JVC 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Victor Company of Japan, Limited36.

20000

10

20

30

40

20042001 2002 2003

20000

150

300

450

600

20042001 2002 2003

2000

0

10

20

30

40

50

20042001 2002 2003

(Billions of yen)(

Billions of yen)(Billions of yen)

Stockholders’ equity

Total assets

Depreciation & amortization

Capital expenditures

STOCKHOLDERS’ EQUITY/

TOTAL ASSETS

DEPRECIATION & AMORTIZATION/

CAPITAL EXPENDITURES

R&D EXPENDITURES

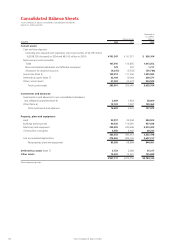

Total current liabilities were up 14.3%, or ¥29.7 billion,

compared to the end of the previous fiscal year, at ¥236.6

billion, reflecting an increase in notes and accounts payable—

trade and the reclassification of convertible bonds due

within one year.

Total long-term liabilities declined 12.4%, or ¥15.2

billion, to ¥107.1 billion, mainly due to the reclassification

of convertible bonds due within one year and a decline in

long-term debt.

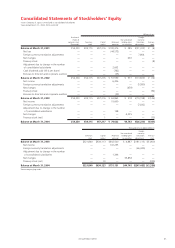

Stockholders’ equity was up 8.8%, or ¥12.9 billion, to

¥159.3 billion, while stockholders’ equity as a percentage

of total assets increased to 31.4%, compared with 30.5%

at the previous fiscal year-end.

Cash Flows

Operating activities provided net cash of ¥40.7 billion,

¥4.9 billion more than the previous fiscal year. Although

there was an increase in inventories of ¥23.5 billion, this

was offset by improvements in income before income

taxes and minority interests, as well as working capital and

other factors.

Net cash used by investing activities increased ¥3.4

billion, to ¥15.8 billion. This rise was mainly attributable to

an increase in cash used for purchases of property, plant

and equipment, partially offset by proceeds from sales of

property, plant and equipment.

Financing activities used net cash of ¥9.4 billion, ¥2.0

billion more than the previous fiscal year, primarily for

repayments of long-term loans and redemption of bonds.

As a result of the foregoing, cash and cash equivalents at

the end of the year stood at ¥97.2 billion, 16.6%, or ¥13.8

billion, higher than at the end of the previous fiscal year.