Logitech 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. F-9

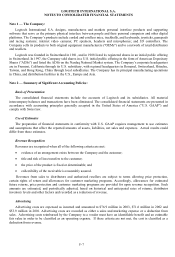

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

three to five years for software development. When property and equipment is retired or otherwise disposed of, the

cost and accumulated depreciation are relieved from the accounts and the net gain or loss is included in the

determination of income.

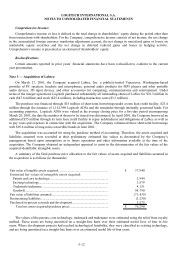

Intangible Assets

The Company’s intangible assets principally include goodwill, acquired technology and trademarks. Intangible

assets with finite lives, which include acquired technology and trademarks, are recorded at cost and amortized on the

straight-line method over their respective useful lives. Intangible assets with indefinite lives, which include goodwill,

are recorded at cost and evaluated at least annually for impairment.

Impairment of Long-Lived Assets

The Company reviews for impairment of long-lived assets, such as investments, property and equipment, and

intangible assets, whenever events indicate that the carrying amount might not be recoverable. Management assesses

recoverability by comparing the projected undiscounted net cash flows associated with those assets to their carrying

values. If impaired, the asset is written down to fair value, which is determined based on discounted cash flows or

appraised value, depending on the nature of the asset. Goodwill is evaluated for impairment at least annually on an

enterprise value basis.

Income Taxes

The Company provides for income taxes using the liability method, which requires that deferred tax assets and

liabilities be recognized for the expected future tax consequences of temporary differences arising between the bases

of assets and liabilities for financial reporting and income tax purposes. In estimating future tax consequences,

expected future events are taken into consideration, with the exception of potential tax law or tax rate changes.

Fair Value of Financial Instruments

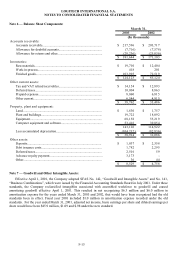

For certain of the Company's financial instruments, including cash and cash equivalents and accounts receivable,

accounts payable and accrued liabilities, short-term debt and current maturities of long-term debt, carrying value

approximates fair value due to their short maturities. The estimated fair value of publicly traded financial equity

instruments are determined by using quoted market prices.

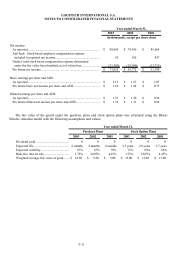

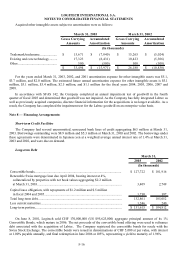

Net Income Per Share and ADS

Basic earnings per share are computed by dividing net income by the weighted average number of outstanding

registered shares. Diluted earnings per share are computed using weighted average registered shares and, if dilutive,

weighted average registered share equivalents. The registered share equivalents are registered shares issuable upon

the exercise of stock options and stock purchase plan agreements (using the treasury stock method), and upon the

conversion of convertible debt (using the if-converted method). For the year ended March 31, 2003 and 2002, the

conversion of convertible debt was included in the registered share equivalents due to its dilutive effect.