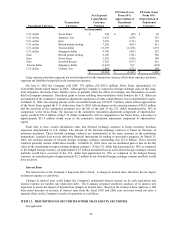

Logitech 2003 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 39

Part II

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

None.

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF

PROCEEDS

On July 5, 2000, a two-for-one stock split became effective resulting in one additional ADS being issued to ADS

holders for each ADS held by ADS holders of record. Each ADS represents one-tenth of a registered share.

In August 2001, the Company completed a ten-for-one stock split for shares traded on the Swiss Exchange.

ADSs traded on NASDAQ were not affected. As a result, the ratio of ten ADSs to one registered share changed to a

new ratio of one ADS to one registered share.

ITEM 15. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Within the 90-day period prior to the date of this Form 20-F, we carried out an evaluation, under the supervision

and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of

the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rule 13a-14(c)

and 15d-14(c) of the Securities Exchange Act of 1934. Based on this evaluation, the Company’s Chief Executive

Officer and Chief Financial Officer concluded that our disclosure controls and procedures are effective to ensure that

information required to be disclosed in our filings and submissions under the Exchange Act is recorded, processed,

summarized, and reported within the time periods specified in the SEC’s rules and forms.

Logitech’s management, including the Chief Executive Officer and Chief Financial Officer, does not expect that

our disclosure controls and procedures will prevent all error and all fraud. Because of inherent limitations in any

systems of disclosure controls and procedures, no evaluation of controls can provide absolute assurance that all

instances of error or fraud, if any, within the Company may be detected.

Changes in Internal Controls

There were no significant changes in the Company’s internal controls or other factors that could significantly

affect these controls subsequent to the date of their evaluation. There were no significant deficiencies or material

weaknesses, and therefore there were no corrective actions taken.

ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT

The Committee consists of four non-employee directors who meet the independence requirements of the Nasdaq

National Market listing standards and the rules and regulations of U.S. Securities and Exchange Commission. The

Board affirmatively determined at its April 2003 meeting that Mr. Gill and Mr. Bengier are audit committee financial

experts. See also the information in Exhibit 12.6 under the caption “Audit Committee”.

ITEM 16B. CODE OF ETHICS

The Company’s code of ethics policy entitled, “Business Ethics and Conflict of Interest Policy of Logitech

International S.A.”, is attached as Exhibit 11.1 to our Form 20-F. Our code of ethics policy covers the Chief

Executive Officer, the Chief Financial Officer, and the Chief Accounting Officer as well as all employees.

The code of ethics addresses, among other things, the following items:

• Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between

personal and professional relationships;

• Full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or

submit to, the Commission and in other public communications made by us;

• Compliance with applicable governmental laws, rules and regulations;