Medtronic 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

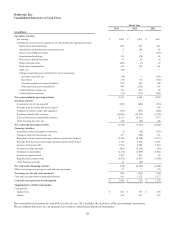

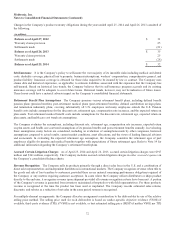

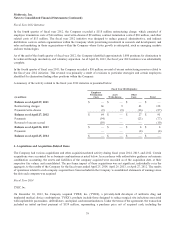

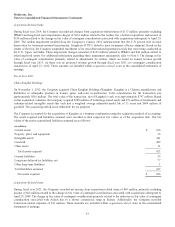

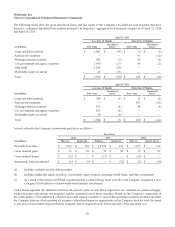

A summary of the activity related to the fiscal year 2014 initiative is presented below:

Fiscal Year 2014 Initiative

(in millions)

Employee

Termination

Costs

Asset

Write-downs

Other

Costs Total

Balance as of April 26, 2013 $—$—$—$—

Restructuring charges 65 26 25 116

Payments/write-downs (1) (26) (14) (41)

Balance as of April 25, 2014 $ 64$ —$ 11$ 75

Fiscal Year 2013 Initiative

The fiscal year 2013 initiative was designed to scale back the Company’s infrastructure in slower growing areas of the business,

while continuing to invest in geographies, businesses, and products where faster growth is anticipated. A number of factors have

contributed to ongoing challenging market dynamics, including increased pricing pressure, various governmental austerity

measures, and the U.S. medical device excise tax. In the fourth quarter of fiscal year 2013, the Company recorded a

$192 million restructuring charge, which consisted of employee termination costs of $150 million, asset write-downs of

$13 million, contract termination costs of $18 million, and other related costs of $11 million. Of the $13 million of asset write-

downs, $10 million related to inventory write-offs of discontinued product lines and production-related asset impairments, and

therefore, was recorded within cost of products sold in the consolidated statements of earnings. In the first quarter of fiscal year

2014, the Company recorded an $18 million restructuring charge, which was the final charge related to the fiscal year 2013

initiative and consisted primarily of contract termination costs of $14 million and other related costs of $4 million.

As of the end of the fourth quarter of fiscal year 2013, the Company identified approximately 2,000 positions for elimination to

be achieved through involuntary and voluntary separation.

In fiscal year 2014, the Company recorded a reversal of excess restructuring reserves related to the fiscal year 2013 initiative of

$46 million. The reversal was primarily a result of revisions to particular strategies and certain employees identified for

elimination finding other positions within the Company.

As a result of certain legal requirements outside the U.S., the fiscal year 2013 initiative is scheduled to be substantially complete

by the end of the third quarter of fiscal year 2016.

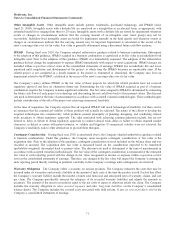

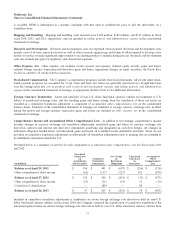

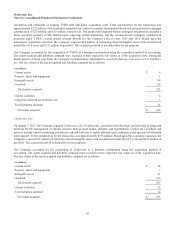

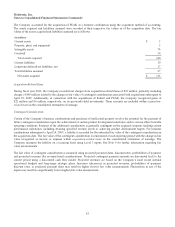

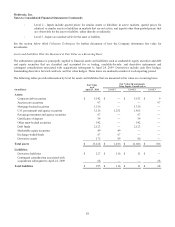

A summary of the activity related to the fiscal year 2013 initiative is presented below:

Fiscal Year 2013 Initiative

(in millions)

Employee

Termination

Costs

Asset

Write-downs

Other

Costs Total

Balance as of April 27, 2012 $—$—$—$—

Restructuring charges 150 13 29 192

Payments/write-downs (3) (13) (6) (22)

Balance as of April 26, 2013 $ 147 $ — $ 23 $ 170

Restructuring charges — — 18 18

Payments (79) — (39) (118)

Reversal of excess accrual (45) — (1) (46)

Balance as of April 25, 2014 $ 23$ —$ 1$ 24

78