Hasbro 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

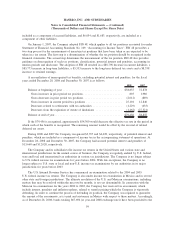

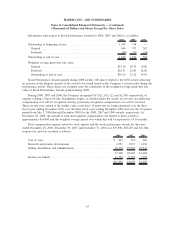

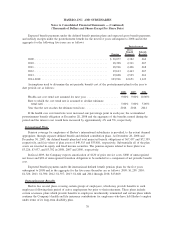

Assumptions used to determine the year-end benefit obligation are as follows:

2008 2007

Weighted average discount rate ................................... 6.20% 6.34%

Rate of future compensation increases .............................. 4.00% 4.00%

Long-term rate of return on plan assets ............................. 8.75% 8.75%

Mortality table . . . ............................................ RP-2000 RP-2000

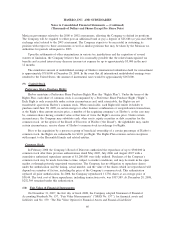

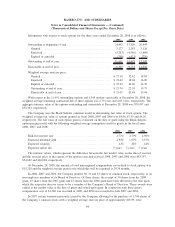

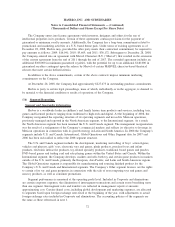

The assets of the funded plans are managed by investment advisors and consist of the following:

Asset Category 2008 2007

Equity:

Large Cap Equity .................................................. 4% 5%

Small Cap Equity .................................................. 6 8

International Equity ................................................. 7 14

Other Equity ...................................................... 9 17

Fixed Income ....................................................... 54 40

Total Return Fund .................................................... 18 16

Cash.............................................................. 2 —

100% 100%

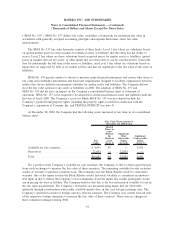

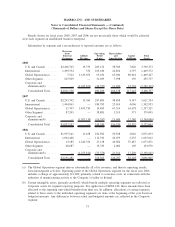

Hasbro’s two major funded plans (the “Plans”) are defined benefit pension plans intended to provide

retirement benefits to participants in accordance with the benefit structure established by Hasbro, Inc. The

Plans’ investment managers, who exercise full investment discretion within guidelines outlined in the Plans’

Investment Policy, are charged with managing the assets with the care, skill, prudence and diligence that a

prudent investment professional in similar circumstance would exercise. Investment practices, at a minimum,

must comply with the Employee Retirement Income Security Act (ERISA) and any other applicable laws and

regulations.

The Plans’ asset allocations are structured to meet a long-term targeted total return consistent with the

ongoing nature of the Plans’ liabilities. The shared long-term total return goal, presently 8.75%, includes

income plus realized and unrealized gains and/or losses on the Plans’ assets. Utilizing generally accepted

diversification techniques, the Plans’ assets, in aggregate and at the individual portfolio level, are invested so

that the total portfolio risk exposure and risk-adjusted returns best meet the Plans’ long-term obligations to

employees. During 2007, the Company reevaluated its investment strategy and, as a result, decided to change

the asset allocation in order to more closely align changes in the value of plan assets with changes in the value

of plan liabilities. This change in asset allocation resulted in a transfer of assets into alternative investment

strategies designed to achieve a modest absolute return in addition to the return on an underlying asset class

such as bond or equity indices. These alternative investment strategies may use derivatives to gain market

returns in an efficient and timely manner; however, derivatives are not used to leverage the portfolio beyond

the market value of the underlying assets. These alternative investment strategies are included in other equity

and fixed income asset categories at December 28, 2008 and December 30, 2007. Plan asset allocations are

reviewed at least quarterly and rebalanced to achieve target allocation among the asset categories when

necessary.

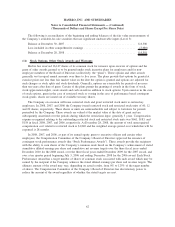

The Plans’ investment managers are provided specific guidelines under which they are to invest the assets

assigned to them. In general, investment managers are expected to remain fully invested in their asset class

with further limitations of risk as related to investments in a single security, portfolio turnover and credit

quality.

68

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)