Hasbro 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

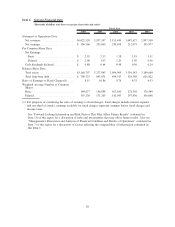

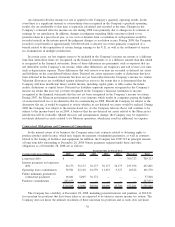

Expenses

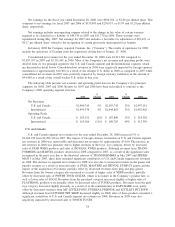

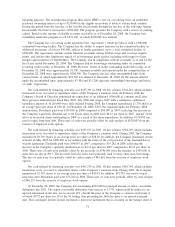

The Company’s operating expenses, stated as percentages of net revenues, are illustrated below for the

three fiscal years ended December 28, 2008:

2008 2007 2006

Amortization ................................................. 1.9% 1.8% 2.5%

Royalties .................................................... 7.8 8.2 5.4

Research and product development ................................. 4.8 4.4 5.4

Advertising .................................................. 11.3 11.3 11.7

Selling, distribution and administration .............................. 19.8 19.7 21.7

Amortization expense increased to $78,265 or 1.9% of net revenues in 2008 compared to $67,716 or

1.8% of net revenues in 2007. The increase is primarily the result of the acquisition of Cranium, Inc. in

January 2008 and the purchase of the intellectual property rights related to TRIVIAL PURSUIT in the second

quarter of 2008. Property rights of $68,500 and $80,800 were recorded as a result of the Cranium, Inc.

acquisition and the purchase of TRIVIAL PURSUIT, respectively, and are each being amortized over fifteen

years. Amortization expense decreased to $67,716 in 2007 from $78,934 in 2006. A portion of amortization

expense relates to licensing rights and is based on expected sales of products related to those licensing rights.

The decrease in amortization expense in 2007 primarily related to decreased amortization of the product rights

related to STAR WARS.

Royalty expense decreased to $312,986 or 7.8% of net revenues in 2008 compared to $316,807 or 8.2%

of net revenues in 2007. The decrease in royalty expense is primarily the result of the impact of foreign

exchange. Absent this foreign exchange impact, royalty expense decreased slightly as the result of slightly

lower sales of entertainment-based products. Royalty expense increased to $316,807 or 8.2% of net revenues

in 2007 compared to $169,731 or 5.4% of net revenues in 2006. This increase was primarily due to increased

sales of entertainment-based products, primarily MARVEL and TRANSFORMERS movie-related products due

to the theatrical releases of SPIDER-MAN 3 and TRANSFORMERS in 2007.

Research and product development expense increased in 2008 to $191,424 or 4.8% of net revenues from

$167,194 or 4.4% of net revenues in 2007. The increase in 2008 reflects higher investments in the Company’s

core brands, increased expenditures relating to the Company’s digital initiatives, as well as additional expenses

as a result of the Company’s Cranium acquisition. Research and product development expense decreased in

2007 to $167,194 or 4.4% of net revenues from $171,358 or 5.4% of net revenues in 2006. This decrease

reflected higher investments in the prior year, primarily as a result of increased expenditures related to the

introduction of the MARVEL product lines in late 2006 and early 2007.

Advertising expense increased in dollars to $454,612 in 2008 from $434,742 in 2007, but remained flat as

a percentage of net revenues at 11.3%. The increase in dollars is primarily the result of higher spending to

increase awareness of the Company’s brands. Advertising expense increased in dollars to $434,742 in 2007

from $368,996 in 2006, but decreased as a percentage of revenues to 11.3% from 11.7% in 2006. The decrease

as a percentage of revenues primarily related to the mix of sales in 2007, which included increased sales of

entertainment-based products, which require lower amounts of advertising and promotion. Revenues from

properties related to major motion picture releases were higher in 2008 and 2007 as compared to 2006.

Selling, distribution and administration expenses increased to $797,209 or 19.8% of net revenues in 2008,

compared to $755,127 or 19.7% of net revenues in 2007. The increase reflects increased sales and marketing

expenses to support the growth in the business; increased investment in the expansion into emerging markets,

including Brazil, China, Russia, the Czech Republic and Korea; increased investment in the Company’s digital

and entertainment strategies; and increased shipping and distribution costs associated with both increased sales

volume and higher transportation costs. Selling, distribution and administration expenses increased in dollars

to $755,127 in 2007 from $682,214 in 2006 but decreased as a percentage of revenues to 19.7% from 21.7%

in 2006. The increase in dollars reflected higher variable selling and distribution costs resulting from higher

revenues in 2007, as well as higher incentive compensation provisions, the impact of foreign currency, and

27