Logitech 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-20

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

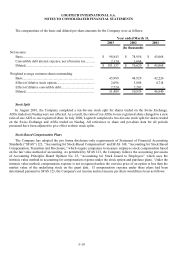

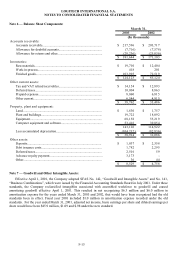

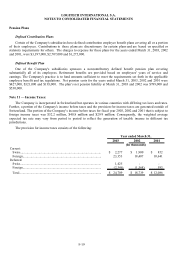

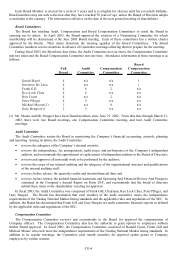

Deferred income tax assets and liabilities consist of the following:

2003 2002

Net operating loss carryforwards............................................................. 17,429$ 25,161$

Research and development and other tax credit carryforwards................ 7,415 6,275

Accruals................................................................................................... 18,144 18,600

Depreciation and amortization................................................................. 4,317 1,237

Other........................................................................................................ - 444

Gross deferred tax assets......................................................................... 47,305 51,717

Deferred tax liabilities related to intangible assets.................................. (3,910) (5,315)

Deferred tax liabilities............................................................................. (3,910) (5,315)

Valuation allowance................................................................................ (33,375) (37,303)

Net deferred tax assets............................................................................. 10,020$ 9,099$

March 31,

(In thousands)

Management regularly assesses the ability to realize deferred tax assets recorded in the Company's subsidiaries

based upon the weight of available evidence, including such factors as the recent earnings history and expected future

taxable income. The methodology used by management to determine the amount of deferred tax assets that are likely

to be realized is based upon the Company's recent earnings and estimated future taxable income in applicable tax

jurisdictions for approximately the next two years. Management believes that it is more likely than not that the

Company will not realize a portion of its deferred tax assets and, accordingly, a valuation allowance of $33.4 million

has been established for such amounts at March 31, 2003. In fiscal years ending 2003, 2002 and 2001, the valuation

allowance decreased by $3.9 million, increased by $13.0 million and increased by $9.2 million. In the event future

taxable income is below management’s estimates or is generated in tax jurisdictions different than projected, the

Company could be required to increase the valuation allowance for deferred tax assets. This would result in an

increase in the Company’s effective tax rate.

At March 31, 2003, the Company’s foreign net operating loss and tax credit carryforwards for income tax

purposes were approximately $47.2 million and $7.4 million. If not utilized, these carryforwards will expire through

2023.

Deferred tax assets of approximately $20 million at March 31, 2003 pertain to certain tax credits and net

operating loss carry forwards resulting from the exercise of employee stock options. When recognized, through

generating sufficient taxable income to utilize the NOL deductions, the tax benefit of these credits and losses will be

accounted for as a credit to shareholders’ equity rather than as a reduction of the income tax provision.

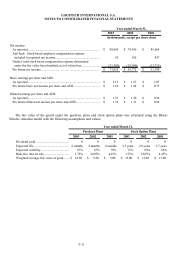

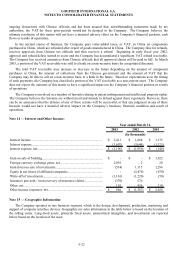

The difference between the provision for income taxes and the expected tax provision at the weighted average

tax rate is reconciled below. The expected tax provision at the weighted average rate is generally calculated using pre-

tax accounting income or loss in each country multiplied by that country's applicable statutory tax rates.

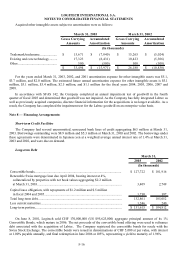

2003 2002 2001

Expected tax provision at weighted average rate....................................... 26,827$ 20,144$ 12,665$

Non-deductible purchased in-process R&D............................................... - - 655

Decrease in valuation allowance, without the impact of stock options....... (2,247) (1,155) (1,380)

Other.......................................................................................................... 129 (250) 146

Total provision for income taxes................................................................ 24,709$ 18,739$ 12,086$

Year ended March 31,

(In thousands)