Graft System in Japan in the first quarter of fiscal year

2014. Growth was partially offset by the divestiture of a reentry catheter product line in the second quarter of fiscal year 2014,

the removal of a peripheral below-the-knee product from the market, unfavorable foreign currency translation, and increased

competitive and pricing pressures in the U.S, Western Europe, and Japan.

The Cardiac and Vascular Group net sales for fiscal year 2013 were $8.695 billion, an increase of 3 percent compared to the

prior fiscal year. Foreign currency translation had an unfavorable impact on net sales of $224 million compared to the prior

fiscal year. The Cardiac and Vascular Group’s performance was primarily a result of strong net sales in Coronary,

Endovascular, AF Solutions, and solid growth in Structural Heart, partially offset by declines in CRDM defibrillation and

pacing systems. Additionally, the Cardiac and Vascular Group’s performance was favorably affected by new products, partially

offset by competitive pricing pressures and negative growth of certain markets, particularly defibrillation and pacing systems.

Further, declining growth rates in Western Europe beginning in the third quarter of fiscal year 2013 negatively impacted the

Cardiac and Vascular Group’s performance. See the more detailed discussion of each business’s performance below.

CRDM net sales for fiscal year 2013 were $4.922 billion, a decrease of 2 percent compared to the prior fiscal year. Net sales of

our defibrillation system products declined primarily due to market declines in the U.S. and Western Europe and unfavorable

foreign currency translation. In fiscal year 2012, CRDM net sales were unfavorably affected by a declining U.S. defibrillation

systems market. However, during fiscal year 2013, the U.S. defibrillation systems market showed signs of stabilization. In

addition, U.S. procedure volumes increased slightly in fiscal year 2013, while the rate of pricing declines was fairly consistent

41