Logitech 2003 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 24

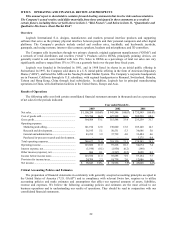

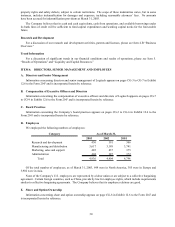

Valuation of Long-Lived and Intangible Assets and Goodwill

We review for impairment of long-lived assets, such as investments, property and equipment, and goodwill and

other intangible assets, whenever events indicate that the carrying amount might not be recoverable. Factors we

consider important which could trigger an impairment review include the following:

• significant underperformance relative to historical or projected future operating results;

• significant changes in the manner of our use of the acquired assets or the strategy for our overall business;

• significant negative industry or economic trends;

• significant decline in our stock price for a sustained period; and

• our market capitalization relative to net book value.

When Logitech determines that the carrying value of intangibles and long-lived assets may not be recoverable

based upon the existence of one or more of the above indicators, we measure any impairment based on a projected

discounted cash flow method using a discount rate determined by our management to be commensurate with the risk

inherent in our current business model.

Logitech completed an annual impairment review of goodwill in fiscal 2003 and determined that goodwill is not

impaired. As the Company has fully integrated Labtec as well as previously acquired companies, discrete financial

information for the acquisitions is no longer available. As a result, Logitech completed the impairment test of Labtec

goodwill on an enterprise value basis.

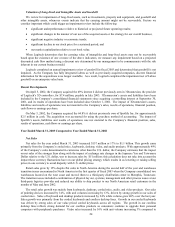

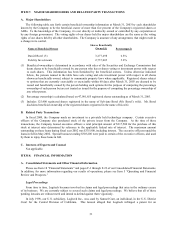

Recent Developments

On April 5, 2002, the Company acquired the 49% interest it did not previously own in 3Dconnexion, the provider

of Logitech’s 3D controllers, for $7.4 million, payable in July 2003. 3Dconnexion’s assets and liabilities have been

included in the Company’s consolidated financial statements since acquiring a controlling interest at September 30,

2001, and its results of operations have been included since October 1, 2001. The impact of 3Dconnexion’s assets,

liabilities and results of operations was not material to the Company’s sales, results of operations, financial position,

cash flows or earnings per share.

On May 3, 2002, the Company acquired the 64.8% it did not previously own of Spotlife Inc. for approximately

$2.5 million in cash. The acquisition was accounted for using the purchase method of accounting. The impact of

Spotlife’s assets, liabilities and results of operations was not material to the Company’s financial position, sales,

results of operations, cash flows or earnings per share.

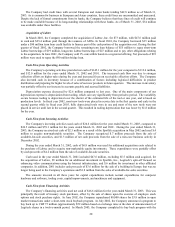

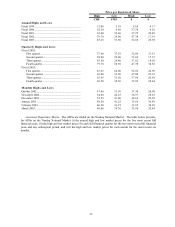

Year Ended March 31, 2003 Compared to Year Ended March 31, 2002

Net Sales

Net sales for the year ended March 31, 2003 increased $157 million or 17% to $1.1 billion. This growth came

primarily from the Company’s corded mice, keyboards, desktop, video, and audio products. With approximately 49%

of the Company’s sales denominated in currencies other than the U.S. dollar, the Company estimates that the impact

on net sales of the stronger Euro along with the impact of exchange rate changes in the Japanese Yen and Taiwanese

Dollar relative to the U.S. dollar, was to increase sales by $51 million; this calculation does not take into account the

impact these currency fluctuations have on our global pricing strategy which results in us lowering or raising selling

prices in one currency to avoid disparity with U.S. dollar prices.

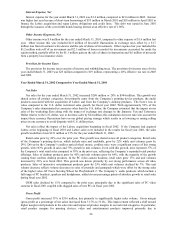

Retail sales grew by 15% despite flat sales in North America during the second half of the year and warehouse

transition issues encountered in North America in the first quarter of fiscal 2003 when the Company consolidated two

warehouses located on the west coast and moved them to a third-party distribution center in Memphis, Tennessee.

The transition issues included a combination of physical lay out, systems, management and other process issues at our

third-party logistics provider and reduced our ability to ship product to our North American retail customers in the

months of May and June 2002.

The retail sales growth was mainly from keyboards, desktops, corded mice, audio, and video products. Our sales

of pointing devices increased by 14%, with unit volumes increasing by 13%, driven by strong growth in our sales of

corded mice. Sales of keyboard and desktop products increased by 24% while volume grew 40% over the last year.

Sales growth was primarily from the corded keyboards and cordless desktop lines. Growth in our corded keyboards

was driven by strong sales of our value priced corded keyboards across all regions. The growth in our cordless

desktop lines reflects strong demand for our cordless products as consumers continue to upgrade their personal

computers with peripherals purchases. Video sales increased by 16% with unit volume increasing 3% compared to