JVC 1999 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1999 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

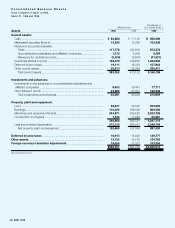

Total current assets declined ¥26,770 million (US$221.2

million) owing to a reduction in inventories and a decrease

in notes and accounts receivable. Total current liabilities fell

¥45,004 million (US$371.9 million) due to decreases in

bank loans and notes and accounts payable. As a result,

working capital rose ¥18,234 million to ¥142,628 million

(US$1,178.7 million). The current ratio improved from 1.44

to 1.59.

Interest-bearing debt advanced ¥4,602 million to

¥165,811 million (US$1,370.3 million) owing to an increase

in the number of consolidated subsidiaries. In considera-

tion of the Company’s financial position, bank loans were

decreased and direct procurement of funds was increased.

Stockholders’ equity fell ¥10,924 million to ¥232,162

million (US$1,918.7 million) as a result of allocation of re-

tained earnings following the net loss during the term. As

the reduction in liabilities was greater than the decline in

stockholders’ equity, stockholders’ equity as a percentage

of total assets was 39.5% compared with 39.0% in the

previous fiscal year. Stockholders’ equity per share was

¥913.20 (US$7.55).

Year 2000 Preparations

JVC recognizes the seriousness of the Year 2000 (Y2K)

problem, and is promoting Y2K readiness primarily through

the Committee for Year 2000 Problems. The Committee

comprises five smaller committees representing products,

information systems, production materials, production

facilities and buildings. Duties include checking the status

of current preparations, execution of preparations, in-

house and affiliate awareness programs and the formation

of a risk management plan for contingencies. Progress is

reported to Company management and conferences are

held concerning preparations as necessary.

A review of all Company products sold since January

1992 for Y2K compliance has been completed. Information

regarding products that require attention is available on the

Company’s web site and from other sources. Ongoing

preparations of in-house information systems began in

1996 and are scheduled for completion in August 1999.

Primary Group companies in Japan and overseas are also

implementing similar preparations. Preparations of other

production facilities, production materials and buildings are

underway with completion planned for September 1999.

While it is difficult to pin down Y2K costs, expenditures

of ¥2,700 million are allocated for the Group, including in-

house preparation costs. Approximately 70% of this

amount has been accounted for up to the fiscal year under

review. These expenditures are not expected to adversely

affect future business performance.

18 JVC 1999