Medtronic 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

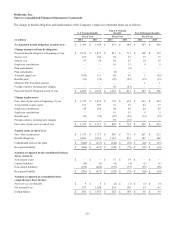

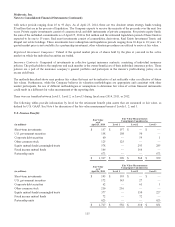

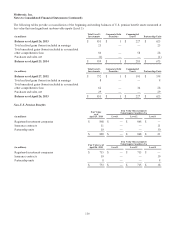

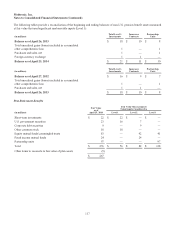

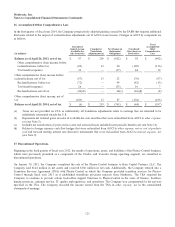

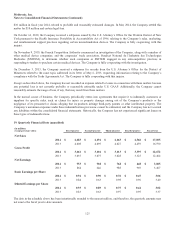

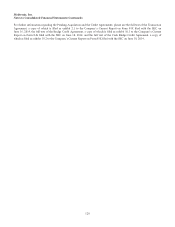

16. Accumulated Other Comprehensive Loss

In the first quarter of fiscal year 2014, the Company prospectively adopted guidance issued by the FASB that requires additional

disclosure related to the impact of reclassification adjustments out of AOCI on net income. Changes in AOCI by component are

as follows:

(in millions)

Unrealized

Gain (Loss) on

Available-for-

Sale Securities

Cumulative

Translation

Adjustments (a)

Net Change in

Retirement

Obligations

Unrealized

Gain (Loss) on

Derivatives

Total

Accumulated

Other

Comprehensive

Loss

Balance as of April 26, 2013, net of tax $ 97 $ 205 $ (852) $ 58 $ (492)

Other comprehensive (loss) income before

reclassifications, before tax (89) 13 60 (120) (136)

Tax benefit (expense) 32 — (37) 44 39

Other comprehensive (loss) income before

reclassifications, net of tax (57) 13 23 (76) (97)

Reclassifications, before tax (72) — 99 (42) (15)

Tax benefit (expense) 26 — (35) 16 7

Reclassifications, net of tax (46)(b) — 64(c) (26)(d) (8)

Other comprehensive (loss) income, net of

tax (103) 13 87 (102) (105)

Balance as of April 25, 2014, net of tax $ (6) $ 218 $ (765) $ (44) $ (597)

(a) Taxes are not provided on CTA as substantially all translation adjustments relate to earnings that are intended to be

indefinitely reinvested outside the U.S.

(b) Represents net realized gains on sales of available-for-sale securities that were reclassified from AOCI to other expense,

net (see Note 5).

(c) Includes net amortization of prior service costs and actuarial losses included in net periodic benefit cost (see Note 14).

(d) Relates to foreign currency cash flow hedges that were reclassified from AOCI to other expense, net or cost of products

sold and forward starting interest rate derivative instruments that were reclassified from AOCI to interest expense, net

(see Note 9).

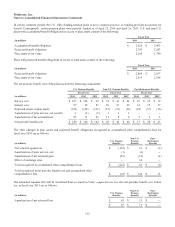

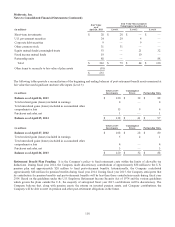

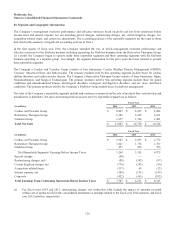

17. Discontinued Operations

Beginning in the third quarter of fiscal year 2012, the results of operations, assets, and liabilities of the Physio-Control business,

which were previously presented as a component of the Cardiac and Vascular Group operating segment, are classified as

discontinued operations.

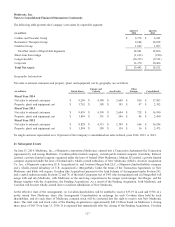

On January 30, 2012, the Company completed the sale of the Physio-Control business to Bain Capital Partners, LLC. The

Company sold $164 million in net assets and received $386 million in net cash. Additionally, the Company entered into a

Transition Services Agreement (TSA) with Physio-Control in which the Company provided transition services for Physio-

Control through fiscal year 2013 as it established standalone processes separate from Medtronic. The TSA required the

Company to continue to provide certain back-office support functions to Physio-Control in the areas of finance, facilities,

human resources, customer service, IT, quality and regulatory, and operations. The Company was compensated for the services

specified in the TSA. The Company recorded the income earned from the TSA in other expense, net in the consolidated

statements of earnings.

121