Logitech 2003 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2003 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-14

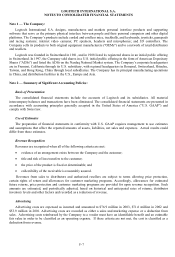

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

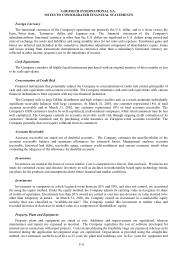

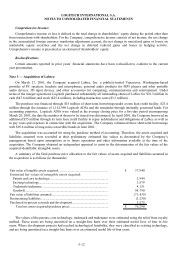

3Dconnexion using the equity method as well as the fair value of the assets and liabilities acquired at the time of the

2% acquisition.

The Company obtained an independent appraisal to assist in the determination of the fair values of the acquired

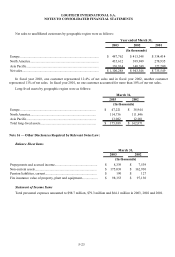

identifiable intangible assets. A summary of the allocation of the purchase price to the fair values of assets acquired

and liabilities assumed in the acquisition is as follows (in thousands):

2,100$

4,800

200

6,610

13,710$

Goodwill.........................................................................

Total net assets...........................................................

Core technology..............................................................

Existing technology.........................................................

Trademarks.....................................................................

The values of the core technology and trademarks were estimated using the relief from royalty method and the

values of the existing technology were estimated using the future cash flows method. These assets are being

amortized on a straight-line basis over their estimated useful lives of five years.

The 3Dconnexion business has been combined with the 3D input device business acquired with the Labtec

acquisition to offer a complete line of 3D input devices utilizing the market strengths, engineering resources and

global presence of both entities.

Spotlife

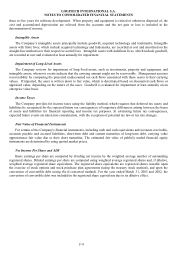

In November 1999, Logitech announced the formation of a new company, Spotlife Inc., whose business was to

enhance video communications using the Internet infrastructure. Logitech invested $7 million in Spotlife and, at

March 31, 2002, owned approximately 35.2% of Spotlife’s outstanding shares on a fully diluted basis. Outside

investors had the ability to exercise significant influence over the management of the company, and Logitech

accounted for its investment in this company using the equity method.

On May 3, 2002, the Company acquired the remaining 64.8% of Spotlife Inc. for approximately $2.5 million in

cash. The acquisition was accounted for using the purchase method of accounting. The assets acquired and liabilities

assumed were recorded at their estimated fair values as determined by the Company’s management based upon

assumptions as to future operations and other information available at the time of the acquisition. The fair value of

the assets acquired and liabilities assumed approximated the cash paid. As a result, no intangible assets were

recorded. The impact of Spotlife’s assets, liabilities and results of operations was not material to the Company’s

financial position, sales, results of operations, cash flows or earnings per share.

Connector Resources Unlimited, Inc.

With the acquisition of Labtec in March 2001, the Company acquired Connector Resources Unlimited, Inc.

(CRU). CRU is a supplier of security-oriented computer data storage products. In November 2002, the Company

sold the assets net of liabilities of CRU to an acquisition group organized by Veber Partners for $1.5 million in cash,

which approximated book value. The Company recognized no gain or loss on this sale in fiscal 2003. The impact of

CRU’s assets, liabilities and results of operations was not material to the Company’s financial position, sales, results

of operation, cash flows or earning per share.

Note 5 — Equity Investments:

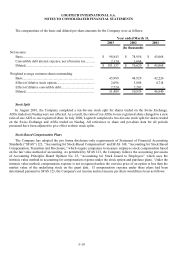

In April 1998, the Company acquired 10% of the then outstanding stock of Immersion Corporation, a developer

of force feedback technology for PC peripherals and software applications. In November 1999, Immersion registered

shares on the U.S. Nasdaq Stock Market in an initial public offering. In June 2002, the Company reviewed the fair

value of its investment in Immersion Corporation and determined that a portion of the decrease in the value was other

than temporary and wrote down the securities by $.5 million, included in other income, net. In September 2002, the

Company sold its remaining interest in Immersion. The Company recognized losses of $.2 million in 2003 and gains

of $1.1 million and $1.3 million in 2002 and 2001 on sales of Immersion stock, included in other income, net.

The Company uses the cost method of accounting for all other investments, all of which represent less than 20%

ownership interests.