JVC 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited46.

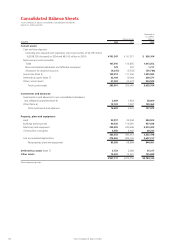

Significant components of the Companies’ deferred tax assets

and liabilities at March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

Deferred tax assets:

Loss on devaluation

of inventory ¥ 4,017 ¥ 5,365 $ 37,896

Accrued expenses not

deductible for tax

purposes 10,028 7,887 94,604

Accrual for losses on

business restructuring 1,269 367 11,972

Depreciation 8,920 8,378 84,151

Retirement and severance

benefits 5,272 2,383 49,736

Tax loss carry forwards 17,746 23,275 167,415

Other 11,295 12,665 106,556

Total gross deferred

tax assets 58,547 60,320 552,330

Less valuation allowance (28,808) (37,026) (271,773)

Net deferred tax assets ¥ 29,739 ¥ 23,294 $ 280,557

Deferred tax liabilities:

Net unrealized holding

gains on securities (3,223) (356) (30,406)

Other (1,299) (1,077) (12,255)

Total gross deferred

tax liabilities ¥ (4,522) ¥ (1,433) $ (42,661)

Net deferred tax assets ¥ 25,217 ¥ 21,861 $ 237,896

8. SHORT-TERM BANK LOANS AND LONG-TERM DEBT

Short-term bank loans of certain of the Company’s consolidated

subsidiaries consist of notes maturing generally in three months.

The applicable annual interest rates on short-term bank loans

outstanding at March 31, 2004 and 2003 range from 0.04% to

10.22% and from 1.26% to 26.42% , respectively.

Long-term debt at March 31, 2004 and 2003 are as follows:

Thousands of

Millions of yen U.S. dollars

2004 2003 2004

1.5% unsecured convertible

bonds due in 2005 ¥ 10,968 ¥11,483 $103,472

0.55% unsecured convertible

bonds due in 2005 19,528 20,000 184,226

1.75% unsecured bonds

due in 2003 —5,000 —

2.15% unsecured bonds

due in 2005 9,500 10,000 89,623

1.68% unsecured bonds

due in 2006 20,000 20,000 188,679

1.89% unsecured bonds

due in 2007 10,000 10,000 94,340

1.50% guaranteed notes

due in 2005 6,864 7,206 64,755

Loans, primarily from banks

with interest principally at

1.19% to 6.10%

Secured —322 —

Unsecured 26,405 34,184 249,103

103,265 118,195 974,198

Less current portion 16,928 12,727 159,698

¥ 86,337 ¥105,468 $814,500

The 1.5% unsecured convertible bonds are redeemable prior

to their stated maturity, in whole or in part, at the option of the

Company at prices ranging from 107% to 100% of the principal

amount. The price at which shares of common stock shall be

issued upon conversion is ¥2,867 ($27.05) per share, subject to

adjustment under certain circumstances. The 0.55% unsecured

convertible bonds are redeemable prior to their stated maturity,

in whole or in part, at the option of the Company at prices

ranging from 103% to 100% of the principal amount. The price

at which shares of common stock shall be issued upon conversion

is ¥1,487 ($14.03) per share, subject to adjustment under

certain circumstances.

The aggregate annual maturities of long-term debt at March

31, 2004 are as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2005 ¥ 16,928 $159,698

2006 46,016 434,113

2007 30,126 284,208

2008 10,129 95,557

2009 66 622

¥103,265 $974,198

9. EMPLOYEES’ SEVERANCE AND RETIREMENT BENEFITS

Employees of Japanese companies are compulsorily included in the

Welfare Pension Insurance Scheme operated by the government.

Employers are legally required to deduct employees’ welfare

pension insurance contributions from their payroll and to pay

them to the government together with employers’ own contribu-

tions. For companies that have established their own Employees’

Pension Fund which meets certain legal requirements, it is possible

to transfer a part of their welfare pension insurance contributions

(referred to as the substitutional portion of the government’s

scheme) to their own Employees’ Pension Fund under the

government’s permission and supervision.

Based on the newly enacted Defined Benefit Corporate

Pension Law, the Company and its consolidated domestic

subsidiaries decided to restructure their Employees’ Pension

Fund and were permitted by the Minister of Health, Labor and

Welfare on July 1, 2002 to be released from their future obliga-

tion for payments for the substitutional portion of the Welfare

Pension Insurance Scheme. Plan assets for the substitutional

portion maintained by the Employees’ Pension Fund are to be

transferred back to the government.

The Company and its consolidated domestic subsidiaries applied

the transitional provisions as prescribed in paragraph 47-2 of the

JICPA Accounting Committee Report No. 13, “Practical Guideline

for Accounting of Retirement Benefits (Interim Report)”, and the

effect of transferring of the substitutional portion was recognized

on the date permission was received from the Ministry of Health,

Labor and Welfare. As a result, in the year ended March 31, 2003,

the Company and its consolidated domestic subsidiaries recorded

gains on the release from the substitutional portion of the

government’s Welfare Pension Insurance Scheme amounting to

¥3,456 million, which was calculated based on the amounts of the

substitutional portion of the projected benefit obligations, the

related plan assets, and the related unrecognized items.

The amount of plan assets expected to be transferred back to the

government approximated ¥65,305 million as of March 31, 2003.