Logitech 2003 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LISA - 4

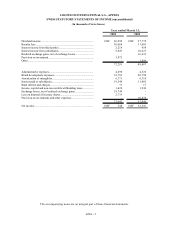

LOGITECH INTERNATIONAL S.A., APPLES

NOTES TO SWISS STATUTORY FINANCIAL STATEMENTS

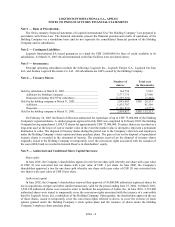

Note 1 — Basis of Presentation:

The Swiss statutory financial statements of Logitech International SA (“the Holding Company”) are prepared in

accordance with Swiss Law. The financial statements present the financial position and results of operations of the

Holding Company on a standalone basis and do not represent the consolidated financial position of the Holding

Company and its subsidiaries.

Note 2 — Contingent Liabilities:

Logitech International SA issued guarantees to a bank for CHF 20,000,000 for lines of credit available to its

subsidiaries. At March 31, 2003 the aforementioned credit line facilities were not drawn down.

Note 3 — Investments:

Principal operating subsidiaries include the following: Logitech Inc., Logitech Europe S.A., Logitech Far East

Ltd., and Suzhou Logitech Electronic Co. Ltd. All subsidiaries are 100% owned by the Holding Company.

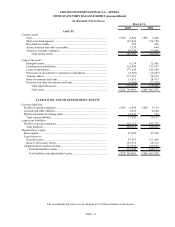

Note 4 — Treasury Shares:

Number of

shares

Total cost

(in thousands)

Held by subsidiaries at March 31, 2001................................................. 164,750 5,967

Additions (by Holding Company).................................................... 3,777,775 27,996

Disposals (including 164,750 by subsidiary)................................... (1,859,522) (5,448)

Held by the holding company at March 31, 2002................................... 2,083,003 28,515CHF

Additions.......................................................................................... 1,835,707 91,569

Disposals.......................................................................................... (1,463,853) (4,771)

Held by the holding company at March 31, 2003................................... 2,454,857 115,313CHF

On February 24, 2003 the Board of Directors authorized the repurchase of up to CHF 75,000,000 of the Holding

Company's registered shares. A similar program approved in July 2002 was completed in February 2003; the Holding

Company having repurchased 1,509,332 shares for approximately CHF 75,000,000. Treasury shares are recorded as a

long-term asset at the lower of cost or market value in the event the market value is deemed to represent a permanent

diminution in value. The disposal of treasury shares during the period was to the Company’s directors and employees

under the Holding Company’s share option and share purchase plans. The gain or loss on the disposal of repurchased

treasury shares is recorded in the statement of income. The premium received on the disposal of treasury shares

originally issued to the Holding Company to temporarily cover the conversion rights associated with the issuance of

the convertible bond is recorded in General Reserve in shareholders’ equity.

Note 5 — Authorized and Conditional Share Capital Increases:

Share splits

In June 2001, the Company’s shareholders approved a ten for one share split whereby one share with a par value

of CHF 10 was converted into ten shares with a par value of CHF 1 per share. In June 2000, the Company’s

shareholders approved a two for one share split whereby one share with a par value of CHF 20 was converted into

two shares with a par value of CHF 10 per share.

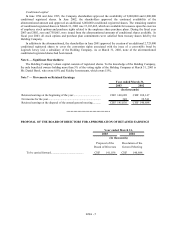

Authorized capital

In June 2002, the Company’s shareholders renewed their approval of 10,000,000 authorized registered shares for

use in acquisitions, mergers and other similar transactions, valid for the period ending June 27, 2004. In March 2001,

1,242,120 authorized shares were issued in order to facilitate the acquisition of Labtec Inc. In June 2001, 2,725,000

authorized shares were issued to temporarily cover the conversion rights associated with the issuance of a convertible

bond by Logitech Jersey Ltd, a subsidiary of the Holding Company. Subsequently, the shareholders approved the use

of those shares, issued to temporarily cover the conversion rights referred to above, to cover the exercise of stock

options granted under the Holding Company’s stock option plans and the issuance of shares under the Holding

Company’s employee share purchase plans.