Logitech 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CG-8

Under the 1988 Stock Option Plan, options to purchase registered shares were granted to employees and

consultants at exercise prices ranging from zero to amounts in excess of the fair market value of the registered shares

on the date of grant. The terms and conditions with respect to options granted were determined by the Board of

Directors who administered this plan. Options generally vest over four years and remain outstanding for periods not

exceeding ten years. Further grants may not be made under this plan.

Under the 1996 Employee Stock Plan, the Company may grant to employees options for registered shares or

ADRs, restricted shares, stock appreciation rights, and stock units, which are bookkeeping entries representing the

equivalent of shares. A total of 19,000,000 registered shares and/or ADRs may be issued under this plan. Options

generally vest over four years and remain outstanding for periods not to exceed ten years. Options may only be

granted at exercise prices of at least 100% of the fair market value of the registered shares on the date of grant;

restricted shares and stock appreciation rights may be granted at prices less than 100% of the fair market value of the

registered shares on the date of grant; no cash consideration is required to be paid by employees in connection with

the grant of stock units.

The Company also maintains one other option plan, for a small number of Asian executives, under which options

were granted at exercise prices discounted from fair market value of the registered shares on the date of grant. No

further stock options may be granted under this plan.

As of March 31, 2003, there were a total of 7,737,136 registered shares subject to outstanding options granted

under all plans. Of these options, 3,612,857 were exercisable, with the balance subject to continued vesting over time.

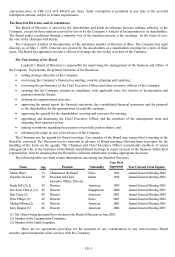

Share and Option Ownership of Management

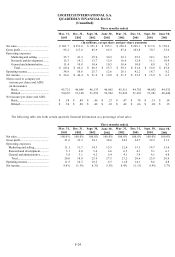

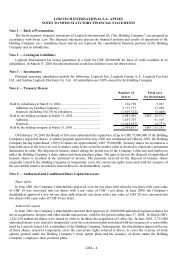

The following table presents information as of March 31, 2003 regarding the share and option ownership of our

registered shares, including shares represented by American Depositary Receipts, by our non-employee directors and

executive officers as a group:

Name

Shares

Owned

% of

Outstanding (1)

Options

Held (2)

Exercise

Price per

share

Expiration

Year

All non-employee directors $7.19 to

as a group (6 individuals).......... 9,300 0.02% 150,000 $45.41 2009 - 2012

All executive officers as a $4.85 to

group (9 individuals) (3)......... 3,344,091 6.98% 2,428,226 $39.55 2008 - 2013

(1) Percentage ownership is calculated based on 47,901,655 registered shares outstanding as of March 31, 2003.

(2) Options for shares were granted under stock option plans to purchase registered shares, including shares

represented by ADSs. Exercise prices per registered share are generally equal to the fair market value of

registered shares on the date of grant. Options for employees generally vest over four years with options for non-

employee directors vesting over three years. Options remain outstanding for periods not exceeding ten years.

(3) Includes 125,400 registered shares registered in the name of Sylviane Borel (Mr. Borel’s wife). Mr. Borel

disclaims beneficial ownership of the registered shares registered in the name of his wife. Includes 1,675 shares

owned and 1,316,140 options held by Mr. De Luca.

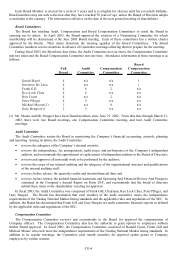

Compensation of Directors and Management

Each non-employee director receives options for 20,000 of the Company’s registered shares on his election to the

Board and options for 10,000 shares upon his reelection to the Board. These options are granted at the fair market

value at the date of grant and become exercisable over 3 years in equal annual increments. In addition, non-employee

directors are paid an annual retainer of $20,000, and receive $1,500 for each board or committee meeting attended.

All directors are reimbursed for expenses in connection with attendance at Board and Committee meetings.

Directors who are also employees of the Company do not receive any compensation for their service on the

Board of Directors.

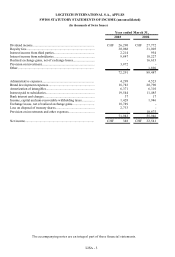

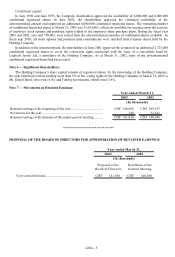

The following table sets forth the compensation we paid to non-employee directors and executive officers in all

capacities for the year ended March 31, 2003. The options granted and exercise prices in the table below are

expressed as registered shares.