JVC 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

robust for ILA presentation systems and favorable for pro-

fessional video systems. In Japan, sales dropped on

account of a fall in capital investment in the private sector

and lackluster sales in the karaoke industry.

Sales of Components & Devices increased 4.0% to

¥73,693 million (US$609.0 million), accounting for 7.8% of

net sales, up 0.1 percentage point. On a volume basis,

sales surged for such core products as motors and deflec-

tion yokes. A drop in prices, however, led to sales approxi-

mately the same as the previous fiscal year. Sales in the

fast-growing business for high-density build-up multilayer

printed wiring boards skyrocketed almost three times

higher than the previous year.

Sales in the Entertainment business climbed 8.9% to

¥148,934 million (US$1,230.9 million), a 0.8 percentage

point increase to 15.7% of net sales. Sales of CDs in

Japan recorded new highs on account of four albums

breaking through the million unit mark. Sales of the video

Titanic also contributed substantially to the increase in

sales.

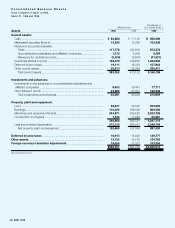

Although net sales rose 3.3%, cost of sales was down 0.9

percentage point to 67.8% owing to lower costs and favor-

able exchange rates.

Selling, general and administrative (SG&A) expenses to

net sales increased 2.1 percentage points to 32.3%.

Although reductions in fixed costs are progressing through

Companywide efforts, sales promotion expenses have in-

creased dramatically alongside price competition.

An operating loss of ¥1,221 million (US$10.1 million)

was recorded. By segment, operating losses were

recorded in the Americas and Asia on account of worsen-

ing market conditions in Latin America, a downtrend in

movie operations in the United States and weak sales in

emerging markets.

An unrealized gain from appreciation of trading securi-

ties was registered in other income. Marketable securities

held by a subsidiary in the United States were revalued.

Other expenses included a loss incurred to strengthen

operations in China, an exchange rate loss at a subsidiary

in Brazil from a drop in the real, and a loss from downsizing

a music production and sales subsidiary in the United

States.

Net interest expense (interest expense plus interest and

dividend income) was ¥5,972 million (US$49.4 million), an

increase of ¥2,663 million due to a rise in interest-bearing

debt.

Loss before income taxes and minority interests

amounted to ¥3,671 million (US$30.3 million). Income

taxes totaled ¥6,443 million (US$53.2 million), of which

¥1,977 million was carried forward to the next fiscal year

through tax-effect accounting. As a result, a net loss of

¥8,315 million (US$68.7 million) was recorded. Net loss per

share of common stock was ¥32.7 (US$0.27). Cash divi-

dends applicable to the year were ¥5.0 (US$0.04).

Cash Flow Analysis

Capital expenditures during the year were ¥28,815 million

(US$238.1 million), lower than depreciation and amortiza-

tion of ¥30,513 million (US$252.2 million).

Net cash provided by operating activities was virtually

the same as the previous fiscal year. Although this term’s

net loss and a decrease in notes and accounts payable

accounted for a decrease in cash, these factors were

offset by an increase in depreciation and amortization

due to aggressive investment in the previous term, a de-

crease in notes and accounts receivable and a decrease in

inventories.

Net cash used in investing activities decreased to

¥12,943 million (US$107.0 million) on account of holding

capital expenditures within depreciation and amortization

and a decrease in marketable and investment securities.

Net cash provided by financing activities remained rel-

atively unchanged from the previous term. Efforts were

made to decrease short-term bank loans and acquire long-

term stable funds through an issuance of bonds.

As a result, cash at end of the year increased ¥9,740

million (US$80.5 million) to ¥80,888 million (US$668.5

million).

Financial Position

Total assets decreased ¥36,049 million (US$297.9 million)

to ¥588,001 million (US$4,859.5 million) as a result of ef-

forts to reduce assets to improve asset efficiency.

JVC 1999 17