Logitech 2003 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

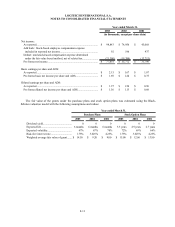

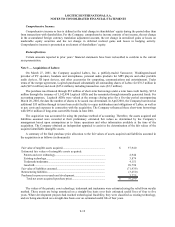

F-5

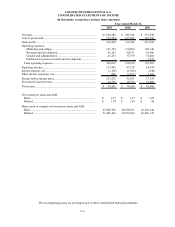

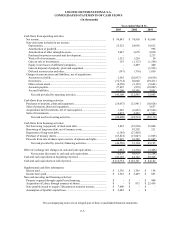

LOGITECH INTERNATIONAL S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

2003 2002 2001

Cash flows from operating activities:

Net income.................................................................................................. 98,843$ 74,956$ 45,068$

Non-cash items included in net income:

Depreciation............................................................................................. 25,522 28,092 19,012

Amortization of goodwill......................................................................... - - 998

Amortization of other intangible assets.................................................... 5,047 3,678 2,030

Purchased in-process research and development..................................... - - 3,275

Write-off of investments.......................................................................... 1,512 1,220 50

Gain on sale of investments...................................................................... 163 (1,115) (1,296)

Equity in net losses of affiliated companies............................................. - 2,469 440

Gain on disposal of property, plant and equipment.................................. - - (1,922)

Deferred income taxes and other.............................................................. (387) (376) 1,030

Changes in current assets and liabilities, net of acquisitions:

Accounts receivable................................................................................. 2,565 (28,937) (6,630)

Inventories................................................................................................ (32,714) 26,040 (29,411)

Other current assets.................................................................................. (4,356) (3,139) (5,643)

Accounts payable..................................................................................... 27,807 (878) (18,009)

Accrued liabilities.................................................................................... 21,106 10,585 3,051

Net cash provided by operating activities............................................. 145,108 112,595 12,043

Cash flows from investing activities:

Purchases of property, plant and equipment................................................ (28,657) (21,941) (16,824)

Sales of property, plant and equipment....................................................... - - 3,637

Acquisitions and investments, net of cash acquired.................................... 1,985

(

6,822

)

(

47,696

)

Sales of investments.................................................................................... 2,072 4,249 1,767

Net cash used in investing activities..................................................... (24,600) (24,514) (59,116)

Cash flows from financing activities:

Net borrowing (repayment) of short-term debt............................................ 2,822 (53,994) 35,000

Borrowing of long-term debt, net of issuance costs..................................... - 93,292 211

Repayment of long-term debt...................................................................... (1,185) (27,450) -

Purchase of treasury shares......................................................................... (63,822) (15,043) (1,065)

Proceeds from sale of shares upon exercise of options and rights............... 15,629 16,389 11,049

Net cash provided by (used in) financing activities.............................. (46,556) 13,194 45,195

Effect of exchange rate changes on cash and cash equivalents....................... 1,681 (2,316) (3,406)

Net increase (decrease) in cash and cash equivalents........................... 75,633 98,959 (5,284)

Cash and cash equivalents at beginning of period.......................................... 143,101 44,142 49,426

Cash and cash equivalents at end of period.................................................... 218,734$ 143,101$ 44,142$

Supplemental cash flow information:

Interest paid................................................................................................. 1,336$ 1,709$ 158$

Income taxes paid........................................................................................ 5,343$ 3,409$ 863$

Non-cash investing and financing activities:

Property acquired through capital lease financing....................................... -$ -$ 900$

Acquisition of Labtec through issuance of shares....................................... -$ 875$ 25,436$

Note payable issued to acquire 3Dconnexion minority interest................... 7,400$ -$ -$

Assumption of Spotlife capital lease........................................................... 2,682$ -$ -$

Year ended March 31,

The accompanying notes are an integral part of these consolidated financial statements.