Medtronic 2014 Annual Report Download - page 53

Download and view the complete annual report

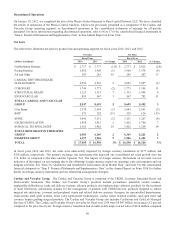

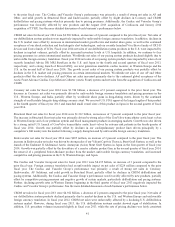

Please find page 53 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Spine net sales for fiscal year 2013 were $3.131 billion, a decrease of 4 percent over the prior fiscal year. Core Spine and BMP

net sales decreased 2 percent and 15 percent, respectively, as a result of continued pricing and competitive pressures, a

challenging reimbursement environment in certain of our major markets, and unfavorable foreign currency translation. The U.S.

Core Spine market showed signs of stabilization during fiscal year 2013, as supported by the flat fiscal year 2013 market and no

significant changes in the underlying market conditions, including procedure trends, pricing pressure, or competitive dynamics.

The net sales decline in Core Spine over the prior fiscal year was primarily driven by negative performance in BKP. Net sales in

BKP declined 10 percent when compared to the prior fiscal year due to the continued decrease in demand, competitive pricing

pressures, and reimbursement challenges with select payers. The decline in Core Spine from BKP was partially offset by recent

launches of new products and therapies, including the second quarter launch of AMT implants, the Capstone Control, and Bryan

ACD Instrument Set, as well as the continued adoption of Solera, Atlantis Vision Elite, and other biologics products. Core Spine

also benefited from our focus on enabling technologies, including the O-Arm imaging, StealthStation surgical navigation, and

Powerease powered surgical instruments. A strong contributing factor to the decline in Spine net sales was the decline in BMP

net sales over the prior fiscal year. Significant declines in U.S. sales of INFUSE bone graft have continued since the June 2011

articles in The Spine Journal as further described below.

Neuromodulation net sales for fiscal year 2013 were $1.812 billion, an increase of 7 percent over the prior fiscal year. The

increase in net sales was primarily due to the continued U.S. adoption of RestoreSensor spinal cord stimulator, new implant

growth of Activa DBS system for movement disorders, and sales of InterStim Therapy for overactive bladder, urinary retention,

and bowel control. Additionally, revenue growth in Western Europe was driven by sales of the SureScan spinal cord stimulation

system, approved for full-body MRI scans. Growth was partially offset by unfavorable foreign currency translation.

Surgical Technologies net sales for fiscal year 2013 were $1.426 billion, an increase of 14 percent over the prior fiscal year. The

increase in net sales was driven by sales of capital equipment, including O-arm imaging and StealthStation S7 surgical

navigation systems, Midas Rex powered surgical equipment, and Advanced Energy products, including the Aquamantys bipolar

sealers and PEAK PlasmaBlade electrosurgical products. Additionally, net sales were positively affected by balanced growth of

disposables and service revenue in our Neurosurgery and ENT businesses. Growth was partially offset by unfavorable foreign

currency translation.

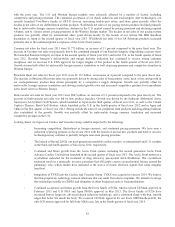

Looking ahead, we expect our Restorative Therapies Group could be affected by the following:

•Changes in procedural volumes, competitive and pricing pressure, reimbursement challenges, impacts from

changes in the mix of our product offerings, and fluctuations in foreign currency.

•Market acceptance and continued adoption of innovative new products, such as our Solera product line, Bryan

ACD Instrument Set, second generation MAST MidLF set, and other biologics products, including

MAGNIFUSE and GRAFTON products, and POWEREASE, a powered instrument solution for Solera.

•Market acceptance of BKP. We remain focused on communicating the clinical and economic benefits for

BKP. We will continue to tailor this product offering to meet market needs and respond to competitive

challenges. We anticipate additional continued pricing pressures and competitive alternatives in the U.S. and

European markets. Additionally, opportunities for growth exist in vertebroplasty and other vertebral

compression fractures (VCF) treatments. We continue to evaluate global markets and specific therapies for

ways to treat more patients with VCF.

•Spine sales continue to be negatively affected by the June 2011 articles in The Spine Journal, and by the

reaction from inquiries by governmental authorities, relating to our INFUSE bone graft product. The Spine

Journal articles suggested that some physicians’ peer-reviewed studies may have underreported complications

and adverse events associated with INFUSE. These articles did not question the integrity of the data provided

by Medtronic to the U.S. FDA for product approval or the disclosure of safety issues on the product’s

Instructions for Use for approved indications. In August 2011, we provided a grant to Yale University to

oversee two independent, systematic reviews of data from completed clinical studies of INFUSE bone graft,

as well as data from other Medtronic studies of rhBMP-2, the protein used in INFUSE. The two systematic

reviews, which were summarized in articles published in the Annals of Internal Medicine in June 2013,

concluded, among other things, that INFUSE is an effective therapy in certain types of spine surgery, and that

INFUSE entails a number of risks that should be considered by physicians and patients. Looking ahead, the

Company expects continued scientific and clinical research scrutiny focused on the safety and efficacy of

INFUSE in real-world, clinical experience. Medtronic remains committed to the safe use of INFUSE bone

graft for the approved indications, as supported by the safety data reported to the U.S. FDA.

45