JVC 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited44.

The ranges of useful lives for computing depreciation are

generally as follows:

Buildings 20 to 50 years

Machinery and equipment 3 to 7 years

Accounting standard for impairment of fixed assets

In the year ended March 31, 2004, the Company did not adopt

early the new accounting standard for impairment of fixed Assets

(“Opinion Concerning Establishment of Accounting Standard for

Impairment of Fixed Assets” issued by the Business Accounting

Deliberation Council on August 9, 2002) and the implementation

guidance for accounting standard for impairment of fixed assets

(the Financial Accounting Standard Implementation Guidance No.

6 issued by the Accounting Standards Board of Japan on October

31, 2003). These standards are required to be adopted in periods

beginning no later than on April 1, 2005.

Finance leases

Finance leases, except those leases for which the ownership of the

leased assets is considered to be transferred to the lessee, are

accounted for in the same manner as operating leases.

Research and development

Research and development expenditures for new products or

significant improvement of existing products are charged to income

as incurred.

Income taxes

Income taxes are accounted for under the asset and liability

method. Deferred tax assets and liabilities are recognized for the

estimated future tax consequences attributable to differences

between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases and net operat-

ing loss carried forward and foreign tax credit carry forwards.

Deferred tax assets and liabilities are measured using enacted tax

rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or

settled. The effect on deferred tax assets and liabilities of a change

in tax rates is recognized in income in the period that includes the

enactment date.

Employees’ severance and retirement benefits

The Company has funded pension plans and unfunded benefit

plans to provide retirement benefits for substantially all employees.

Upon retirement or termination of employment for reasons other

than dismissal for cause, eligible employees are entitled to lump-sum

and/or annuity payments based on the current rates of their salary

and length of service.

The liabilities and expenses for severance and retirement benefits

are determined based on the amounts actuarially calculated using

certain assumptions.

The Company provided allowance for employees’ severance and

retirement benefits as of the balance sheet dates based on the

estimated amounts of projected benefit obligation and the fair

value of plan assets at those dates.

The excess of the projected benefit obligation over the total of

the fair value of plan assets as of April 1, 2000 and the liabilities

for severance and retirement benefits recorded as of April 1, 2000

(the ”net transition obligation”) is recognized in expenses in equal

amounts primarily over 15 years commencing with the year ended

March 31, 2001.

Prior service costs are recognized in income or expenses using

the straight-line method over 10 years, and actuarial gains and

losses are recognized in expenses using the straight-line method

over 10 years commencing with the succeeding period.

Amounts per share of common stock

The computation of net income per share is based on the weighted

average number of shares of common stock outstanding during

each year.

Diluted net income per share assumes dilution that could occur

if convertible bonds or similar securities were converted into

common stock resulting in the issuance of common stock. As the

Companies reported net losses for the year ended March 31,

2002, inclusion of potential common shares would have an

antidilutive effect on per share amounts.

Effective April 1, 2002, the Companies adopted the new

accounting standard for earnings per share and related guidance

(Accounting Standards Board Statement No. 2, “Accounting

Standard for Earnings Per Share” and Financial Standards

Implementation Guidance No. 4, “Implementation Guidance for

Accounting Standard for Earnings Per Share”, issued by the

Accounting Standards Board of Japan on September 25, 2002).

The effect on earnings per share of the adoption of the new

accounting standard was not material. Such amounts for the year

ended March 31, 2002 have not been recalculated using the new

accounting standard.

Cash dividends per share represent the actual amount declared

as applicable to the respective years.

Accounting standard for treasury stock and reversal of

statutory reserves

Effective April 1, 2002, the Companies adopted the new account-

ing standard for treasury stock and reversal of statutory reserves

(Accounting Standards Board Statement No. 1, “Accounting

Standard for Treasury Stock and Reduction of Statutory Reserves”,

issued by the Accounting Standards Board of Japan on February

21, 2002).

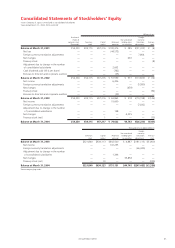

The adoption of the new accounting standard had no impact

on net income. However, as a result of adopting this new

accounting standard and application of the related revised disclosure

requirements, stockholders’ equity accounts in the accompanying

balance sheet as of March 31, 2003 are presented differently from

prior years.

Reclassifications

Certain prior year amounts have been reclassified to conform to

the 2004 presentation. These changes had no impact on previ-

ously reported results of operations or stockholders’ equity.

3. CHANGE IN ACCOUNTING METHOD

The Company changed the method of accounting for royalty

income and related expenses. Under the former method, the net

amount of the two items was included in the statements of opera-

tions as royalty income—net, under other income (expenses).

Effective April 1, 2002, royalty income is included in net sales,

and the related expenses are included in selling, general and

administrative expenses.

This change reflects the recognition that royalty income is

directly attributable to the Company’s principal operating activities,

in light of the increasing number of technological alliances with

partners both in Japan and overseas, and their growing strategic

significance. Therefore, royalty income and the related expenses