Logitech 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-16

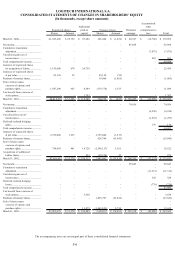

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

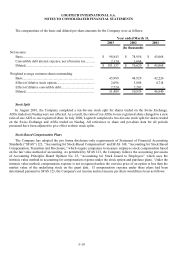

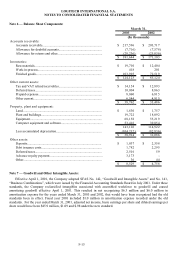

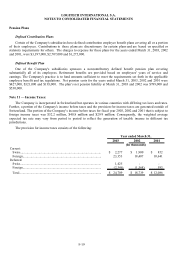

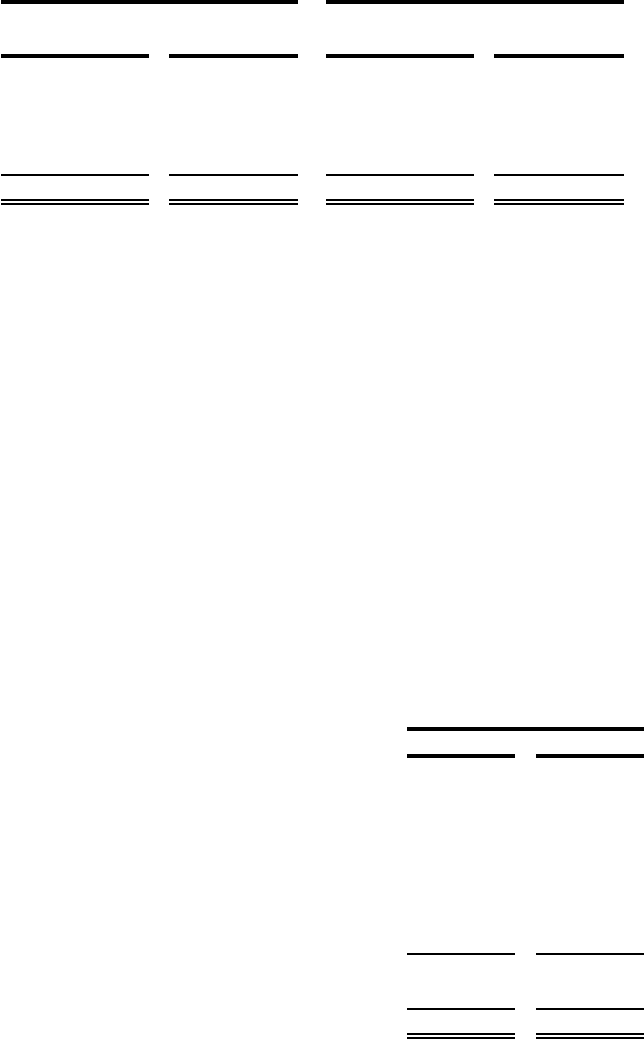

Acquired other intangible assets subject to amortization were as follows:

Gross Carrying Accumulated Gross Carrying Accumulated

Amounts Amortization Amounts Amortization

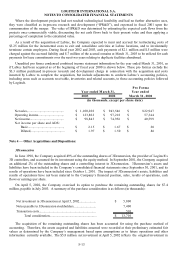

Trademark/tradename..................... 15,671$ (7,040)$ 15,265$ (5,024)$

Existing and core technology.......... 17,323 (8,431) 10,423 (5,306)

Other............................................... 500 (500) 500 (500)

33,494$ (15,971)$ 26,188$ (10,830)$

(In thousands)

March 31, 2003 March 31, 2002

For the years ended March 31, 2003, 2002, and 2001 amortization expense for other intangible assets was $5.1,

$3.7 million, and $2.0 million. The estimated future annual amortization expense for other intangible assets is $5.1

million, $5.1 million, $3.4 million, $2.5 million, and $1.1 million for the fiscal years 2004, 2005, 2006, 2007 and

2008.

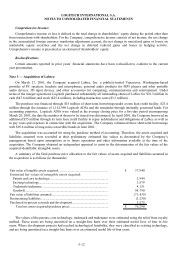

In accordance with SFAS 142, the Company completed an annual impairment test of goodwill in the fourth

quarter of fiscal 2003 and determined that goodwill was not impaired. As the Company has fully integrated Labtec as

well as previously acquired companies, discrete financial information for the acquisitions is no longer available. As a

result, the Company has completed the impairment test for the Labtec goodwill on an enterprise value basis.

Note 8 — Financing Arrangements:

Short-term Credit Facilities

The Company had several uncommitted, unsecured bank lines of credit aggregating $63 million at March 31,

2003. Borrowings outstanding were $8.9 million and $5.3 million at March 31, 2003 and 2002. The borrowings under

these agreements were denominated in Japanese yen at a weighted average annual interest rate of 1.4% at March 31,

2003 and 2002, and were due on demand.

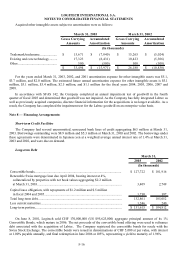

Long-term Debt

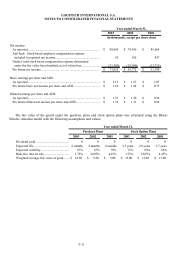

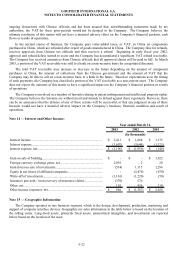

2003 2002

Convertible bonds........................................................................................................ 127,722$ 101,916$

Renewable Swiss mortgage loan due April 2004, bearing interest at 4%,

collateralized by properties with net book values aggregating $2.2 million

at March 31, 2003..................................................................................................... 3,409 2,749

Capital lease obligation, with repayments of $1.2 million and $.5 million

in fiscal 2004 and 2005............................................................................................. 1,730 387

Total long-term debt..................................................................................................... 132,861 105,052

Less current maturities.................................................................................................. 1,246 240

Long-term portion........................................................................................................ 131,615$ 104,812$

March 31,

(In thousands)

On June 8, 2001, Logitech sold CHF 170,000,000 (US $95,625,000) aggregate principal amount of its 1%

Convertible Bonds, which mature in 2006. The net proceeds of the convertible bond offering were used to refinance

debt associated with the acquisition of Labtec. The Company registered the convertible bonds for resale with the

Swiss Stock Exchange. The convertible bonds were issued in denominations of CHF 5,000 at par value, with interest

at 1.00% payable annually, and final redemption in June 2006 at 105%, representing a yield to maturity of 1.96%.