Logitech 2003 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-18

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

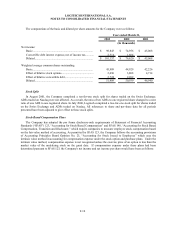

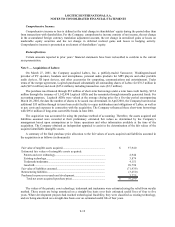

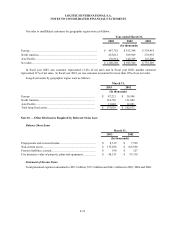

Under the 1996 Employee Stock Plan, the Company may grant to employees options for registered shares or

ADRs, restricted shares, stock appreciation rights, and stock units, which are bookkeeping entries representing the

equivalent of shares. A total of 19,000,000 registered shares and/or ADRs may be issued under this plan. Options

generally vest over four years and remain outstanding for periods not to exceed ten years. Options may only be

granted at exercise prices of at least 100% of the fair market value of the registered shares on the date of grant;

restricted shares and stock appreciation rights may be granted at prices less than 100% of the fair market value of the

registered shares on the date of grant; no cash consideration is required to be paid by employees in connection with

the grant of stock units. The Company has made no grants of restricted shares, stock appreciation rights or stock

units.

The Company also maintains one other option plan for a small number of Asian executives, under which options

were granted at exercise prices discounted from fair market value of the registered shares on the date of grant. No

further stock options may be granted under this plan. At March 31, 2003, 274,800 options had been granted with

7,455 options outstanding under this plan.

Compensation expense is recognized over the vesting period when the exercise price of an option is less than the

fair market value of the underlying stock on the date of grant. Compensation expense of $92,000, $196,000 and

$437,000 was recorded for the years ended March 31, 2003, 2002 and 2001. Such amounts are accrued as a liability

when the expense is recognized and subsequently credited to additional paid-in capital upon exercise of the related

stock option. There is no further compensation expense arising from stock options outstanding at March 31, 2003 to

be recognized in future periods.

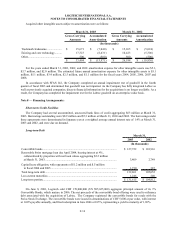

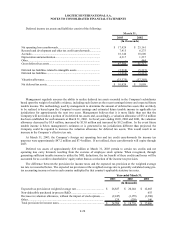

A summary of activity under the stock option plans, including weighted average exercise price, is as follows:

Number

Exercise

Price Number

Exercise

Price Number

Exercise

Price

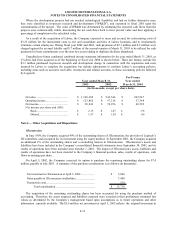

Outstanding, beginning of year.......... 7,787,950 17$ 7,846,660 12$ 7,705,540 6$

Granted............................................... 1,581,725 31$ 2,355,375 27$ 2,112,180 29$

Exercised............................................ (1,301,845) 9$ (1,998,981) 7$ (1,547,290) 5$

Cancelled or expired.......................... (330,694) 30$ (415,104) 15$ (423,770) 13$

Outstanding, end of year.................... 7,737,136 21$ 7,787,950 17$ 7,846,660 12$

Exercisable, end of year..................... 3,612,857 13$ 2,796,675 9$ 2,450,770 5$

Year ended March 31,

2003 2002 2001

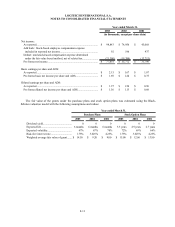

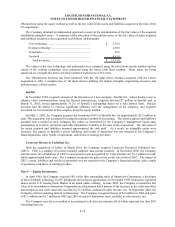

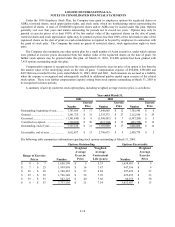

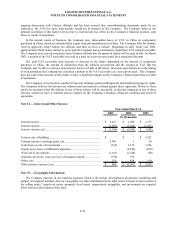

The following table summarizes information regarding stock options outstanding at March 31, 2003:

Number

Weighted

Average

Exercise

Price

Weighted

Average

Contractual

Life (years) Number

Weighted

Average

Exercise

Price

$0- 7$ 1,658,198 5$ 5.33 1,658,031 5$

$7- 25$ 1,999,998 16$ 7.47 947,396 9$

$26- 28$ 1,740,467 27$ 8.84 297,422 27$

$29- 38$ 1,796,348 32$ 7.99 625,653 33$

$39- 55$ 542,125 40$ 7.66 84,355 38$

$0- 55$ 7,737,136 21$ 7.54 3,612,857 13$

Options Outstanding Options Exercisable

Range of Exercise

Prices