JVC 1999 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1999 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC 1999 27

12. FORWARD FOREIGN EXCHANGE CONTRACTS —

THE COMPANY ONLY

At March 31, 1999, the Company had contracts to sell various foreign

currencies, mainly U.S. dollars. The aggregate contract amount and

fair value of forward foreign exchange contracts equivalent in Japanese

yen at March 31, 1999 were ¥40,852 million and ¥40,081 million,

respectively.

The Company also had contracts to purchase various foreign

currencies, mainly U.S. dollars. The aggregate contract amount and

fair value of forward foreign exchange contracts equivalent in Japanese

yen at March 31, 1999 were ¥23,105 million and ¥22,993 million,

respectively.

The forward contracts on the foreign currency receivables and

payables translated into Japanese yen at the forward exchange rates

on the accompanying financial statements were not included in the

above amounts.

13. LEASE INFORMATION

Finance leases which do not transfer ownership to lessees are not capi-

talized and are accounted for in the same manner as operating leases.

Certain information for such non-capitalized finance leases is as follows.

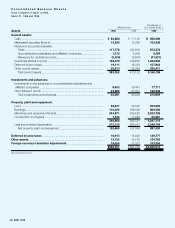

(1) A summary of assumed amounts of acquisition cost, accumulated

depreciation and net book value at March 31, 1999 is as follows:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Buildings and structures .................. ¥ 1,335 ¥ 386 ¥ 949

Vehicles, machinery and

equipment ...................................... 6,455 3,293 3,162

Tools, furniture and fixtures .............. 11,395 5,412 5,983

Leasehold rights .............................. 234 141 93

Software.......................................... 153 73 80

¥19,572 ¥9,305 ¥10,267

Thousands of U.S. dollars

Acquisition Accumulated Net book

cost depreciation value

Buildings and structures .................. $ 11,033 $ 3,190 $ 7,843

Vehicles, machinery and

equipment ...................................... 53,347 27,216 26,131

Tools, furniture and fixtures .............. 94,174 44,727 49,447

Leasehold rights .............................. 1,934 1,165 769

Software ......................................... 1,264 603 661

$161,752 $76,901 $84,851

Assumed amounts of acquisition cost, accumulated depreciation and

net book value at March 31, 1998 were not required to be disclosed.

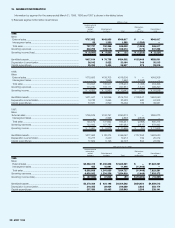

(2) Future minimum lease payments at March 31, 1999 and 1998 are

as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

Due within one year ..................... ¥ 3,802 ¥3,450 $31,421

Due after one year ....................... 6,463 5,493 53,414

¥10,265 ¥8,943 $84,835

(3) Lease payments and assumed depreciation charges for the year

ended March 31, 1999, 1998 and 1997 are as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1997 1999

Lease payments ............. ¥3,276 ¥3,352 ¥3,353 $27,074

Assumed depreciation

charges.......................... 3,276 —— 27,074

Assumed depreciation charges were not required to be disclosed in

1998 or 1997.

(4) Assumed depreciation charges are computed using the straight-line

method over lease terms assuming no residual value.

14. SUBSEQUENT EVENT

On June 29, 1999, the Company’s stockholders authorized payment of

a cash dividend to stockholders of record on March 31, 1999 of ¥1.5

($0.01) per share, totaling ¥381 million ($3,152 thousand).