Logitech 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-12

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

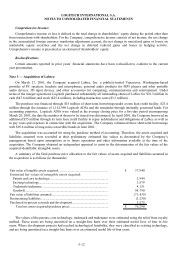

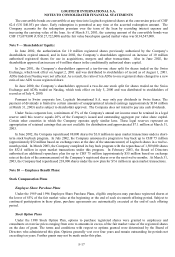

Comprehensive Income:

Comprehensive income or loss is defined as the total change in shareholders’ equity during the period other than

from transactions with shareholders. For the Company, comprehensive income consists of net income, the net change

in the accumulated foreign currency translation adjustment account, the net change in unrealized gains or losses on

marketable equity securities and the net change in deferred realized gains and losses in hedging activity.

Comprehensive income is presented as an element of shareholders’ equity.

Reclassifications

Certain amounts reported in prior years’ financial statements have been reclassified to conform to the current

year presentation.

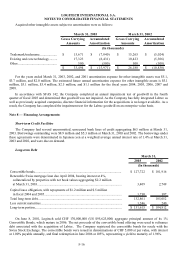

Note 3 — Acquisition of Labtec:

On March 27, 2001, the Company acquired Labtec, Inc. a publicly-traded Vancouver, Washington-based

provider of PC speakers, headsets and microphones, personal audio products for MP3 players and other portable

audio devices, 3D input devices, and other accessories for computing, communications and entertainment. Under

terms of the merger agreement, Logitech purchased substantially all outstanding shares of Labtec for $76.3 million in

cash ($47.6 million) and stock ($25.4 million), including transaction costs ($3.3 million).

The purchase was financed through $35 million of short-term borrowings under a term loan credit facility, $25.4

million through the issuance of 1,142,998 Logitech ADSs and the remainder through internally generated funds. For

accounting purposes, Logitech ADSs were valued at the average closing price for a five-day period encompassing

March 20, 2001, the date the number of shares to be issued was determined. In April 2001, the Company borrowed an

additional $55 million through its term loan credit facility to repay indebtedness and obligations of Labtec as well as

to pay costs and expenses in connection with the acquisition. The Company refinanced these short-term borrowings

with $95.6 million of long-term convertible bonds in June 2001.

The acquisition was accounted for using the purchase method of accounting. Therefore, the assets acquired and

liabilities assumed were recorded at their preliminary estimated fair values as determined by the Company’s

management based upon assumptions as to future operations and other information available at the time of the

acquisition. The Company obtained an independent appraisal to assist in the determination of the fair values of the

acquired identifiable intangible assets.

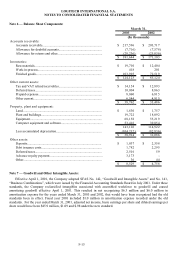

A summary of the final purchase price allocation to the fair values of assets acquired and liabilities assumed in

the acquisition is as follows (in thousands):

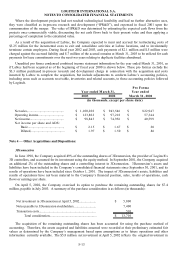

Fair value of tangible assets acquired.............................................................. 37,940$

Estimated fair values of intangible assets acquired:

Patents and core technology......................................................................... 2,944

Existing technology...................................................................................... 3,879

Trademark/tradename.................................................................................. 4,151

Goodwill...................................................................................................... 98,790

Fair value of liabilities assumed...................................................................... (71,439)

Restructuring liabilities................................................................................... (3,250)

Purchased in-process research and development............................................. 3,275

Total net assets acquired (purchase price)................................................ 76,290$

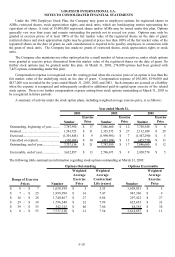

The values of the patents, core technology, trademark and tradename were estimated using the relief from royalty

method. These assets are being amortized on a straight-line basis over their estimated useful lives of four to five

years. Where development projects had reached technological feasibility, they were classified as existing technology,

and are being amortized on a straight-line basis over an estimated useful life of four years.