JVC 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 JVC 1999

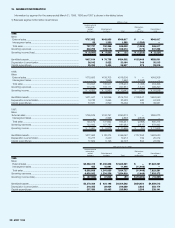

7. INCOME TAXES

Income taxes in Japan consist of corporation, enterprise and inhabi-

tants taxes. The Company and its domestic consolidated subsidiaries

are subject to the income taxes referred to above which, in the aggre-

gate, resulted in normal effective tax rates of approximately 48% for the

year ended March 31, 1999 and 51% for the years ended March 31,

1998 and 1997. Foreign subsidiaries are subject to income taxes of the

countries in which they domicile. The actual effective tax rates differ

from the normal effective rate mainly because of (1) tax reductions for

dividend income received from Japanese companies and (2) expenses

not deductible for income tax purposes.

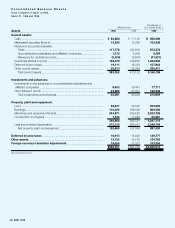

8. SHORT-TERM BANK LOANS AND LONG-TERM DEBT

Short-term bank loans of certain of the Company’s consolidated sub-

sidiaries consist of notes maturing generally in three months. The ap-

plicable annual interest rates on short-term bank loans outstanding at

March 31, 1999 and 1998 ranged from 0.575% to 19.0% and from

1.2% to 20.0%, respectively.

Long-term debt at March 31, 1999 and 1998 was as follows:

Thousands of

Millions of yen U.S. dollars

1999 1998 1999

1.4% unsecured convertible

bonds due 1999 ........................ ¥—¥20,431 $—

1.5% unsecured convertible

bonds due 2005 ........................ 11,483 11,483 94,901

0.35% unsecured convertible

bonds due 2002 ........................ 19,999 19,999 165,281

0.55% unsecured convertible

bonds due 2005 ........................ 20,000 20,000 165,289

4.3% Eurobonds due 2000.......... 9,765 10,700 80,702

1.375% unsecured

bonds due 2001....................... 5,000 —41,322

1.75% unsecured

bonds due 2003....................... 5,000 —41,322

2.15% unsecured

bonds due 2005....................... 10,000 —82,645

1.30% guaranteed

notes due 2001........................ 5,180 —42,810

1.61% guaranteed

notes due 2002........................ 4,914 —40,612

Loans, primarily from banks

with

interest principally at 1.44%

to 8.95%

Secured.................................. 379 561 3,132

Unsecured .............................. 12,494 7,503 103,256

Other ........................................... 545 649 4,505

.................................................... 104,759 91,326 865,777

Less current portion..................... 15,733 20,431 130,025

.................................................... ¥ 89,026 ¥70,895 $735,752

The 1.5% unsecured convertible bonds are redeemable prior to their

stated maturity, in whole or in part, at the option of the Company at

prices ranging from 107% to 100% of the principal amount, respec-

tively. The price at which shares of common stock shall be issued upon

conversion is ¥2,867 ($23.69) per share, subject to adjustment under

certain circumstance. The 0.35% and 0.55% unsecured convertible

bonds are redeemable prior to their stated maturity, in whole or in part,

at the option of the Company at prices ranging from 102% to 100%

and 103% to 100% of the principal amount, respectively. For both is-

sues, the price at which shares of common stock shall be issued upon

conversion is ¥1,487 ($12.29) per share, subject to adjustment under

certain circumstance.

The aggregate annual maturities of long-term debt at March 31,

1999 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2000 ................................................... ¥ 15,733 $130,025

2001 ................................................... 26 215

2002 ................................................... 10,585 87,479

2003 ................................................... 24,939 206,108

2004 ................................................... 8,920 73,719

Thereafter............................................ 44,556 368,231

........................................................... ¥104,759 $865,777

9. PLEDGED ASSETS

The following assets were pledged as collateral for long-term debt and

accrued expenses at March 31, 1999:

Thousands of

Millions of yen U.S. dollars

Investments......................................... ¥ 8 $ 66

Machinery and equipment ................... 379 3,132

Finished goods.................................... 145 1,198

........................................................... ¥532 $4,396

10. CONTINGENT LIABILITIES

The contingent liabilities of the Company and its consolidated sub-

sidiaries at March 31, 1999 were as follows:

Thousands of

Millions of yen U.S. dollars

As endorser of export bills

discounted with banks........................ ¥ 9,574 $ 79,124

As guarantor for loans to

employees.......................................... 17,573 145,231

As guarantor for loans to

affiliated companies............................ 759 6,273

........................................................... ¥27,906 $230,628

11. STOCKHOLDERS’ EQUITY

Under the Commercial Code of Japan (the “Code”), at least 50% of the

issue price of new shares, with a minimum of the par value thereof, is

required to be designated as stated capital. The portion which is to be

designated as stated capital is determined by resolution of the Board of

Directors. Proceeds in excess of the amounts designated as stated

capital are credited to additional paid-in capital.

In accordance with the new disclosure requirements effective from

the year ended March 31, 1999, legal reserve is included in retained

earnings for 1999. Previously it was presented as a separate compo-

nent of the stockholders’ equity. The accompanying consolidated finan-

cial statements for the years ended March 31, 1998 and 1997 have

been reclassified to conform to the 1999 presentation.

The maximum amount that the Company can distribute as divi-

dends is calculated based on the unconsolidated financial statements

of the Company in accordance with the Code.