Logitech 2003 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CG-10

Change of Control Provisions

Swiss law requires that any shareholder who acquires more than 33 1/3 percent of the voting rights of a listed

company is required to make an offer to acquire all listed securities of the company that are listed for trading on the

Swiss Exchange. Logitech has not waived or otherwise changed these rules.

Our executive officers generally have Change of Control Severance Agreements with Logitech. Under the terms

of these agreements, if the executive officer’s employment is involuntarily terminated or the employee is demoted

within twelve months (eighteen months for one individual) after a change in control of Logitech, the executive would

receive his or her base salary, annual and quarterly bonuses, and payment of health benefits for up to a year following

the termination, as well as 100% vesting of all unvested stock options. In the case of a demotion, the executive

officer would be required to remain employed for a period of time (generally 12 months) in order to receive these

benefits.

Auditors

PricewaterhouseCoopers S.A.(PwC) assumed the existing auditing mandate for Logitech in 1988. Each year at

the Genera1 Assembly, the shareholders approve the renewal of the auditors for a one-year term. PwC was

reappointed as the worldwide auditors of the Company in June 2002. Since fiscal year 2000, the responsible principal

auditor has been Michael Foley.

In addition to the audit services they provide with respect to our annual audited consolidated financial

statements and other filings with the Securities and Exchange Commission, PwC has provided non-audit services to

us in the past and may provide them in the future. Non-audit services are services other than those provided in

connection with an audit or a review of the financial statements of the Company. The Company’s audit committee

pre-approves all audit and non-audit services provided by our audit firm. This pre-approval must occur before the

auditor is engaged. Audit services can be approved no more than six months in advance of the services being

performed. Services that last longer than a year must be reapproved by the audit committee.

Our audit committee can delegate the pre-approval ability to a single independent member of the audit

committee. The delegate must communicate all services approved at the next scheduled audit committee meeting.

The audit committee or its delegate can pre-approve types of services to be performed by the auditors with a set dollar

limit per the type of service. The Chief Financial Officer is responsible for ensuring that the work performed is

within the scope and dollar limit as approved by the audit committee. Management must report to the audit

committee the status of each project or service provided by the auditors.

During fiscal year 2003, PwC performed the following non-audit services that were approved by the audit

committee: Tax planning and compliance advice, advising on potential acquisitions and other transactions, reviewing

the application of generally accepted accounting principles, consultations regarding implementation of various

provisions of the Sarbanes-Oxley Act and providing statutory audit services in foreign jurisdictions.

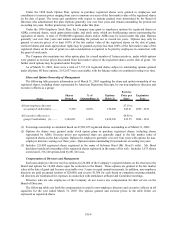

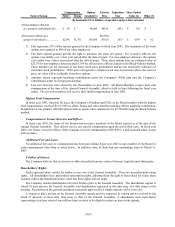

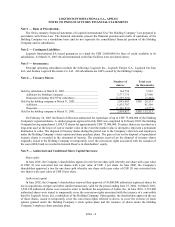

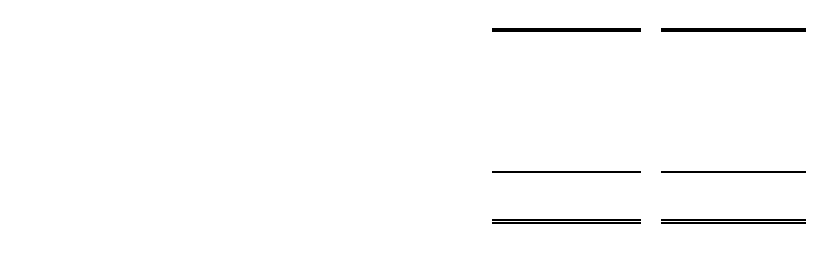

The following table presents the aggregate fees for professional audit services and other services rendered by

PricewaterhouseCoopers to Logitech in fiscal years 2003 and 2002.

2003 2002

615,600$ 530,000$

1,700 51,000

452,000 585,000

57,000 637,000

1,126,300$ 1,803,000$ Total...................................................................................

Audit fees (1).....................................................................

Audit-related fees...............................................................

Tax fees..............................................................................

All Other Fees (2)..............................................................

(1) Audit fees represent those fees incurred for the indicated fiscal year, regardless of when they were paid. Audit

fees include both group and statutory audit fees.

(2) Included within “All Other Fees” in 2003 are services provided implementing the various provisions of the

Sarbanes-Oxley Act, and in 2002 are services provided in connection with the due diligence, audit and SEC

filings of the Labtec acquisition, the issuance of our convertible bonds, and the due diligence, audit, resolution of

tax and accounting issues for the 3Dconnexion acquisition.